Answered step by step

Verified Expert Solution

Question

1 Approved Answer

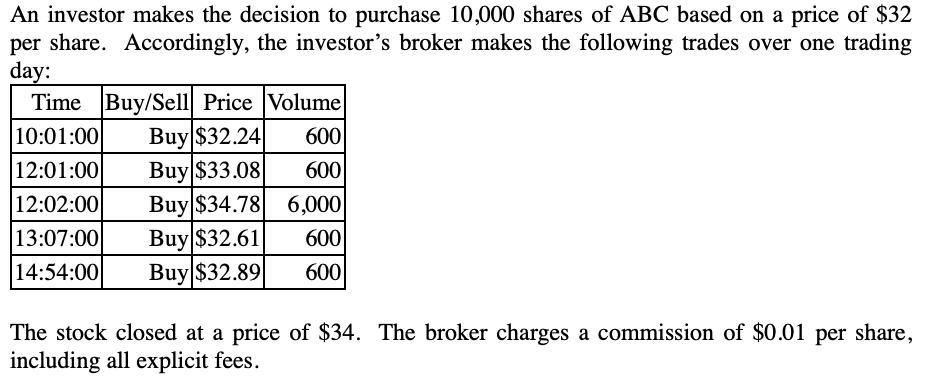

An investor makes the decision to purchase 10,000 shares of ABC based on a price of $32 per share. Accordingly, the investor's broker makes

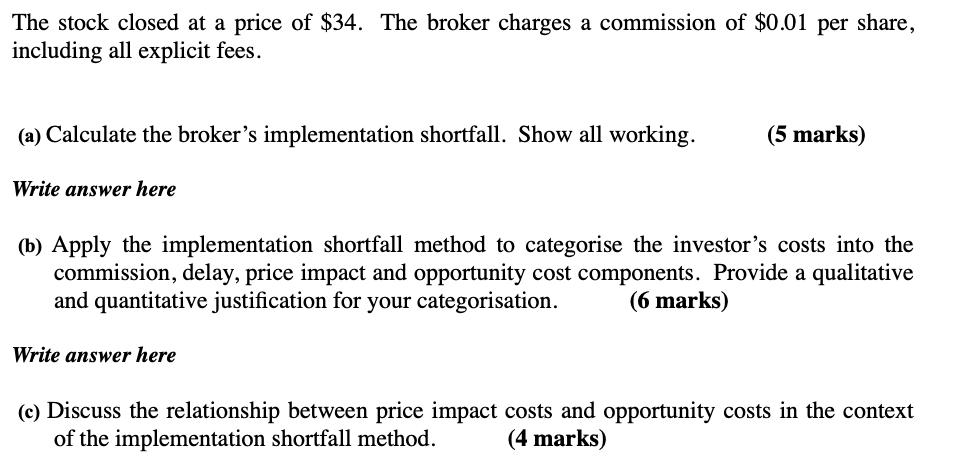

An investor makes the decision to purchase 10,000 shares of ABC based on a price of $32 per share. Accordingly, the investor's broker makes the following trades over one trading day: Time Buy/Sell Price Volume 10:01:00 Buy $32.24 600 12:01:00 600 12:02:00 6,000 13:07:00 600 14:54:00 600 Buy $33.08 Buy $34.78 Buy $32.61 Buy $32.89 The stock closed at a price of $34. The broker charges a commission of $0.01 per share, including all explicit fees. The stock closed at a price of $34. The broker charges a commission of $0.01 per share, including all explicit fees. (a) Calculate the broker's implementation shortfall. Show all working. Write answer here (5 marks) (b) Apply the implementation shortfall method to categorise the investor's costs into the commission, delay, price impact and opportunity cost components. Provide a qualitative and quantitative justification for your categorisation. (6 marks) Write answer here (c) Discuss the relationship between price impact costs and opportunity costs in the context of the implementation shortfall method. (4 marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Implementation shortfall 600 x 3224 600 x 3308 6000 x 3478 600 x 3261 600 x 3289 10000 x 34 10000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started