Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An issue of bonds with par of $1000 matures in 12 years and pays interest at 7% annually. The current quoted market price is

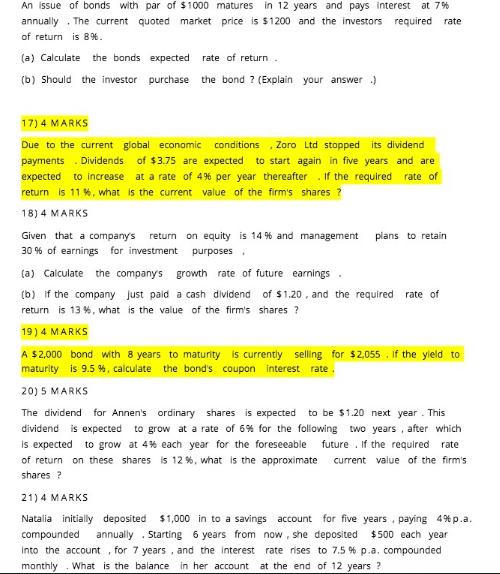

An issue of bonds with par of $1000 matures in 12 years and pays interest at 7% annually. The current quoted market price is $1200 and the investors required rate of return is 8%. (a) Calculate the bonds expected rate of return. (b) should the investor purchase the bond ? (Explain your answer.) 17) 4 MARKS Due to the current global economic conditions, Zoro Ltd stopped its dividend payments Dividends of $3.75 are expected to start again in five years and are expected to increase at a rate of 4% per year thereafter. If the required rate of return is 11 %, what is the current value of the firm's shares ? 18) 4 MARKS Given that a company's return on equity is 14 % and management plans to retain 30% of earnings for investment purposes. (a) Calculate the company's growth rate of future earnings (b) if the company just paid a cash dividend of $1.20, and the required rate of return is 13%, what is the value of the firm's shares ? 19) 4 MARKS A $2,000 bond with 8 years to maturity is currently selling for $2,055. If the yield to maturity is 9.5%, calculate the bond's coupon interest rate. 20) 5 MARKS The dividend for Annen's ordinary shares is expected to be $1.20 next year. This dividend is expected to grow at a rate of 6% for the following two years, after which is expected to grow at 4% each year for the foreseeable future. If the required rate of return on these shares is 12 %, what is the approximate current value of the firm's shares ? 21) 4 MARKS Natalia initially deposited $1,000 in to a savings account for five years paying 4% p.a. compounded. annually. Starting 6 years from now, she deposited $500 each year into the account, for 7 years, and the interest rate rises to 7.5 % p.a. compounded monthly What is the balance in her account at the end of 12 years?

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

14 a The bonds expected rate of return is the yield to maturity which can be calculated using the current market price the par value the annual coupon payment and the time to maturity Using the given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started