Answered step by step

Verified Expert Solution

Question

1 Approved Answer

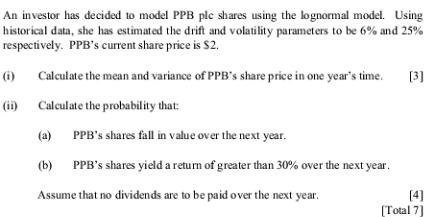

An investor has decided to model PPB ple shares using the lognormal model. Using historical data, she has estimated the drift and volatility parameters

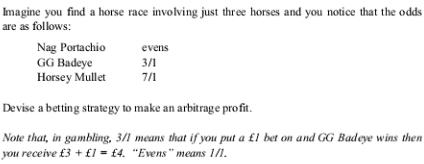

An investor has decided to model PPB ple shares using the lognormal model. Using historical data, she has estimated the drift and volatility parameters to be 6% and 25% respectively. PPB's current share price is $2. (i) (ii) Calculate the mean and variance of PPB's share price in one year's time. [3] Calculate the probability that: (a) PPB's shares fall in value over the next year. (b) PPB's shares yield a return of greater than 30% over the next year. Assume that no dividends are to be paid over the next year. [4] [Total 7] Imagine you find a horse race involving just three horses and you notice that the odds are as follows: Nag Portachio GG Badeye Horsey Mullet evens 3/1 7/1 Devise a betting strategy to make an arbitrage profit. Note that, in gambling, 3/1 means that if you put a 1 bet on and GG Badeye wins then you receive 3 + 1 = 4. "Evens" means 1/1.

Step by Step Solution

★★★★★

3.54 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

i For a lognormal model Mean return Drift rate 6 Variance Volatility rate2 x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started