Answered step by step

Verified Expert Solution

Question

1 Approved Answer

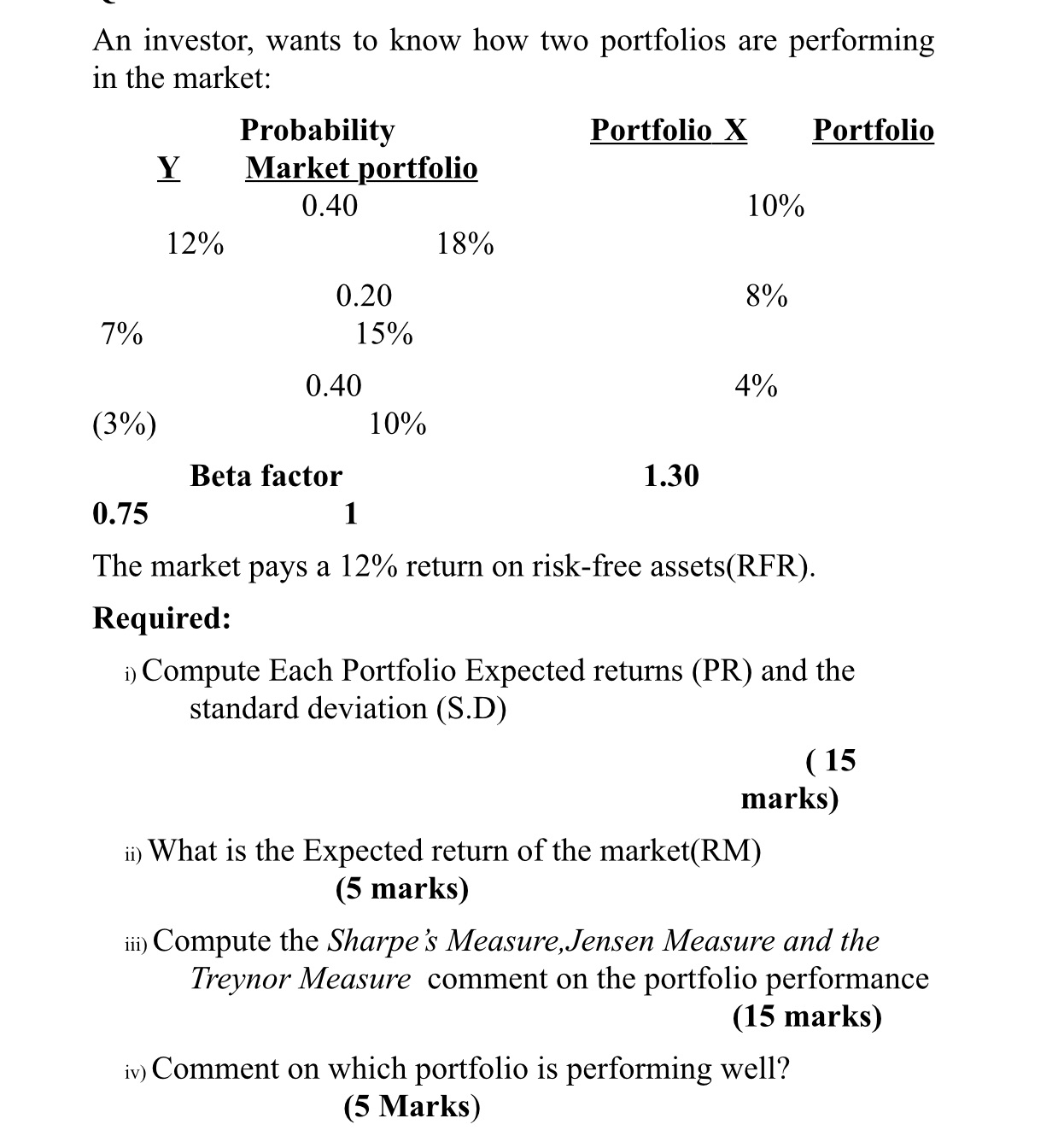

An investor, wants to know how two portfolios are performing in the market: 7% Y (3%) 12% Probability Market portfolio 0.40 0.20 15% 0.40

An investor, wants to know how two portfolios are performing in the market: 7% Y (3%) 12% Probability Market portfolio 0.40 0.20 15% 0.40 Beta factor 10% 18% Portfolio X 1.30 10% 8% 4% 0.75 1 The market pays a 12% return on risk-free assets(RFR). Portfolio Required: i) Compute Each Portfolio Expected returns (PR) and the standard deviation (S.D) ii) What is the Expected return of the market(RM) (5 marks) marks) (15 iv) Comment on which portfolio is performing well? (5 Marks) iii) Compute the Sharpe's Measure,Jensen Measure and the Treynor Measure comment on the portfolio performance (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Compute Each Portfolio Expected Returns PR and Standard Deviation SD To compute the expected returns and standard deviation for each portfolio we will use the given probabilities and returns We will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started