Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wild Holidays (Pty) Limited is a company that offers various adventure holidays and packages around the country. The company owns a fleet of vehicles

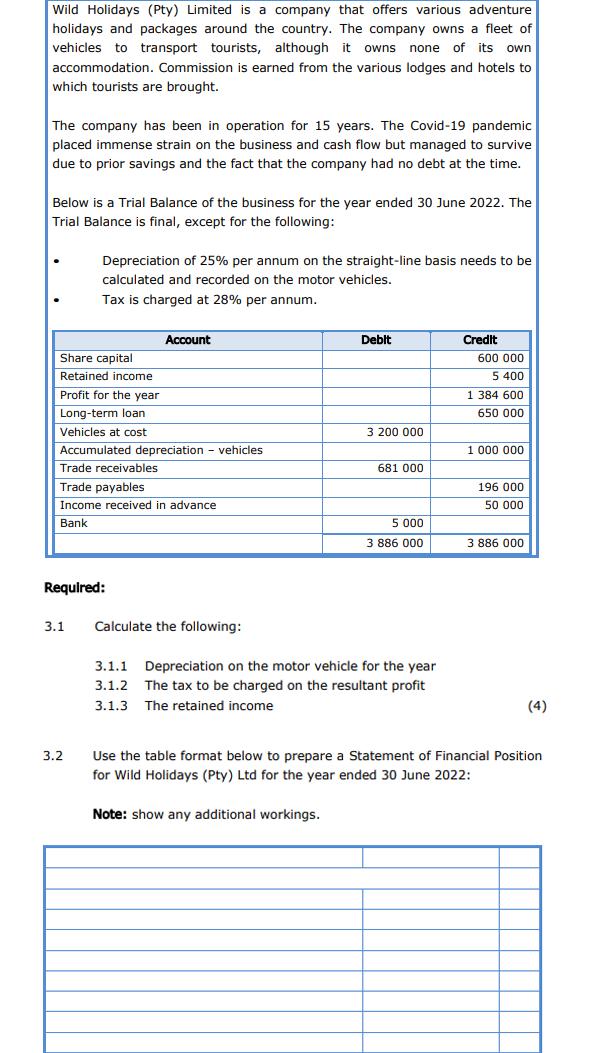

Wild Holidays (Pty) Limited is a company that offers various adventure holidays and packages around the country. The company owns a fleet of vehicles to transport tourists, although it owns none of its own accommodation. Commission is earned from the various lodges and hotels to which tourists are brought. The company has been in operation for 15 years. The Covid-19 pandemic placed immense strain on the business and cash flow but managed to survive due to prior savings and the fact that the company had no debt at the time. Below is a Trial Balance of the business for the year ended 30 June 2022. The Trial Balance is final, except for the following: Depreciation of 25% per annum on the straight-line basis needs to be calculated and recorded on the motor vehicles. Tax is charged at 28% per annum. Share capital Retained income Profit for the year Long-term loan Vehicles at cost Accumulated depreciation - vehicles Trade receivables Trade payables Income received in advance Bank Required: 3.1 Account 3.2 Calculate the following: 3.1.1 3.1.2 3.1.3 The retained income Debit 3 200 000 681 000 5 000 3 886 000 Depreciation on the motor vehicle for the year The tax to be charged on the resultant profit Credit 600 000 5 400 1 384 600 650 000 1 000 000 196 000 50 000 3 886 000 (4) Use the table format below to prepare a Statement of Financial Position for Wild Holidays (Pty) Ltd for the year ended 30 June 2022: Note: show any additional workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 31 Calculations 311 Depreciation on the motor vehicle for the year Depreciation Rate 25 per a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started