Question

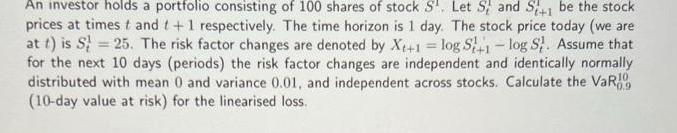

An investor holds a portfolio consisting of 100 shares of stock S. Let S and S+ be the stock prices at times t and

An investor holds a portfolio consisting of 100 shares of stock S. Let S and S+ be the stock prices at times t and t + 1 respectively. The time horizon is 1 day. The stock price today (we are at t) is S25. The risk factor changes are denoted by Xt+1 log St1-log S. Assume that for the next 10 days (periods) the risk factor changes are independent and identically normally distributed with mean 0 and variance 0.01, and independent across stocks. Calculate the VaR 0.9 (10-day value at risk) for the linearised loss. 10

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The question asks us to calculate the 10day Value at Risk VaR for linearized loss of a portfolio con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App