Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor will allocate her funds in these two assets D and E. With standard deviation on the horizontal axis and expected return on

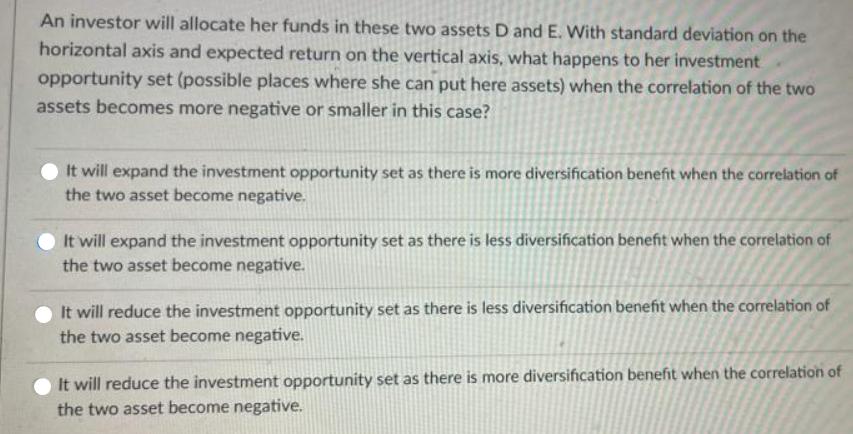

An investor will allocate her funds in these two assets D and E. With standard deviation on the horizontal axis and expected return on the vertical axis, what happens to her investment opportunity set (possible places where she can put here assets) when the correlation of the two assets becomes more negative or smaller in this case? It will expand the investment opportunity set as there is more diversification benefit when the correlation of the two asset become negative. It will expand the investment opportunity set as there is less diversification benefit when the correlation of the two asset become negative. It will reduce the investment opportunity set as there is less diversification benefit when the correlation of the two asset become negative. It will reduce the investment opportunity set as there is more diversification benefit when the correlation of the two asset become negative.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below It ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started