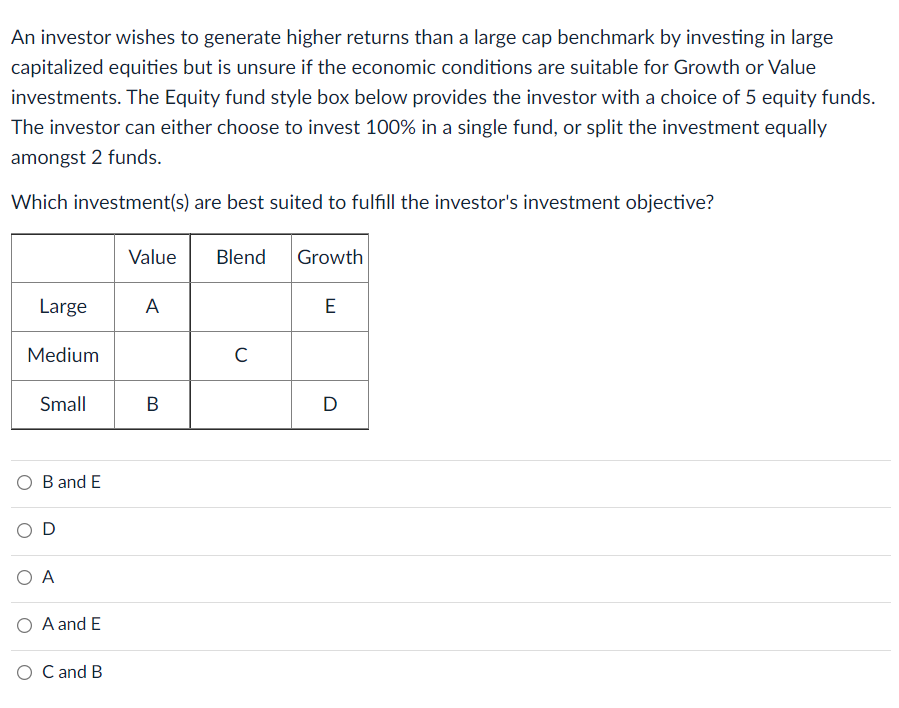

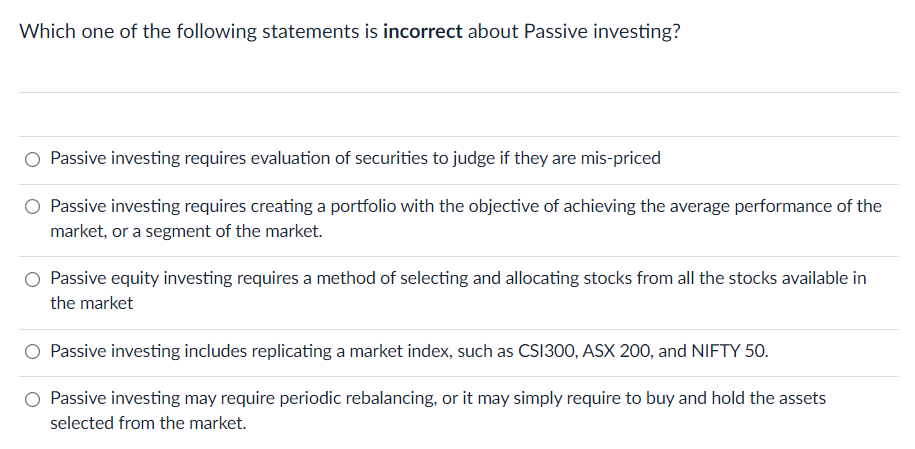

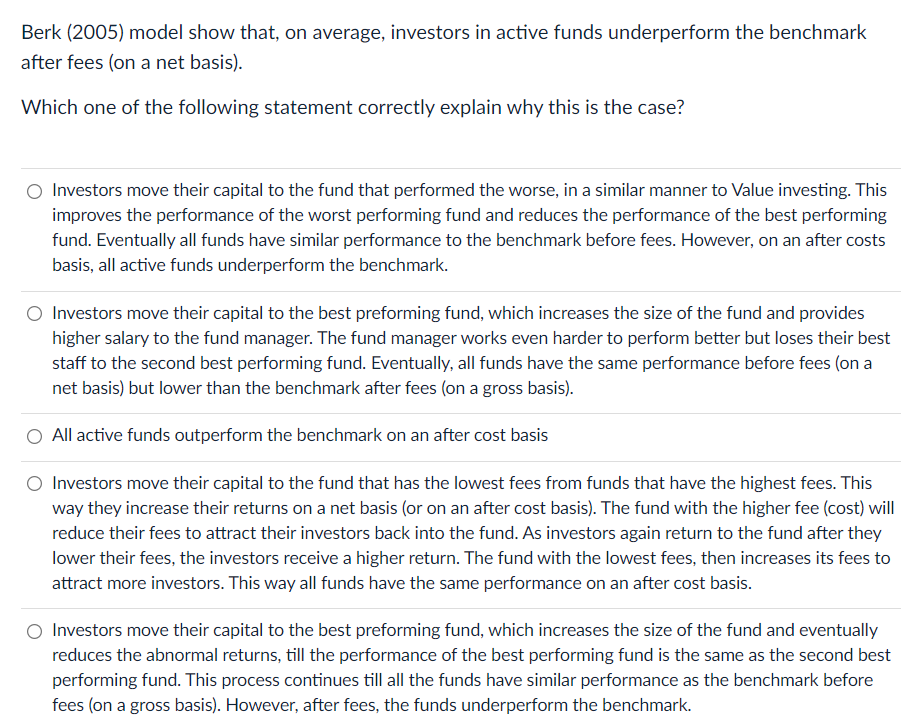

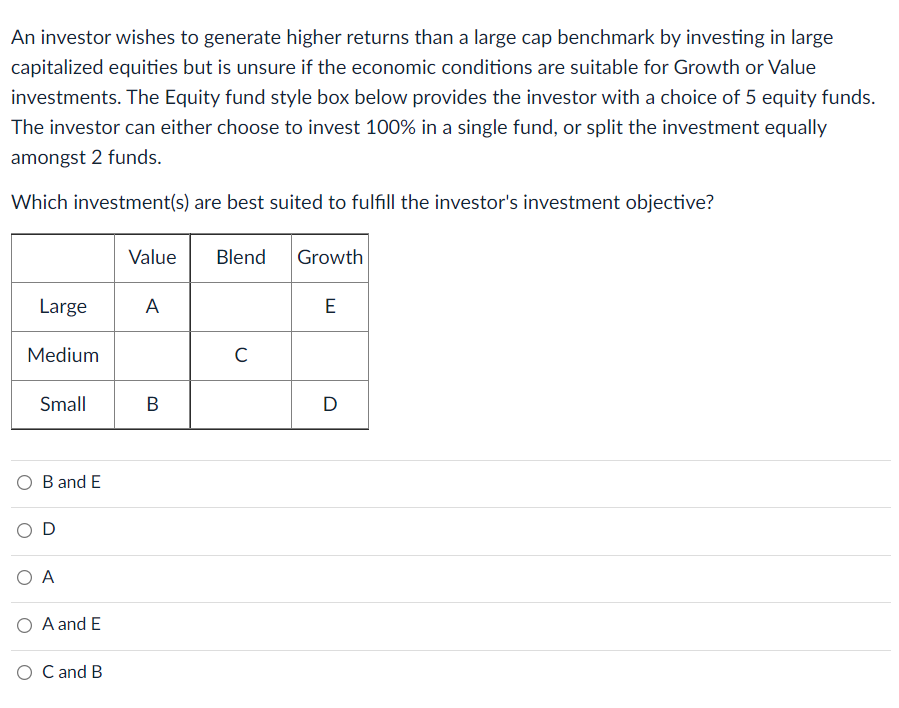

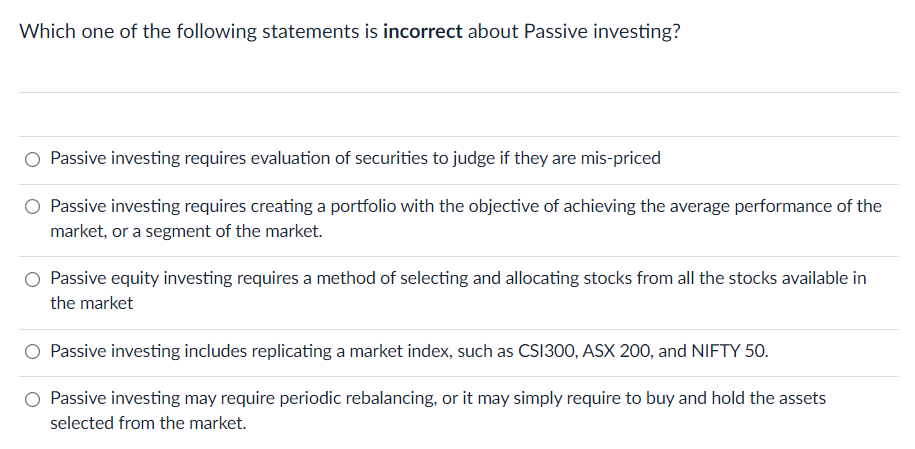

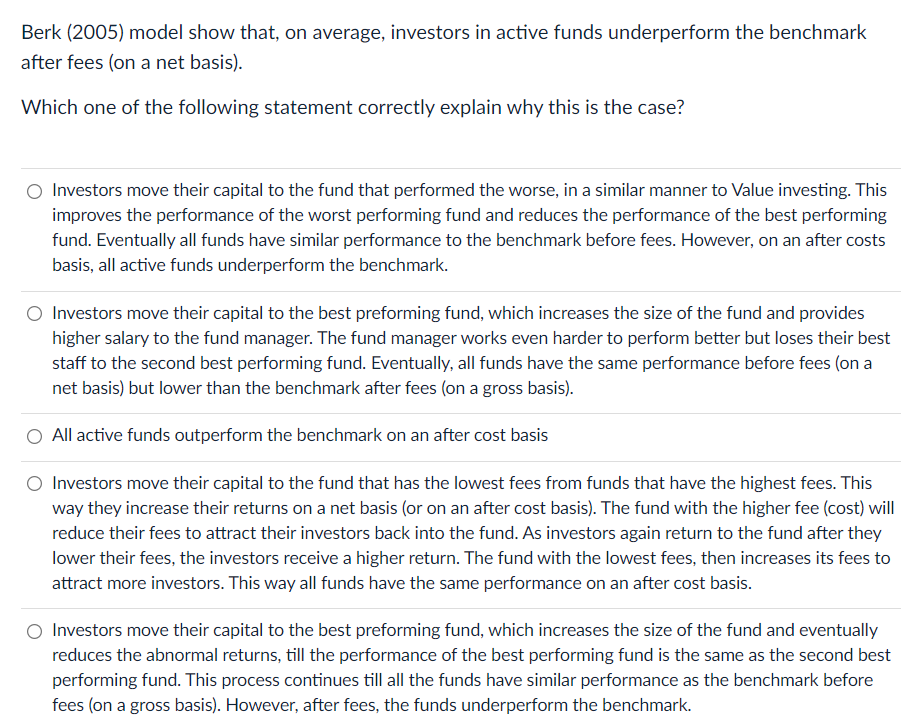

An investor wishes to generate higher returns than a large cap benchmark by investing in large capitalized equities but is unsure if the economic conditions are suitable for Growth or Value investments. The Equity fund style box below provides the investor with a choice of 5 equity funds. The investor can either choose to invest 100% in a single fund, or split the investment equally amongst 2 funds. Which investment(s) are best suited to fulfill the investor's investment objective? Value Blend Growth Large A E Medium Small B D B and E O A and E O C and B Which one of the following statements is incorrect about Passive investing? O Passive investing requires evaluation of securities to judge if they are mis-priced Passive investing requires creating a portfolio with the objective of achieving the average performance of the market, or a segment of the market. Passive equity investing requires a method of selecting and allocating stocks from all the stocks available in the market O Passive investing includes replicating a market index, such as CS1300, ASX 200, and NIFTY 50. Passive investing may require periodic rebalancing, or it may simply require to buy and hold the assets selected from the market. Berk (2005) model show that, on average, investors in active funds underperform the benchmark after fees (on a net basis). Which one of the following statement correctly explain why this is the case? Investors move their capital to the fund that performed the worse, in a similar manner to Value investing. This improves the performance of the worst performing fund and reduces the performance of the best performing fund. Eventually all funds have similar performance to the benchmark before fees. However, on an after costs basis, all active funds underperform the benchmark. Investors move their capital to the best preforming fund, which increases the size of the fund and provides higher salary to the fund manager. The fund manager works even harder to perform better but loses their best staff to the second best performing fund. Eventually, all funds have the same performance before fees (on a net basis) but lower than the benchmark after fees (on a gross basis). O All active funds outperform the benchmark on an after cost basis Investors move their capital to the fund that has the lowest fees from funds that have the highest fees. This way they increase their returns on a net basis (or on an after cost basis). The fund with the higher fee (cost) will reduce their fees to attract their investors back into the fund. As investors again return to the fund after they lower their fees, the investors receive a higher return. The fund with the lowest fees, then increases its fees to attract more investors. This way all funds have the same performance on an after cost basis. Investors move their capital to the best preforming fund, which increases the size of the fund and eventually reduces the abnormal returns, till the performance of the best performing fund is the same as the second best performing fund. This process continues till all the funds have similar performance as the benchmark before fees (on a gross basis). However, after fees, the funds underperform the benchmark