Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor would like to purchase a new apartment property for $2 M and sell in 5 years. She will use 80% finance at

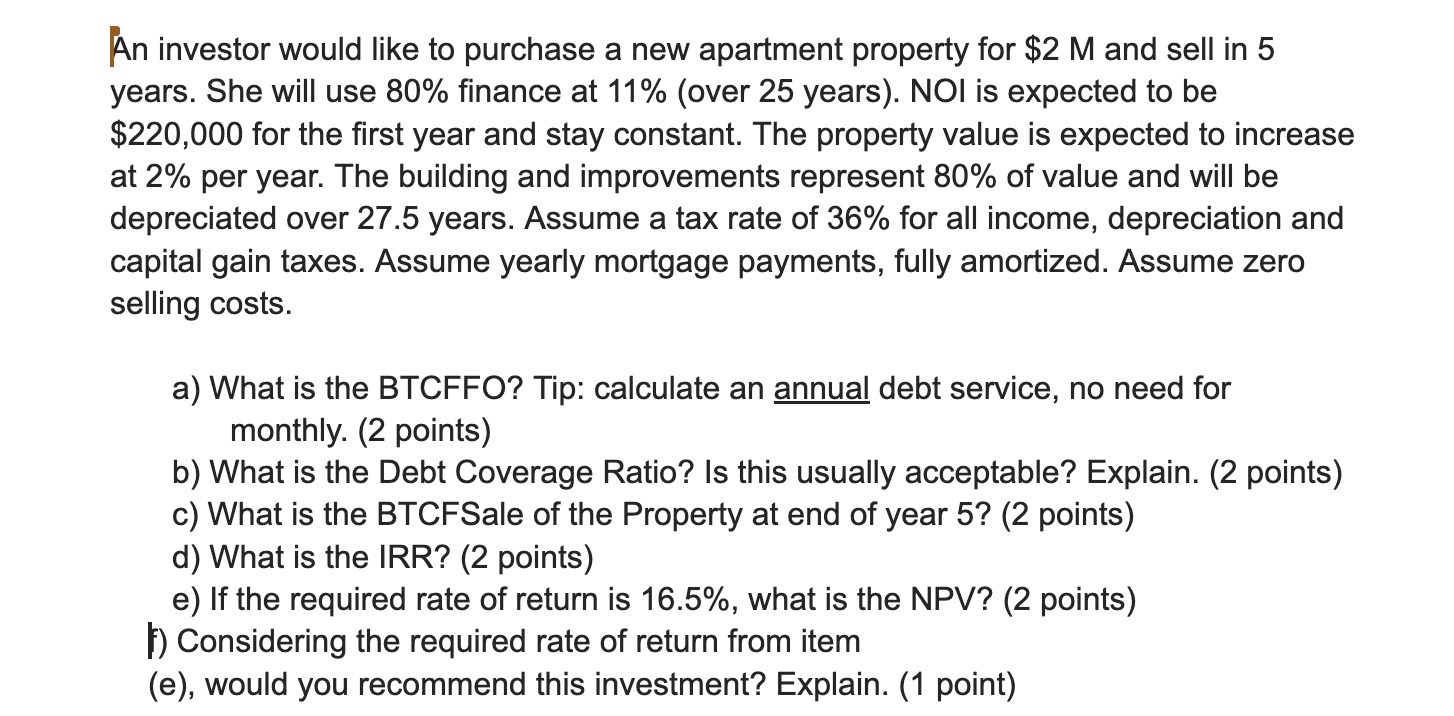

An investor would like to purchase a new apartment property for $2 M and sell in 5 years. She will use 80% finance at 11% (over 25 years). NOI is expected to be $220,000 for the first year and stay constant. The property value is expected to increase at 2% per year. The building and improvements represent 80% of value and will be depreciated over 27.5 years. Assume a tax rate of 36% for all income, depreciation and capital gain taxes. Assume yearly mortgage payments, fully amortized. Assume zero selling costs. a) What is the BTCFFO? Tip: calculate an annual debt service, no need for monthly. (2 points) b) What is the Debt Coverage Ratio? Is this usually acceptable? Explain. (2 points) c) What is the BTCFSale of the Property at end of year 5? (2 points) d) What is the IRR? (2 points) e) If the required rate of return is 16.5%, what is the NPV? (2 points) F) Considering the required rate of return from item (e), would you recommend this investment? Explain. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The BTCFFO Before Tax Cash Flow From Operations is calculated as follows BTCFFO Net Operating Income NOI Debt Service NOI for the first year 220000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started