Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor is considering the possibility of developing a mixed-use property. Currently, it is necessary to buy back the land for 230 billion VND. Because

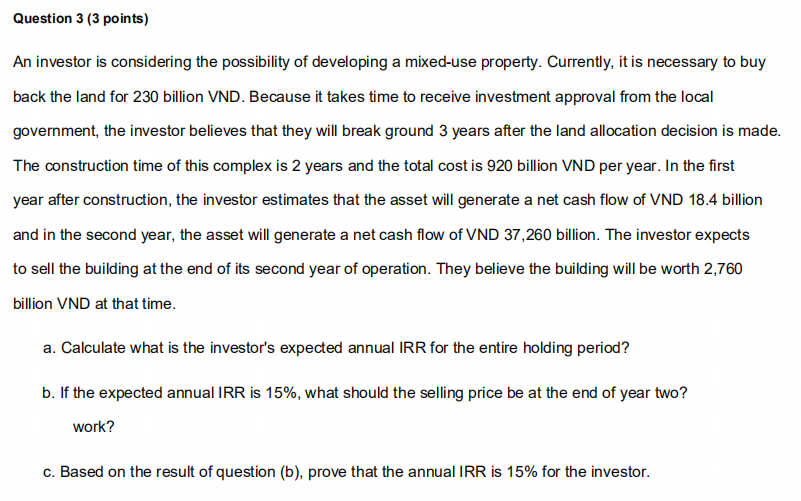

An investor is considering the possibility of developing a mixed-use property. Currently, it is necessary to buy back the land for 230 billion VND. Because it takes time to receive investment approval from the local government, the investor believes that they will break ground 3 years after the land allocation decision is made. The construction time of this complex is 2 years and the total cost is 920 billion VND per year. In the first year after construction, the investor estimates that the asset will generate a net cash flow of VND 18.4 billion and in the second year, the asset will generate a net cash flow of VND 37,260 billion. The investor expects to sell the building at the end of its second year of operation. They believe the building will be worth 2,760 billion VND at that time. a. Calculate what is the investor's expected annual IRR for the entire holding period? b. If the expected annual IRR is 15%, what should the selling price be at the end of year two? work? c. Based on the result of question (b), prove that the annual IRR is 15% for the investor

An investor is considering the possibility of developing a mixed-use property. Currently, it is necessary to buy back the land for 230 billion VND. Because it takes time to receive investment approval from the local government, the investor believes that they will break ground 3 years after the land allocation decision is made. The construction time of this complex is 2 years and the total cost is 920 billion VND per year. In the first year after construction, the investor estimates that the asset will generate a net cash flow of VND 18.4 billion and in the second year, the asset will generate a net cash flow of VND 37,260 billion. The investor expects to sell the building at the end of its second year of operation. They believe the building will be worth 2,760 billion VND at that time. a. Calculate what is the investor's expected annual IRR for the entire holding period? b. If the expected annual IRR is 15%, what should the selling price be at the end of year two? work? c. Based on the result of question (b), prove that the annual IRR is 15% for the investor Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started