Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An oil production company extracts and ships 4,000 barrels of oil every day. Each barrel of oil costs $50 and takes one month to

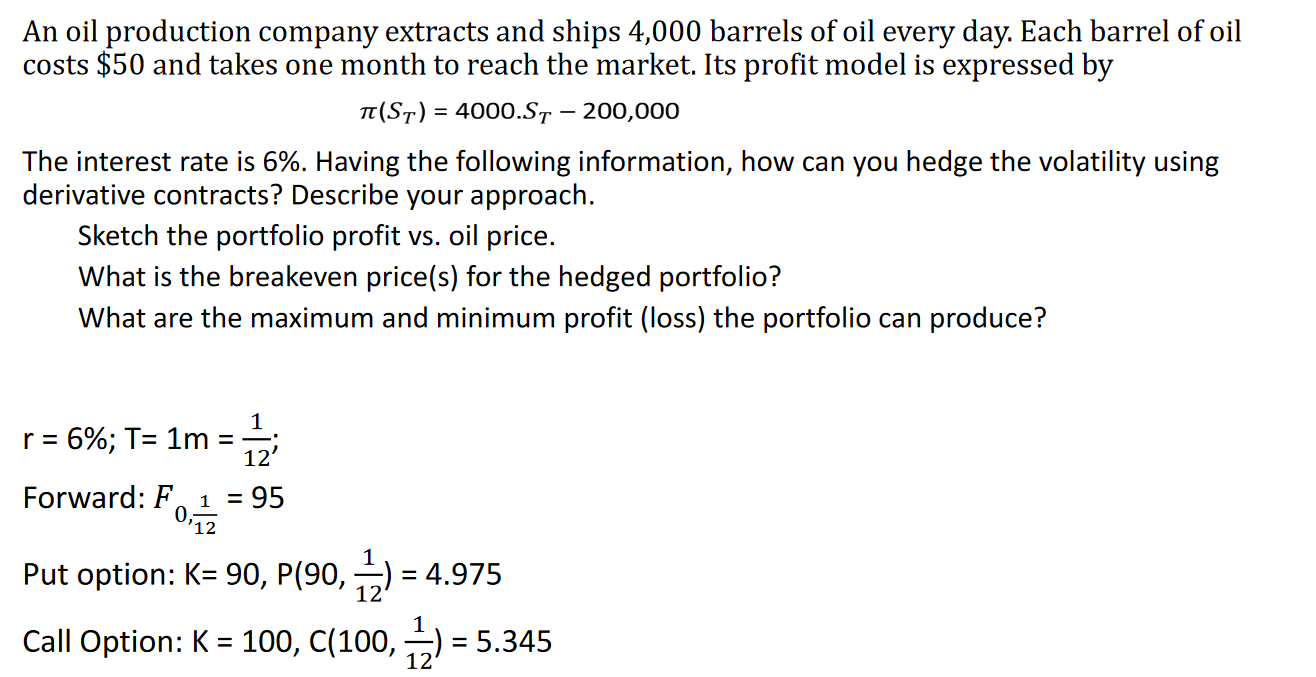

An oil production company extracts and ships 4,000 barrels of oil every day. Each barrel of oil costs $50 and takes one month to reach the market. Its profit model is expressed by (ST) = 4000.ST - 200,000 The interest rate is 6%. Having the following information, how can you hedge the volatility using derivative contracts? Describe your approach. Sketch the portfolio profit vs. oil price. What is the breakeven price(s) for the hedged portfolio? What are the maximum and minimum profit (loss) the portfolio can produce? r = 6%; T= 1m = 1 12' Forward: F 1 = 95 0,12 Put option: K= 90, P(90, 1) = 4.975 Call Option: K = 100, C(100, 12) = = 5.345

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To hedge the volatility using derivative contracts the company can use a combination of forward cont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started