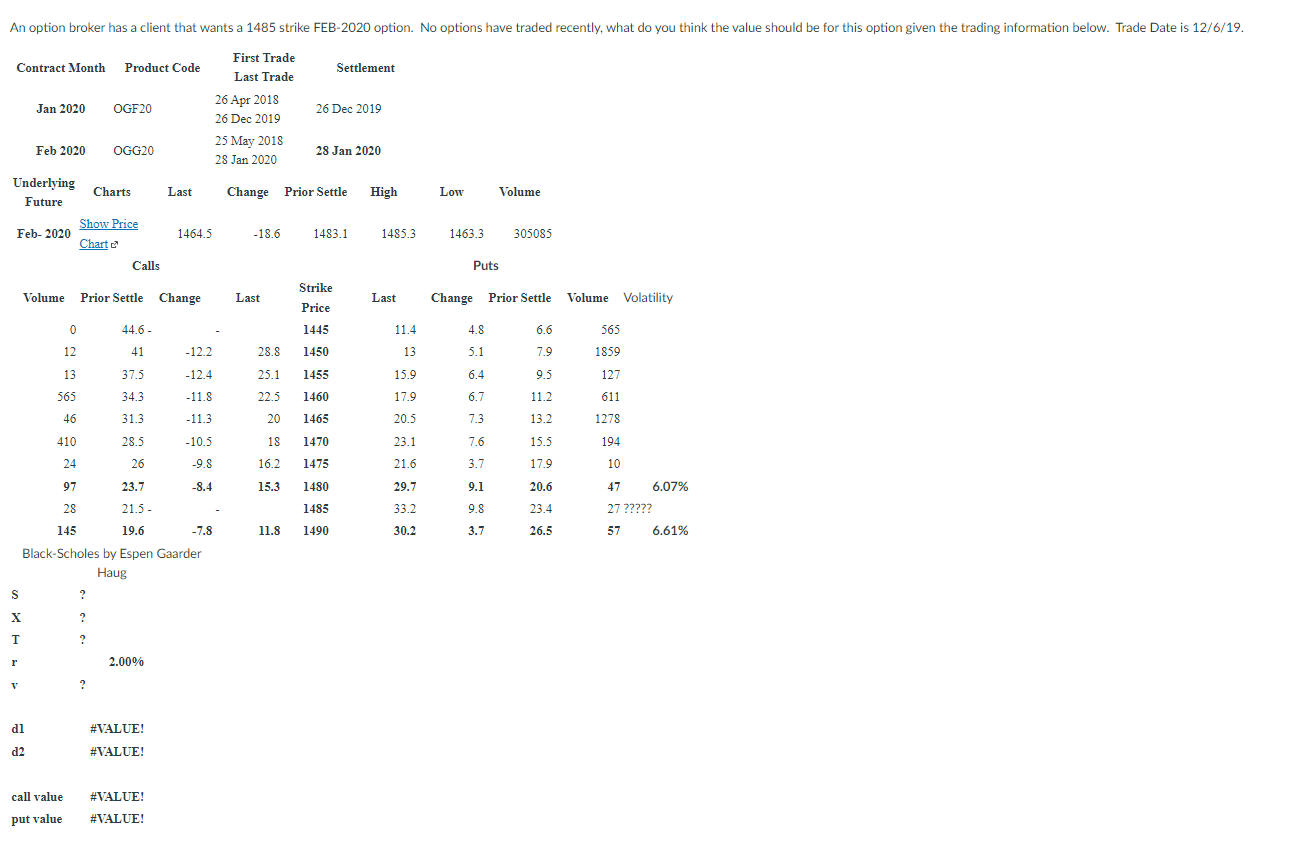

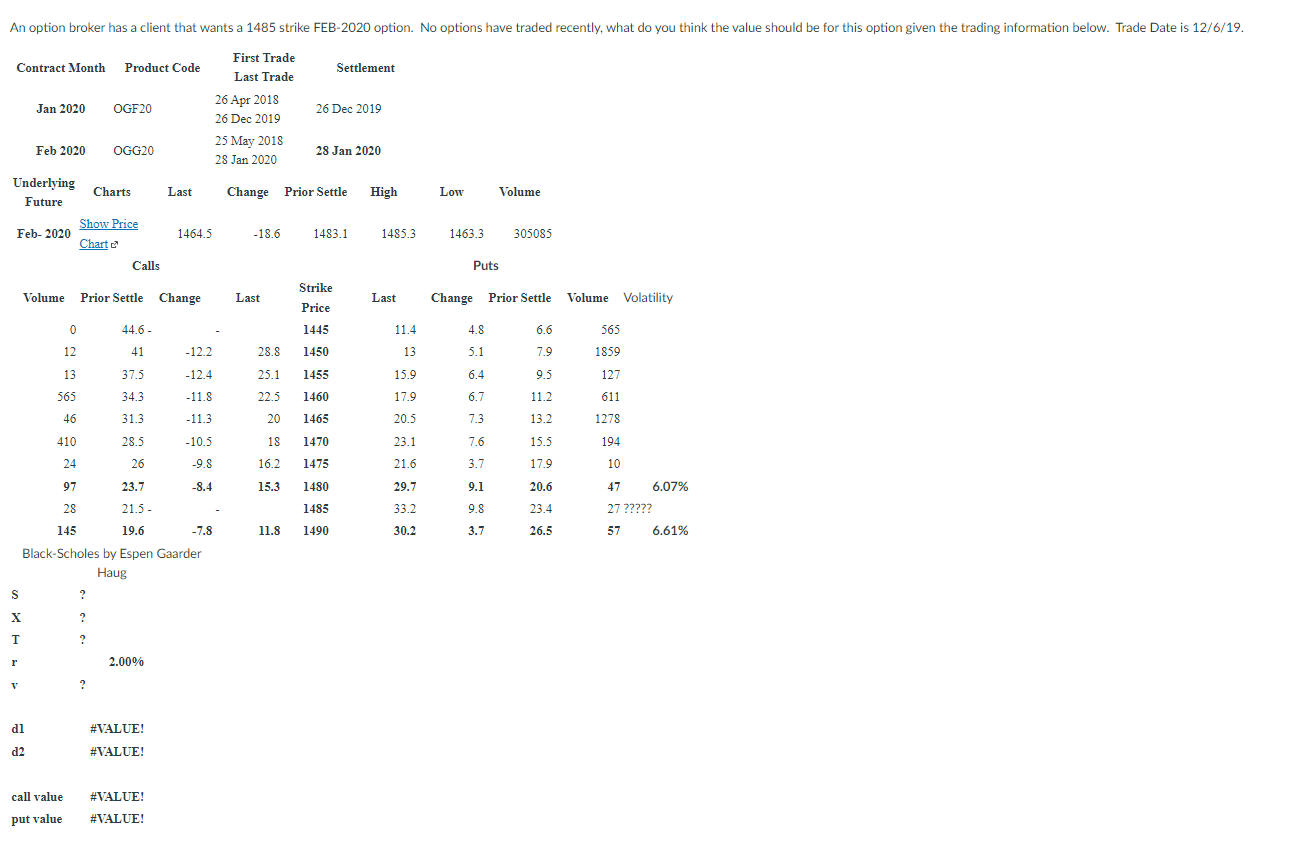

An option broker has a client that wants a 1485 strike FEB-2020 option. No options have traded recently, what do you think the value should be for this option given the trading information below. Trade Date is 12/6/19. Contract Month Product Code Settlement Jan 2020 OGF20 First Trade Last Trade 26 Apr 2018 26 Dec 2019 25 May 2018 28 Jan 2020 26 Dec 2019 Feb 2020 OGG20 28 Jan 2020 Last Change Prior Settle High Low Volume Underlying Charts Future Show Price Feb-2020 Chart Calls 1464.5 -18.6 1483.1 1485.3 1463.3 305085 Puts Volume Prior Settle Change Last Last Change Prior Settle Volume Volatility 44.6 - 4.8 6.6 0 12 Strike Price 1445 1450 1455 1460 11.4 13 41 -12.2 28.8 5.1 7.9 565 1859 127 13 37.5 -12.4 25.1 9.5 15.9 17.9 565 34.3 -11.8 22.5 6.4 6.7 7.3 11.2 611 46 31.3 -11.3 20 1465 20.5 13.2 1278 410 -10.5 18 23.1 7.6 15.5 194 28.5 26 24 -9.8 16.2 21.6 3.7 17.9 10 15.3 1470 1475 1480 1485 1490 9.1 20.6 97 23.7 -8.4 28 21.5 - 145 19.6 -7.8 Black-Scholes by Espen Gaarder Haug 29.7 33.2 30.2 47 6.07% 27 ????? 9.8 23.4 26.5 11.8 3.7 57 6.61% S ? ? T ? r 2.00% V dl #VALUE! d2 #VALUE! call value #VALUE! #VALUE! put value An option broker has a client that wants a 1485 strike FEB-2020 option. No options have traded recently, what do you think the value should be for this option given the trading information below. Trade Date is 12/6/19. Contract Month Product Code Settlement Jan 2020 OGF20 First Trade Last Trade 26 Apr 2018 26 Dec 2019 25 May 2018 28 Jan 2020 26 Dec 2019 Feb 2020 OGG20 28 Jan 2020 Last Change Prior Settle High Low Volume Underlying Charts Future Show Price Feb-2020 Chart Calls 1464.5 -18.6 1483.1 1485.3 1463.3 305085 Puts Volume Prior Settle Change Last Last Change Prior Settle Volume Volatility 44.6 - 4.8 6.6 0 12 Strike Price 1445 1450 1455 1460 11.4 13 41 -12.2 28.8 5.1 7.9 565 1859 127 13 37.5 -12.4 25.1 9.5 15.9 17.9 565 34.3 -11.8 22.5 6.4 6.7 7.3 11.2 611 46 31.3 -11.3 20 1465 20.5 13.2 1278 410 -10.5 18 23.1 7.6 15.5 194 28.5 26 24 -9.8 16.2 21.6 3.7 17.9 10 15.3 1470 1475 1480 1485 1490 9.1 20.6 97 23.7 -8.4 28 21.5 - 145 19.6 -7.8 Black-Scholes by Espen Gaarder Haug 29.7 33.2 30.2 47 6.07% 27 ????? 9.8 23.4 26.5 11.8 3.7 57 6.61% S ? ? T ? r 2.00% V dl #VALUE! d2 #VALUE! call value #VALUE! #VALUE! put value