Question

An organization is using capital budgeting techniques to compare two independent projects. It could accept one, both, or neither of the projects. Which of the

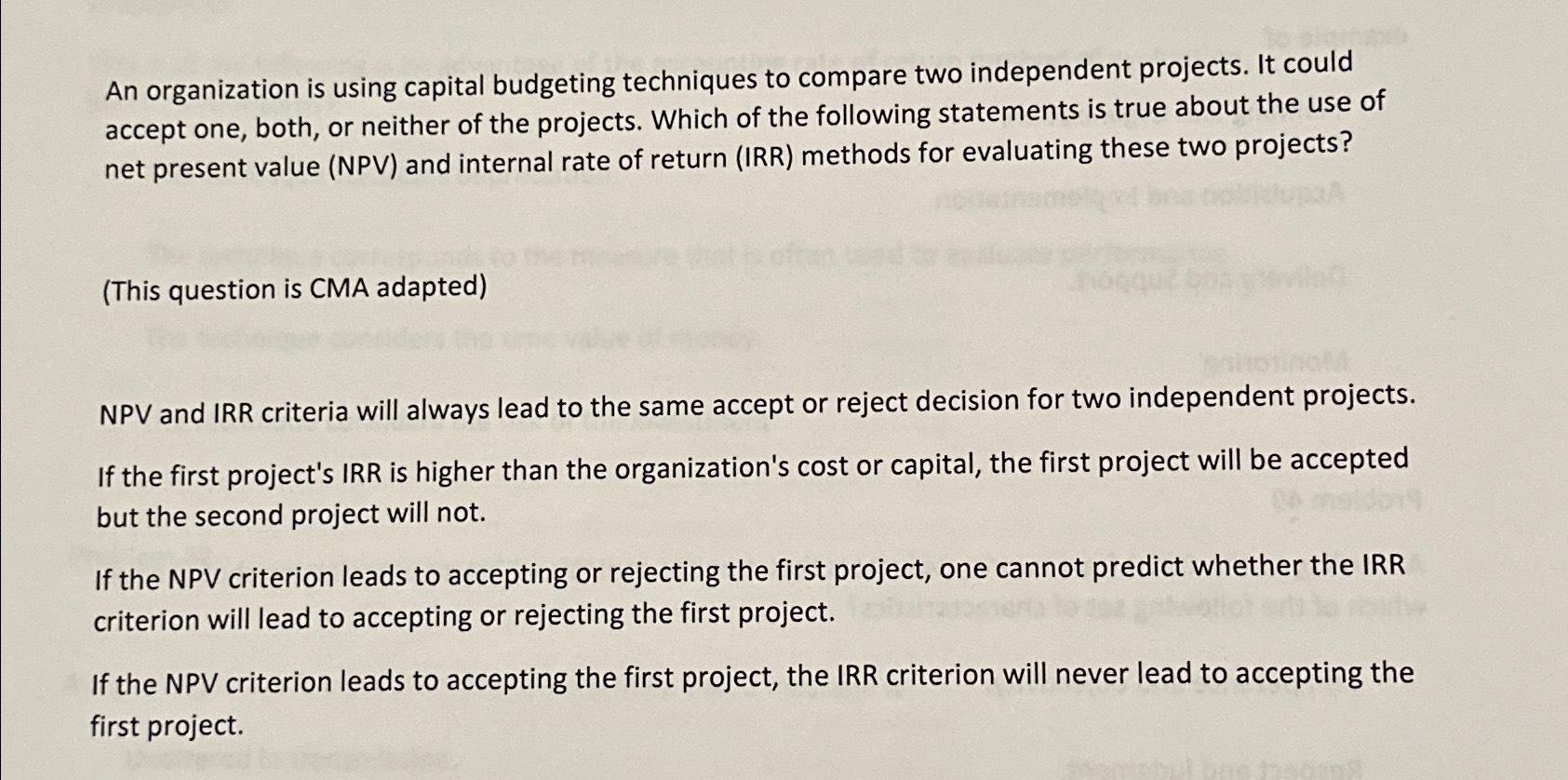

An organization is using capital budgeting techniques to compare two independent projects. It could accept one, both, or neither of the projects. Which of the following statements is true about the use of net present value (NPV) and internal rate of return (IRR) methods for evaluating these two projects?\ (This question is CMA adapted)\ NPV and IRR criteria will always lead to the same accept or reject decision for two independent projects. If the first project's IRR is higher than the organization's cost or capital, the first project will be accepted but the second project will not.\ If the NPV criterion leads to accepting or rejecting the first project, one cannot predict whether the IRR criterion will lead to accepting or rejecting the first project.\ If the NPV criterion leads to accepting the first project, the IRR criterion will never lead to accepting the first project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started