Question

An investor wants to maximize the expected value of his utility of wealth over two years. The utility function is logarithmic. His initial wealth

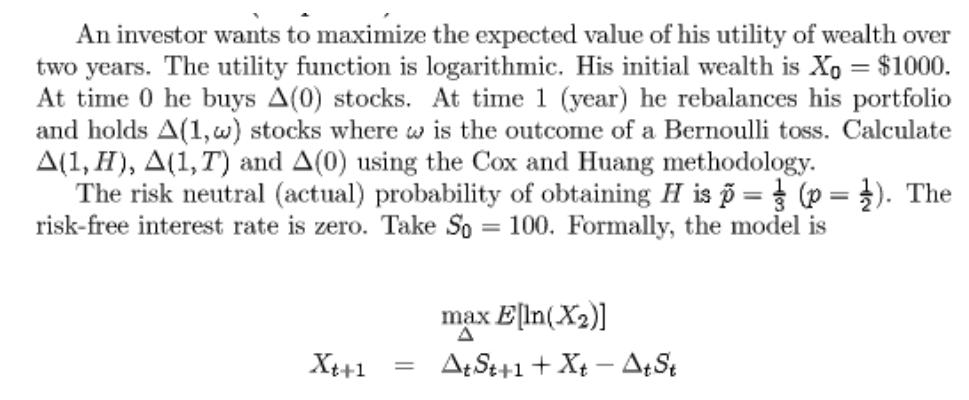

An investor wants to maximize the expected value of his utility of wealth over two years. The utility function is logarithmic. His initial wealth is Xo = $1000. At time 0 he buys A(0) stocks. At time 1 (year) he rebalances his portfolio and holds A(1,w) stocks where w is the outcome of a Bernoulli toss. Calculate A(1, H), A(1, T) and A(0) using the Cox and Huang methodology. The risk neutral (actual) probability of obtaining H is p = (p=1). The risk-free interest rate is zero. Take So= 100. Formally, the model is Xt+1 = max E[In(X)] A At St+1+Xt- At St

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

solution Cox Huang Methodology Given Xo 1000 p 13 p 12 So 100 R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Microeconomics

Authors: Hal R. Varian

9th edition

978-0393123975, 393123979, 393123960, 978-0393919677, 393919676, 978-0393123968

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App