Question

An investor is planning to liquidate her investments in mutual funds and invest in real estate. Before making the change in her investment strategy,

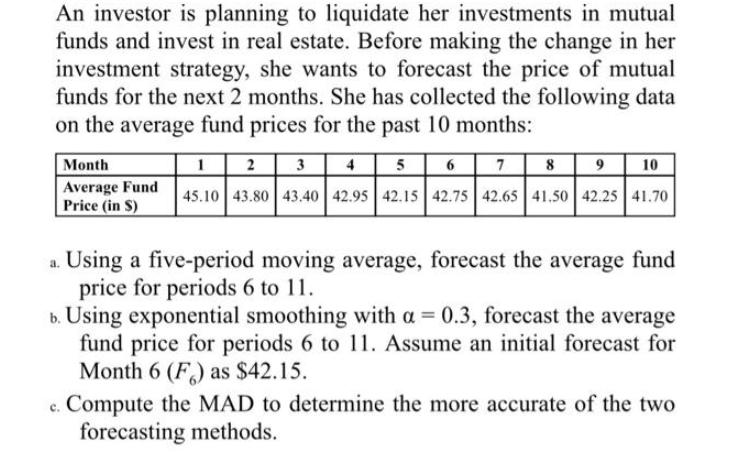

An investor is planning to liquidate her investments in mutual funds and invest in real estate. Before making the change in her investment strategy, she wants to forecast the price of mutual funds for the next 2 months. She has collected the following data on the average fund prices for the past 10 months: Month Average Fund Price (in S) 1 2 3 4 5 6 7 8 9 10 45.10 43.80 43.40 42.95 42.15 42.75 42.65 41.50 42.25 41.70 a. Using a five-period moving average, forecast the average fund price for periods 6 to 11. b. Using exponential smoothing with a = 0.3, forecast the average fund price for periods 6 to 11. Assume an initial forecast for Month 6 (F) as $42.15. Compute the MAD to determine the more accurate of the two forecasting methods.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management Managing Global Supply Chains

Authors: Ray R. Venkataraman, Jeffrey K. Pinto

1st edition

1506302935, 1506302939, 978-1506302935

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App