An Islamic financial institution (IFI) invested in a two years project valued at USD 1,000,000 by providing USD 700,000 of the capital based on

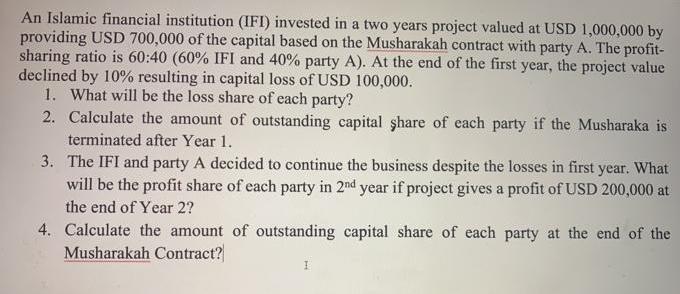

An Islamic financial institution (IFI) invested in a two years project valued at USD 1,000,000 by providing USD 700,000 of the capital based on the Musharakah contract with party A. The profit- sharing ratio is 60:40 (60% IFI and 40% party A). At the end of the first year, the project value declined by 10% resulting in capital loss of USD 100,000. 1. What will be the loss share of each party? 2. Calculate the amount of outstanding capital share of each party if the Musharaka is terminated after Year 1. 3. The IFI and party A decided to continue the business despite the losses in first year. What will be the profit share of each party in 2nd year if project gives a profit of USD 200,000 at the end of Year 2? 4. Calculate the amount of outstanding capital share of each party at the end of the Musharakah Contract? I

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Loss share of each party Total loss 100000 IFIs share of the loss ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started