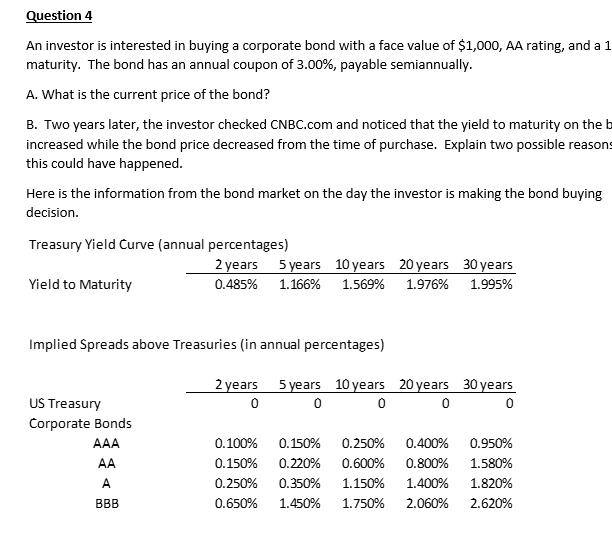

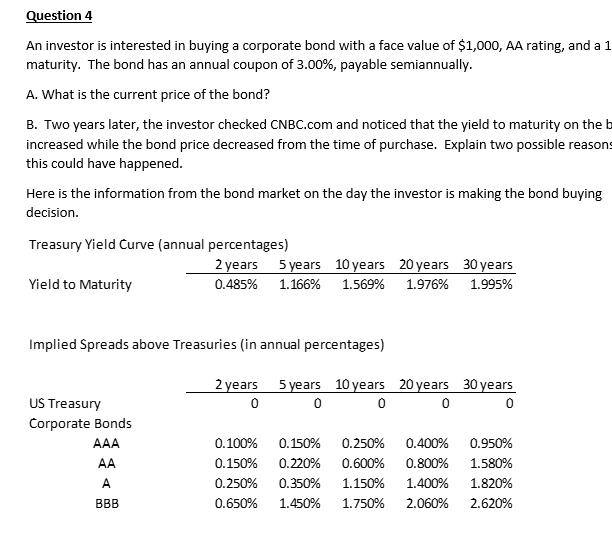

An investor is interested in buying a corporate bond with a face value of $1,000, AA rating, and a 10-year maturity. The bond has an annual coupon of 3.00%, payable semiannually.

A. What is the current price of the bond?

B. Two years later, the investor checked CNBC.com and noticed that the yield to maturity on the bond increased while the bond price decreased from the time of purchase.

Explain two possible reasons that this could have happened. Here is the information from the bond market on the day the investor is making the bond buying decision.

See attached numbers and figures. Please answer in detail.

Question 4 An investor is interested in buying a corporate bond with a face value of $1,000, AA rating, and a 1 maturity. The bond has an annual coupon of 3.00%, payable semiannually. A. What is the current price of the bond? B. Two years later, the investor checked CNBC.com and noticed that the yield to maturity on the b increased while the bond price decreased from the time of purchase. Explain two possible reasons this could have happened. Here is the information from the bond market on the day the investor is making the bond buying decision. Treasury Yield Curve (annual percentages) 2 years 5 years 10 years 20 years 30 years Yield to Maturity 0.485% 1.166% 1.569% 1.976% 1.995% Implied Spreads above Treasuries (in annual percentages) 2 years 5 years 10 years 20 years 30 years 0 0 0 0 US Treasury Corporate Bonds AAA AA 0.100% 0.150% 0.250% 0.650% 0.150% 0.220% 0.350% 1.450% 0.250% 0.600% 1.150% 1.750% 0.400% 0.800% 1.400% 2.060% 0.950% 1.580% 1.820% 2.620% A BBB Question 4 An investor is interested in buying a corporate bond with a face value of $1,000, AA rating, and a 1 maturity. The bond has an annual coupon of 3.00%, payable semiannually. A. What is the current price of the bond? B. Two years later, the investor checked CNBC.com and noticed that the yield to maturity on the b increased while the bond price decreased from the time of purchase. Explain two possible reasons this could have happened. Here is the information from the bond market on the day the investor is making the bond buying decision. Treasury Yield Curve (annual percentages) 2 years 5 years 10 years 20 years 30 years Yield to Maturity 0.485% 1.166% 1.569% 1.976% 1.995% Implied Spreads above Treasuries (in annual percentages) 2 years 5 years 10 years 20 years 30 years 0 0 0 0 US Treasury Corporate Bonds AAA AA 0.100% 0.150% 0.250% 0.650% 0.150% 0.220% 0.350% 1.450% 0.250% 0.600% 1.150% 1.750% 0.400% 0.800% 1.400% 2.060% 0.950% 1.580% 1.820% 2.620% A BBB