Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An obligation can be settled by making a payment of $ 1 , 0 0 0 now and a final payment of $ 1 3

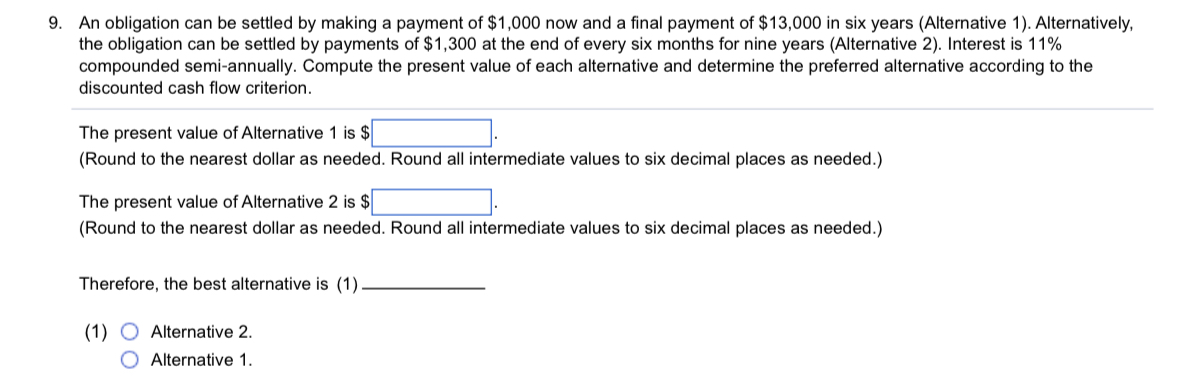

An obligation can be settled by making a payment of $ now and a final payment of $ in six years Alternative Alternatively, the obligation can be settled by payments of $ at the end of every six months for nine years Alternative Interest is compounded semiannually. Compute the present value of each alternative and determine the preferred alternative according to the discounted cash flow criterion.

The present value of Alternative is $

Round to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.

The present value of Alternative is $

Round to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.

Therefore, the best alternative is

Alternative

Alternative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started