Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor wants to invest up to $100,000 as follows: X amount into a Certificate of Deposit (CD) that yields an expected annual return

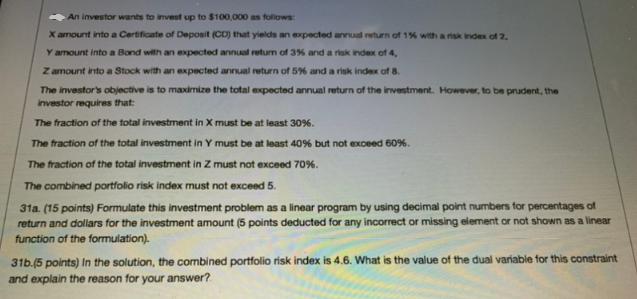

An investor wants to invest up to $100,000 as follows: X amount into a Certificate of Deposit (CD) that yields an expected annual return of 1% with a risk index of 2. Y amount into a Bond with an expected annual return of 3% and a risk index of 4, Zamount into a Stock with an expected annual return of 5% and a risk index of 8. The investor's objective is to maximize the total expected annual return of the investment. However, to be prudent, the investor requires that: The fraction of the total investment in X must be at least 30%. The fraction of the total investment in Y must be at least 40% but not exceed 60%. The fraction of the total investment in Z must not exceed 70%. The combined portfolio risk index must not exceed 5. 31a. (15 points) Formulate this investment problem as a linear program by using decimal point numbers for percentages of return and dollars for the investment amount (5 points deducted for any incorrect or missing element or not shown as a linear function of the formulation). 31b.(5 points) In the solution, the combined portfolio risk index is 4.6. What is the value of the dual variable for this constraint and explain the reason for your answer?

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

31a Formulation of the investment problem as a linear program Let X be the amount invested in the Ce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started