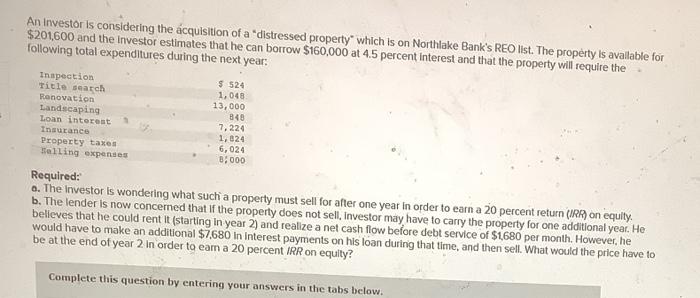

An investor is considering the acquisition of a "distressed property which is on Northlake Bank's REO list. The property is available for $201,600 and the investor estimates that he can borrow $160,000 at 4.5 percent interest and that the property will require the following total expenditures during the next year: Inspection Title search Renovation Landscaping Loan interest Insurance Property taxes Selling expenses $ 524 1,048 13,000 840 7, 224 1,024 6,024 0.000 Required: o. The investor is wondering what such a property must sell for after one year in order to earn a 20 percent return (IR) on equity. b. The lender is now concerned that if the property does not sell, Investor may have to carry the property for one additional year . He believes that he could rent It (starting in year 2) and realize a net cash flow before debt service of $1,680 per month. However , he would have to make an additional $7,680 in interest payments on his loan during that time, and then sell. What would the price have to be at the end of year 2 in order to eam a 20 percent IRR on equity? Complete this question by entering your answers in the tabs below. An investor is considering the acquisition of a "distressed property which is on Northlake Bank's REO list. The property is available for $201,600 and the investor estimates that he can borrow $160,000 at 4.5 percent interest and that the property will require the following total expenditures during the next year: Inspection Title search Renovation Landscaping Loan interest Insurance Property taxes Selling expenses $ 524 1,048 13,000 840 7, 224 1,024 6,024 0.000 Required: o. The investor is wondering what such a property must sell for after one year in order to earn a 20 percent return (IR) on equity. b. The lender is now concerned that if the property does not sell, Investor may have to carry the property for one additional year . He believes that he could rent It (starting in year 2) and realize a net cash flow before debt service of $1,680 per month. However , he would have to make an additional $7,680 in interest payments on his loan during that time, and then sell. What would the price have to be at the end of year 2 in order to eam a 20 percent IRR on equity? Complete this question by entering your answers in the tabs below