An investor enters today into a one-year forward contract to sell a two-year bond providing 4% annual coupon paid semi-annually on a principal of

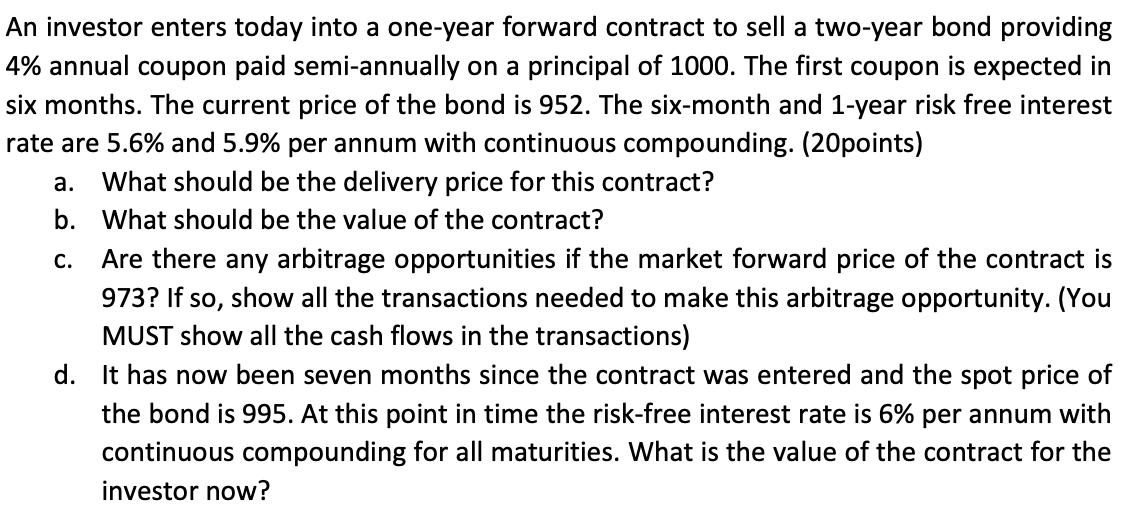

An investor enters today into a one-year forward contract to sell a two-year bond providing 4% annual coupon paid semi-annually on a principal of 1000. The first coupon is expected in six months. The current price of the bond is 952. The six-month and 1-year risk free interest rate are 5.6% and 5.9% per annum with continuous compounding. (20points) What should be the delivery price for this contract? . b. What should be the value of the contract? Are there any arbitrage opportunities if the market forward price of the contract is 973? If so, show all the transactions needed to make this arbitrage opportunity. (You MUST show all the cash flows in the transactions) . d. It has now been seven months since the contract was entered and the spot price of the bond is 995. At this point in time the risk-free interest rate is 6% per annum with continuous compounding for all maturities. What is the value of the contract for the investor now?

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer a 1...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started