Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An item is being sold in a first-price sealed-bid auction. There are n > 1 risk neutral bidders. Bidders have private values. Suppose that,

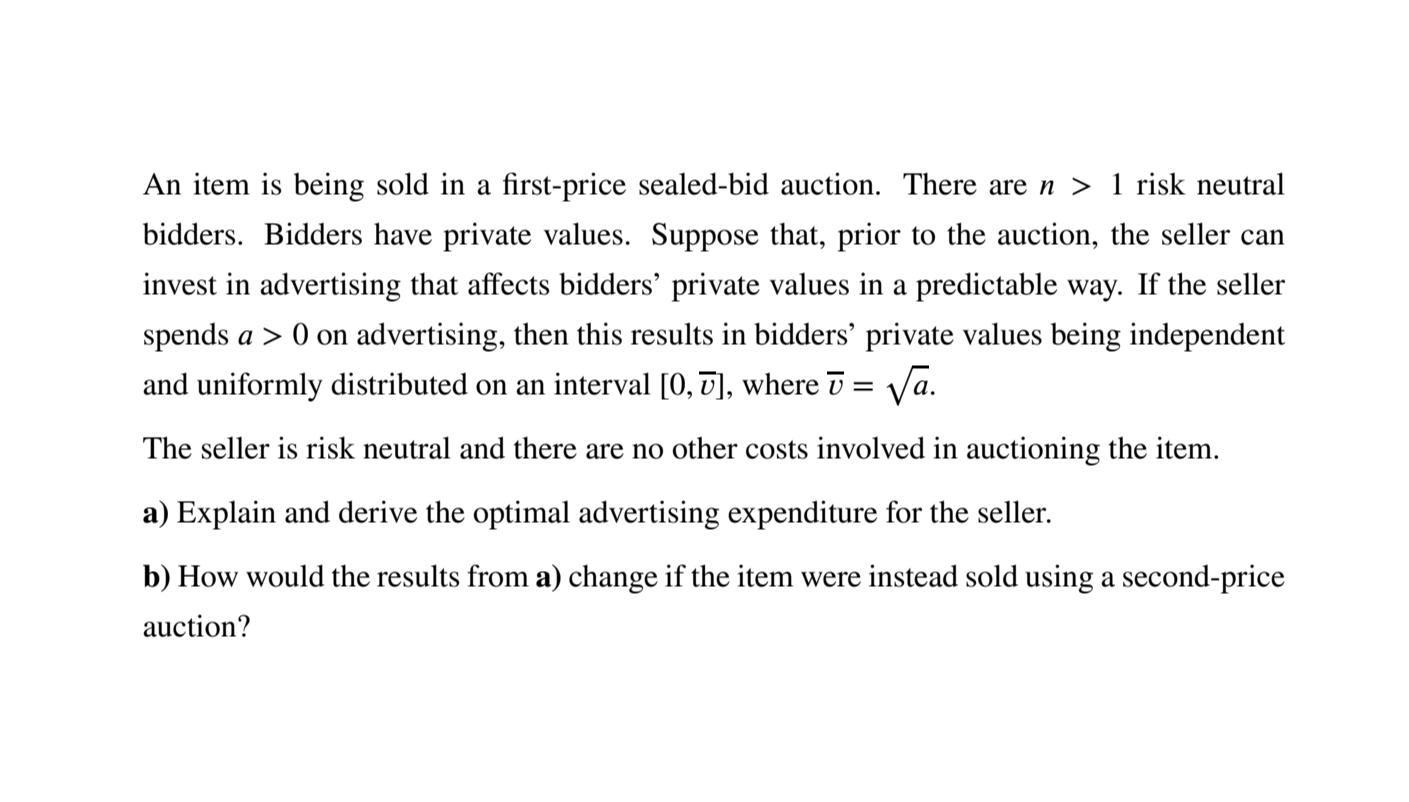

An item is being sold in a first-price sealed-bid auction. There are n > 1 risk neutral bidders. Bidders have private values. Suppose that, prior to the auction, the seller can invest in advertising that affects bidders' private values in a predictable way. If the seller spends a > 0 on advertising, then this results in bidders' private values being independent and uniformly distributed on an interval [0, 7], where = a. The seller is risk neutral and there are no other costs involved in auctioning the item. a) Explain and derive the optimal advertising expenditure for the seller. b) How would the results from a) change if the item were instead sold using a second-price auction?

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a Optimal Advertising Expenditure in a FirstPrice SealedBid Auction In this scenario the seller can invest in advertising to influence the bidders pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started