Question

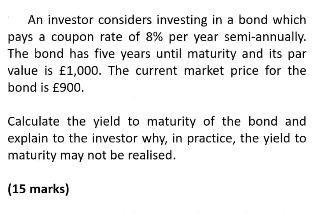

An investor considers investing in a bond which pays a coupon rate of 8% per year semi-annually. The bond has five years until maturity

An investor considers investing in a bond which pays a coupon rate of 8% per year semi-annually. The bond has five years until maturity and its par value is 1,000. The current market price for the bond is 900. Calculate the yield to maturity of the bond and explain to the investor why, in practice, the yield to maturity may not be realised. (15 marks)

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

AP1 r n n 10001 8 5 5 1000106255 10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Business Statistics Communicating With Numbers

Authors: Sanjiv Jaggia, Alison Kelly

1st Edition

78020549, 978-0078020544

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App