Question

An investor's wealth dynamics is given by the following: Xt+1= UfWt where {w} is an i.i.d. positive, R-valued, stochastic process. The investor has access

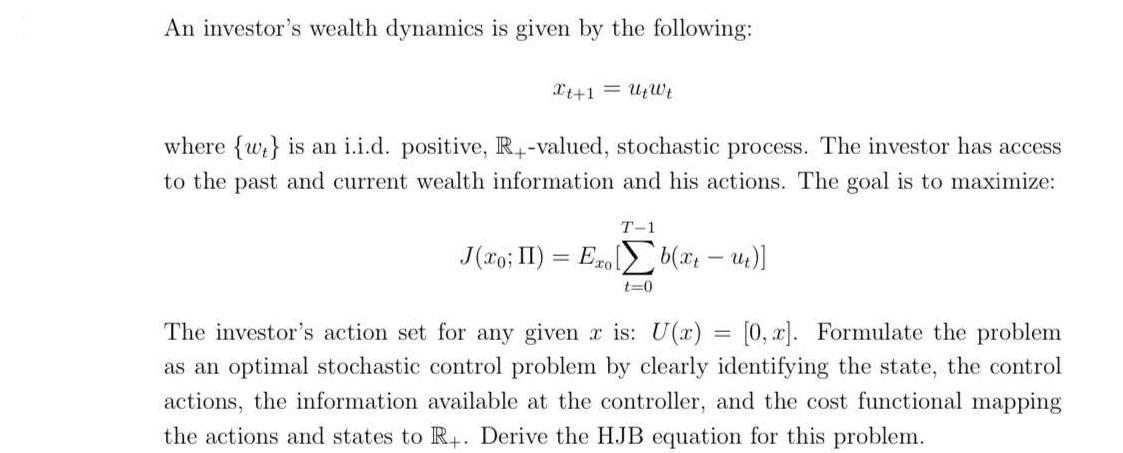

An investor's wealth dynamics is given by the following: Xt+1= UfWt where {w} is an i.i.d. positive, R-valued, stochastic process. The investor has access to the past and current wealth information and his actions. The goal is to maximize: J(xo; II) = T-1 Erolb(x- ut)] t=0 The investor's action set for any given x is: U(x) = [0, x]. Formulate the problem as an optimal stochastic control problem by clearly identifying the state, the control actions, the information available at the controller, and the cost functional mapping the actions and states to R+. Derive the HJB equation for this problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The problem is an optimal stochastic control problem where the objective is to maximize the expected cumulative reward over a finite horizon T The sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing A Practical Approach with Data Analytics

Authors: Raymond N. Johnson, Laura Davis Wiley, Robyn Moroney, Fiona Campbell, Jane Hamilton

1st edition

1119401747, 978-1119401742

Students also viewed these Programming questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App