Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor must decide whether to invest in a risky single hedge fund or not. If he invests and there is no turbulence on

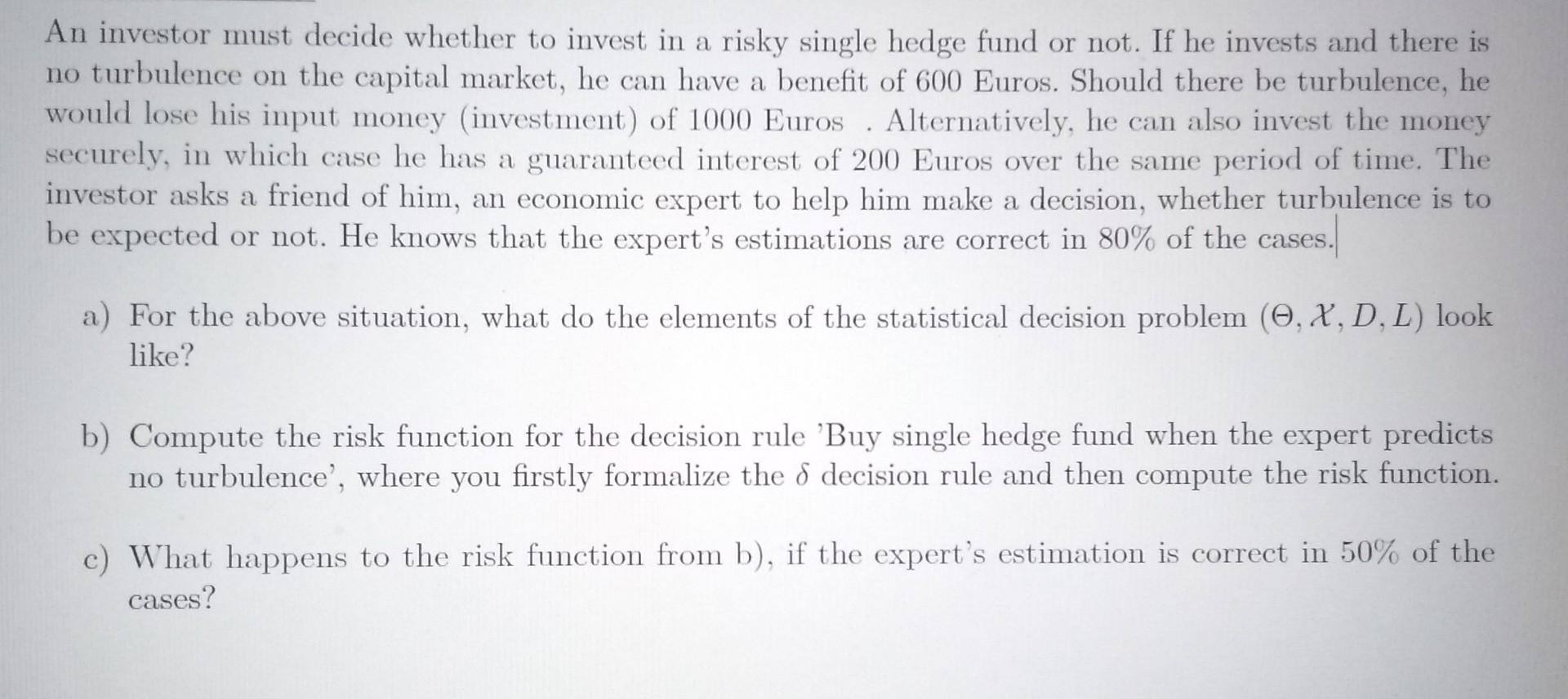

An investor must decide whether to invest in a risky single hedge fund or not. If he invests and there is no turbulence on the capital market, he can have a benefit of 600 Euros. Should there be turbulence, he would lose his input money (investment) of 1000 Euros. Alternatively, he can also invest the money securely, in which case he has a guaranteed interest of 200 Euros over the same period of time. The investor asks a friend of him, an economic expert to help him make a decision, whether turbulence is to be expected or not. He knows that the expert's estimations are correct in 80% of the cases. a) For the above situation, what do the elements of the statistical decision problem (O, X, D, L) look like? b) Compute the risk function for the decision rule 'Buy single hedge fund when the expert predicts no turbulence', where you firstly formalize the & decision rule and then compute the risk function. c) What happens to the risk function from b), if the expert's estimation is correct in 50% of the cases?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A The elements of the statistical decision problem for this situation are as follows X Turbulence on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started