Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor is considering two investment propositions: OPTION 1: A small restaurant business can be purchased for $400,000 today. It is expected to produce

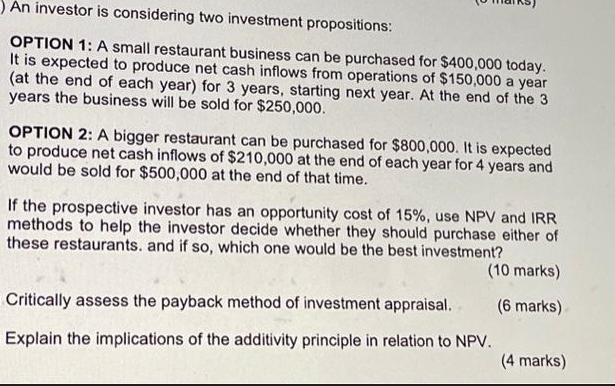

An investor is considering two investment propositions: OPTION 1: A small restaurant business can be purchased for $400,000 today. It is expected to produce net cash inflows from operations of $150,000 a year (at the end of each year) for 3 years, starting next year. At the end of the 3 years the business will be sold for $250,000. OPTION 2: A bigger restaurant can be purchased for $800,000. It is expected to produce net cash inflows of $210,000 at the end of each year for 4 years and would be sold for $500,000 at the end of that time. If the prospective investor has an opportunity cost of 15%, use NPV and IRR methods to help the investor decide whether they should purchase either of these restaurants. and if so, which one would be the best investment? (10 marks) (6 marks) Critically assess the payback method of investment appraisal. Explain the implications of the additivity principle in relation to NPV. (4 marks)

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether the investor should purchase either of the restaurants and which one would be the best investment we can calculate the net present value NPV and internal rate of return IRR for ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started