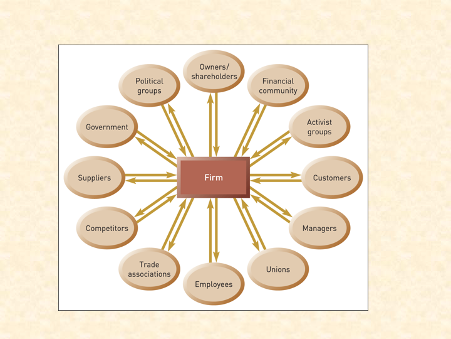

An organization'spurpose and respective strategy are influenced by its stakeholders.

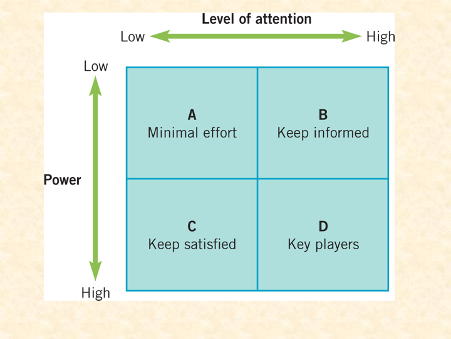

- Use the relevant dimensions of Figure 5.2 to identify the main stakeholders for Volkwagen'selectric vehicle production and their main expectations. Using Figure 5.3, map out thesestakeholders' levels ofpower and attention and indicate whether they are likely to be a'blocker'or'facilitator' ofVolkswagen's attempt to "win the EV contest". In what ways might the expectations of the various stakeholder groups differ and potentially come into conflict?

- Apply the criteria in Table 5.3 to identify and briefly outline how Volkswagen'sposition on corporate social responsibility aligns with one (or more) of the four ethical stances.

- Conclude your analysis by making two recommendations to the CEO on actions that Volkswagen should take with regards to managing its stakeholders as it pursues growth in EV production.

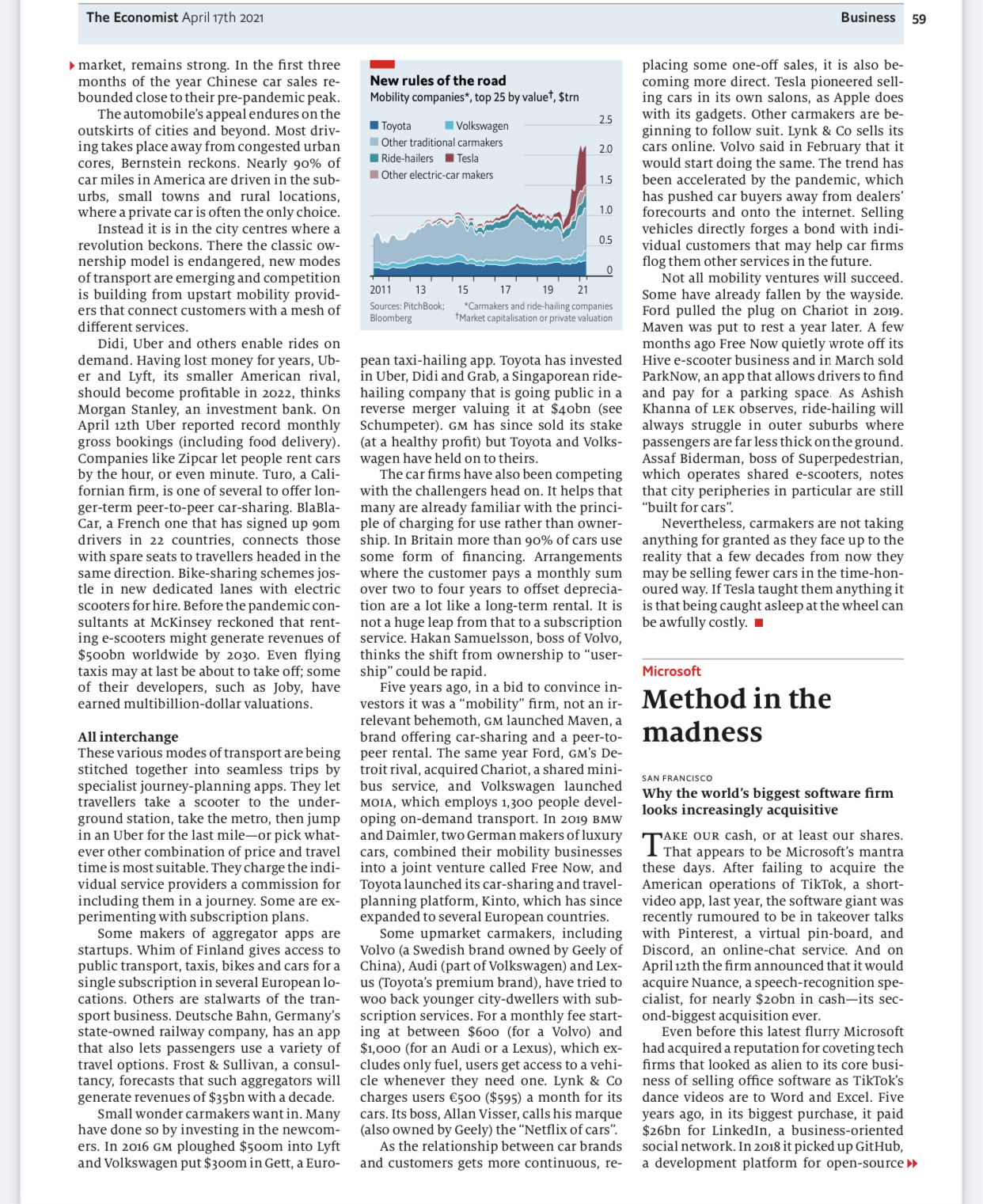

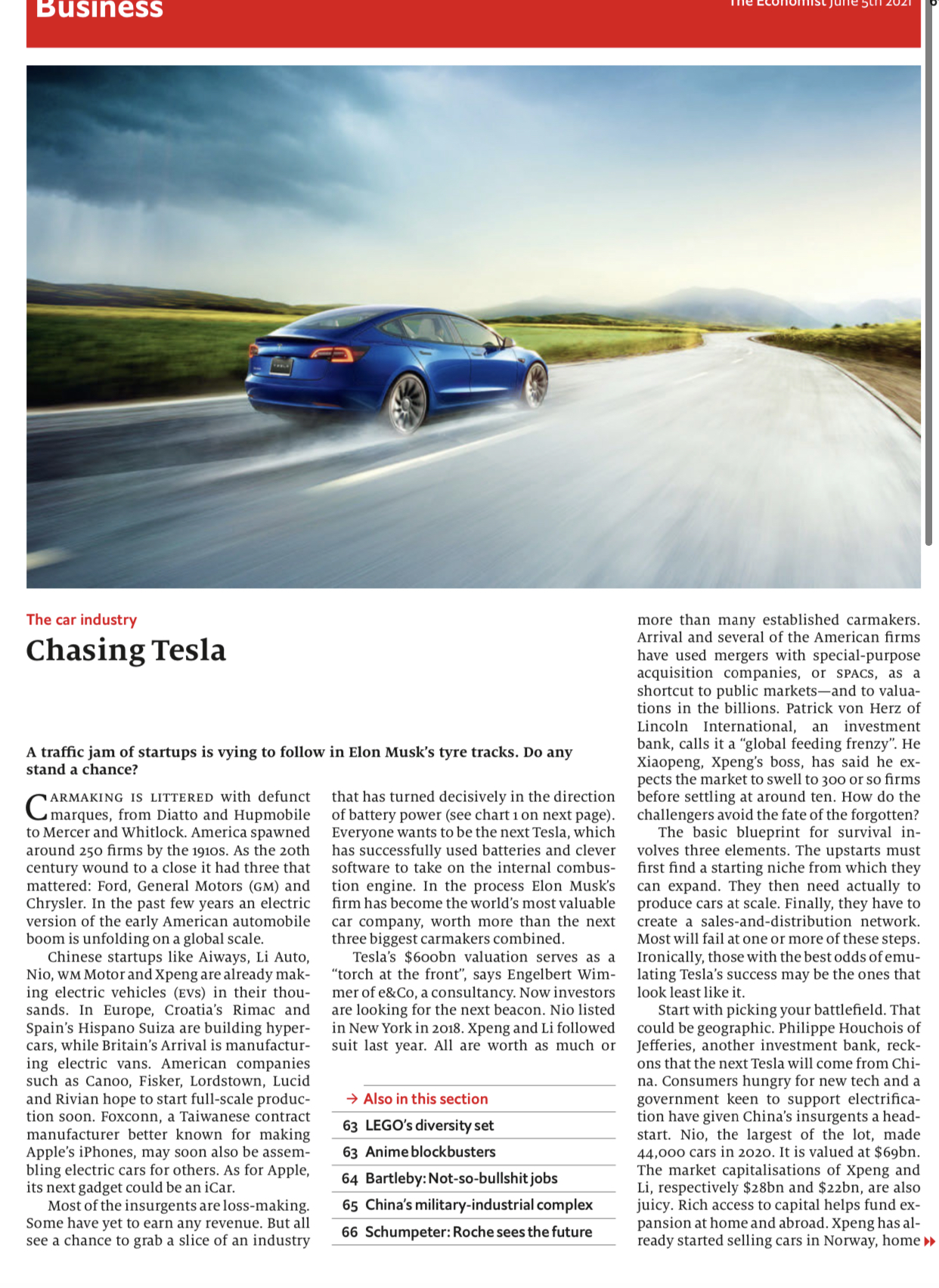

Owners/ Political shareholders Financial groups community Activist Government groups Suppliers Firm Customers Competitors Managers Trade Unions associations EmployeesLevel of attention Low High Low A B Minimal effort Keep informed Power C D Keep satisfied Key players HighThe Economist April 17th 2021 Business 57 are made with products of petroleum-in- implies that markets did not consider the what lower yields for corporate bonds tied cluding its jackets. rhetoric to be of material importance. The to some do-gooding metrics. After study- In terms of its impact on hot-button is- fact that some of the loudest proponents of ing ten years' worth of public-interest pro- sues, corporate activism can backfire if it stakeholder capitalism, such as Salesforce, posals at S&P 500 companies, on every- causes the party against which it is direct- laid off workers amid the pandemic de- thing from economic inequality to animal ed to dig in its heels. Jeffrey Sonnenfeld of spite record revenues suggests that inves- welfare, Roberto Tallarita, also of Harvard the Yale School of Management, who or- tors may be onto something. Law School, found that virtually no such ganised a gathering of CEOS on April 10th to In time, shareholders themselves may motions pass. But support for them is on discuss voter laws, acknowledges parti- become more political. The rise of invest- the rise. In 2010 18% of shareholders voted sanship is involved. He believes both busi- ment funds that consider environmental, for them, on average. By 2019 this had risen ness and Mr Biden share a common inter- social and governance (ESG) factors sug- to 28%. One day the boardroom may be- est in the centre ground. In the face of op- gests an appetite for certain forms of social come as political as the corner office. In the position from "liberal elites", to which ma- stance-taking when allocating capital. ESG meantime, CEO pontificating is likely only ny bosses are seen to belong, Republicans investors are often willing to accept some- to get louder. may be more emboldened to press on with restrictive voter laws-just to rub it in Chief executives claim that they simply have no choice but to tackle societal con- cerns because in the age of social media their customers, employees and share- holders demand it. The evidence for such assertions is mixed. Start with consumers. Some polls show B that supporters of each party would buy more goods from companies that lean either right or left. But other research has found that consumers were more likely to remember a product they stopped using in protest at what a CEO said rather than one they started using in support. After a shooting spree in one of its superstores in 2019 Walmart banned some sales of gun ammunition. A subsequent study found that footfall in Walmart stores in Republi- can districts fell more sharply as a result than it rose in Democratic ones. The impact on employees is also incon- Personal transport clusive. Many tech firms in the knowledge economy are happy to wear their leftie The future of getting from A to B leanings on their sleeves, believing this will attract bright millennial workers who tend to share such views. But it can go too far. Lincoln Network, a conservative-lean- ing consultancy, found that firms promot- ing a political agenda can have an oppres- sive internal monoculture, which stifles New means of moving about may disrupt the car business no less than Tesla has creativity rather than fostering it. IN THE DECADES after the second world are not carmakers at all but Uber, an Amer- Then there are the shareholders. Bosses I war carmakers were the undisputed ican ride-hailing giant worth over $10obn, rarely consult them before making politi- champions of the personal-transport and Didi Chuxing, a Chinese one that on cal statements. Lucian Bebchuk of Harvard economy. Competition and economies of April 10th was reported to have filed confi- Law School found that among signatories scale made cars affordable to millions of dentially to go public in New York and of the Business Roundtable's stakeholder motorists in industrialised countries. In hopes for a similar valuation. pledge only one of 48 for whom data were the 1980s and 1990s the likes of General After being slow to react to the threat available had consulted their board before- Motors (GM) and Toyota boasted some of from Tesla, legacy carmakers are-just hand. That suggests a lot of the pro-social the world's richest market capitalisations. about-getting to grips with electrifica rhetoric is lip service. When it came to getting around town, tion. Now another disruption lurks around Investors seem to see it that way. The nothing beat the automobile. the corner. Changing habits and technolo share prices of s&P 500 companies whose Today the picture looks different. Of the gy are forcing car companies to rethink bosses signed that declaration-which, if five most valuable firms in the moving- how their products are sold, used and taken at face value, would mean that share- people-around business only two, Toyota owned. In a sign of the times, the boss of holders would have to share the spoils with of Japan and Volkswagen of Germany, are Volkswagen, Herbert Diess, concedes that other stakeholders-performed almost established carmakers. Ahead of everyone "ownership is not necessarily what you identically to those of companies whose by a country mile is Tesla, an American want. You want a car when you need a car." CEOS were not among the signatories. That company that has disrupted the car indus- Competitors are elbowing in; Didi is ex- try by turning electric vehicles from an un- pected to be the star turn at the Shanghai Correction In the article "Unbundling sport" (April sightly curiosity (remember the G-wiz?) in- Motor Show later this month. The private 10th) we described Fox in 1993 as a cable-television to a serious challenger to the internal com- car is not obsolete. But the future business channel. It was in fact a free-to-air network. Sorry bustion engine. Rounding off the top five of "mobility"-as the industry has re- >Business r branded getting from A to nwill involve much more besides. The market could beenormous. In 2019. ahead of its otation, Uber put it at $5.7trn. based on the zotrn or so kilometres that passengers travel each year in 175 countries using road vehicles. including public tran- sport. Consultancies' estimates are more subdued. and vary considerably. But all point to rich potential. ms Markit reckons that what it calls "new transport" will be worth saoobn in revenues by 2030. KPMG puts the gure at $1trn. Accenture calcu- lates that revenues from mobility. includ- ing car sales. will hit $6.6trn by zoso; new transport will make up 40% of the total. Individually owned cars will remain a big part of the new ecosystem. They are still the world's preferred means of trans- port. For every ten miles travelled Ameri- cans use the car for eight. Europeans for seven and Chinese for six. Even in Europe. which is friendlier to public transportthan America or China. only one in six miles was travelled on buses. trains and coaches in 2017. Uber accounts forjust 1.5% of total miles driven in its home market. The pandemic has in some ways ce- The Economist April 17th 2021 mented the car's pole position. Many peo- ple have shunned shared vehicles. be they cabs or buses. for fear of infection. A sur- vey ofAmerican travel habits by LEK. a con- sultancy. showed that car journeys de- clined by just 9% last year. compared with 55-65% for public transport and ride-hail- ing. Although today's teenagers are less in- terested in getting behind the wheel than their parents were. that changes when they turn 10. Between 2010 and 1013 America lost Soo.ooo drivers under 19 but gained 1.3m aged ao-zg. estimates Bernstein. a broker. Zeal for cars in China. the biggest HERE comes a time when even the most glittering career must come to an end. Choosing the right moment to retire is difcult enough, but many people also struggle to imagine what they could possibly do next. In their new book. \"Changing Gear". Ian Hall. a former headhunter. and Jon Stokes, a psychol- ogist. discuss the strategies that people can follow when approaching the "third stage\" of life, after their childhood and their careers. As the authors note. the third stage involves individuals redening their role in the community. This process may be particularly difcult for those who have been in high-powered jobs. They must come to terms with a loss of their status and the realisation that they are both replaceable and mortal. Employment provides people with a lot more than just an income: it gives a structure to the day. opens up new friendships and provides a purpose that comes from taking part in a shared endeavour. Those who have reached the top of the tree often neglect the other areas of their lifeindeed. they may not have got so high if they did n't. For such people. retiring may be a lot like the five stages of grief: denial. anger. bargaining. depres- sion and acceptance. Denial is particular- ly signicant. As Ms Hall and Mr Stokes observe. \"those in power gradually be- come insulated from reality" and "devel- op an inated sense of their own impor- tance\". Executives may not realise they have grown out of touch with new mar- ketdevelopments or so overweening in their behaviour that they are alienating their staff. When others suggest that it is time for them to step down, they may feel angry at the apparent betrayal. It can also be hard for high-powered people to map out a future after they quit their posts. While they are working, they may have no time to consider alternative activities. leaving theirjobs maybe a little like a drug addict going \"cold turkey\". The word "retirement.\" conjures up ideas of passivity and retreat that many nd un- attractive, Ms Hall and Mr Stokes point out. Individuals may have chosen leader- ship roles because they like having power over others or sway over events. Shiing into a role as a non-executive. or volun- teering for a charity, will not seem like an adequate substitute. They still want to be in charge of something. Nor will ho me life necessarily be easy. Spouses and children have often become used to coping withouta parent who has worked long hours. They have built their own networks of friends and activities. They may nd it hard to adjust to the presence of a bored pensioner knocking about the house. On top of that. it may have been tricky for those in positions of authority to develop close friendships themselves. particularly at work. The book presents a series of case studies of people who have been through this kind of upheaval. some a lot more successfully than others. There is. inev- itably perhaps. a bit of psychobabble. But readers who tolerate talk of \"transition mindsets\" and \"potential desired compe- tences" will discover that the individual stories are instructive and the questions posed by the authors are important. Those near retirement must work out who they have been. who they are now and who they would like to become. The answers will vary fromperson to person; there is \"no one size ts all" solution. Bartleby's father was never happier than when. after retiring from his job as a headmaster. he was able to spend his time reading, gardening and listening to Mozart. Other people would be bored to tears by such a life. The au- thors suggest that people be willing to experiment. to try new activities, devel- op new skills and talk to others who have been through the same process. Another approach is to keep ajoumal and make a list of things that you like to do. or have also wished to do. In addition. those approaching reti re- ment should consider the type of role they like to play. Do they enjoy wo rking with others or working alone? Do they draw satisfaction mainly from devel- oping ideas or from co-o rdinang teams? Since self-awareness is a difcult skill. people should talk to a few trusted con- tacts to discover how they are perceived by the wider world. They may nd the answers are surprising. This is a critical issue. Think of all the time people spend deciding which uni- versity they would like to attend. which course they would like to study and which career they would wish to follow. Deciding on their post-career lifestyle is just as important. They may have de- cades left to enjoy. The Economist April 17th 2021 Business 59 market, remains strong. In the first three placing some one-off sales, it is also be- months of the year Chinese car sales re- New rules of the road coming more direct. Tesla pioneered sell- bounded close to their pre-pandemic peak. Mobility companies*, top 25 by value, $trn ing cars in its own salons, as Apple does The automobile's appeal endures on the 2.5 with its gadgets. Other carmakers are be- outskirts of cities and beyond. Most driv- Toyota Volkswagen ginning to follow suit. Lynk & Co sells its ing takes place away from congested urban Other traditional carmakers 2.0 cars online. Volvo said in February that it cores, Bernstein reckons. Nearly 90% of Ride-hailers Tesla would start doing the same. The trend has car miles in America are driven in the sub- Other electric-car makers 1.5 been accelerated by the pandemic, which urbs, small towns and rural locations, has pushed car buyers away from dealers where a private car is often the only choice. 1.0 forecourts and onto the internet. Selling Instead it is in the city centres where a vehicles directly forges a bond with indi- revolution beckons. There the classic ow- 0.5 vidual customers that may help car firms nership model is endangered, new modes flog them other services in the future of transport are emerging and competition is building from upstart mobility provid- 2011 13 15 17 Not all mobility ventures will succeed. 19 21 Some have already fallen by the wayside. ers that connect customers with a mesh of Sources: PitchBook; *Carmakers and ride-hailing companies Market capitalisation or private valuation Ford pulled the plug on Chariot in 2019 different services. Bloomberg Maven was put to rest a year later. A few Didi, Uber and others enable rides on months ago Free Now quietly wrote off its demand. Having lost money for years, Ub- pean taxi-hailing app. Toyota has invested Hive e-scooter business and in March sold er and Lyft, its smaller American rival, in Uber, Didi and Grab, a Singaporean ride- ParkNow, an app that allows drivers to find should become profitable in 2022, thinks hailing company that is going public in a and pay for a parking space. As Ashish Morgan Stanley, an investment bank. On reverse merger valuing it at $40bn (see Khanna of LEK observes, ride-hailing will April 12th Uber reported record monthly Schumpeter). GM has since sold its stake always struggle in outer suburbs where gross bookings (including food delivery). (at a healthy profit) but Toyota and Volks- passengers are far less thick on the ground. Companies like Zipcar let people rent cars wagen have held on to theirs. Assaf Biderman, boss of Superpedestrian, by the hour, or even minute. Turo, a Cali- The car firms have also been competing which operates shared e-scooters, notes fornian firm, is one of several to offer lon- with the challengers head on. It helps that that city peripheries in particular are still ger-term peer-to-peer car-sharing. BlaBla- many are already familiar with the princi- "built for cars". Car, a French one that has signed up 9om ple of charging for use rather than owner- Nevertheless, carmakers are not taking drivers in 22 countries, connects those ship. In Britain more than 90% of cars use anything for granted as they face up to the with spare seats to travellers headed in the some form of financing. Arrangements reality that a few decades from now they same direction. Bike-sharing schemes jos- where the customer pays a monthly sum may be selling fewer cars in the time-hon- tle in new dedicated lanes with electric over two to four years to offset deprecia- oured way. If Tesla taught them anything it scooters for hire. Before the pandemic con- tion are a lot like a long-term rental. It is is that being caught asleep at the wheel can sultants at Mckinsey reckoned that rent- not a huge leap from that to a subscription be awfully costly. ing e-scooters might generate revenues of service. Hakan Samuelsson, boss of Volvo, $50obn worldwide by 2030. Even flying thinks the shift from ownership to "user- taxis may at last be about to take off; some ship" could be rapid. Microsoft of their developers, such as Joby, have Five years ago, in a bid to convince in- earned multibillion-dollar valuations. vestors it was a "mobility" firm, not an ir- Method in the relevant behemoth, GM launched Maven, a All interchange brand offering car-sharing and a peer-to- madness These various modes of transport are being peer rental. The same year Ford, GM's De- stitched together into seamless trips by troit rival, acquired Chariot, a shared mini- bus service, and Volkswagen launched SAN FRANCISCO specialist journey-planning apps. They let travellers take a scooter to the under- MOIA, which employs 1,300 people devel- Why the world's biggest software firm ground station, take the metro, then jump oping on-demand transport. In 2019 BMW looks increasingly acquisitive in an Uber for the last mile-or pick what- and Daimler, two German makers of luxury TAKE OUR cash, or at least our shares. ever other combination of price and travel cars, combined their mobility businesses I That appears to be Microsoft's mantra time is most suitable. They charge the indi- into a joint venture called Free Now, and these days. After failing to acquire the vidual service providers a commission for Toyota launched its car-sharing and travel- American operations of TikTok, a short- including them in a journey. Some are ex- planning platform, Kinto, which has since video app, last year, the software giant was perimenting with subscription plans. expanded to several European countries. recently rumoured to be in takeover talks Some makers of aggregator apps are Some upmarket carmakers, including with Pinterest, a virtual pin-board, and startups. Whim of Finland gives access to Volvo (a Swedish brand owned by Geely of Discord, an online-chat service. And on public transport, taxis, bikes and cars for a China), Audi (part of Volkswagen) and Lex- April 12th the firm announced that it would single subscription in several European lo- us (Toyota's premium brand), have tried to acquire Nuance, a speech-recognition spe- cations. Others are stalwarts of the tran- woo back younger city-dwellers with sub- cialist, for nearly $20bn in cash-its sec- sport business. Deutsche Bahn, Germany's scription services. For a monthly fee start- ond-biggest acquisition ever. state-owned railway company, has an app ing at between $600 (for a Volvo) and Even before this latest flurry Microsoft that also lets passengers use a variety of $1,000 (for an Audi or a Lexus), which ex- had acquired a reputation for coveting tech travel options. Frost & Sullivan, a consul- cludes only fuel, users get access to a vehi- firms that looked as alien to its core busi- fancy, forecasts that such aggregators will cle whenever they need one. Lynk & Co ness of selling office software as TikTok's generate revenues of $35bn with a decade. charges users E500 ($595) a month for its dance videos are to Word and Excel. Five Small wonder carmakers want in. Many cars. Its boss, Allan Visser, calls his marque years ago, in its biggest purchase, it paid have done so by investing in the newcom- (also owned by Geely) the "Netflix of cars". $26bn for LinkedIn, a business-oriented ers. In 2016 GM ploughed $5oom into Lyft As the relationship between car brands social network. In 2018 it picked up GitHub, and Volkswagen put $30om in Gett, a Euro- and customers gets more continuous, re- a development platform for open-sourceBusiness The car industry more than many established carmakers. Chasing Tesla Arrival and several of the American firms have used mergers with special-purpose acquisition companies, or SPACS, as a shortcut to public markets-and to valua- tions in the billions. Patrick von Herz of Lincoln International, an investment A traffic jam of startups is vying to follow in Elon Musk's tyre tracks. Do any bank, calls it a "global feeding frenzy". He stand a chance? Xiaopeng, Xpeng's boss, has said he ex- pects the market to swell to 300 or so firms ARMAKING IS LITTERED with defunct that has turned decisively in the direction before settling at around ten. How do the marques, from Diatto and Hupmobile of battery power (see chart 1 on next page). challengers avoid the fate of the forgotten? to Mercer and Whitlock. America spawned Everyone wants to be the next Tesla, which The basic blueprint for survival in- around 250 firms by the 1910s. As the 20th has successfully used batteries and clever volves three elements. The upstarts must century wound to a close it had three that software to take on the internal combus first find a starting niche from which they mattered: Ford, General Motors (GM) and tion engine. In the process Elon Musk's can expand. They then need actually to Chrysler. In the past few years an electric firm has become the world's most valuable produce cars at scale. Finally, they have to version of the early American automobile car company, worth more than the next create a sales-and-distribution network. boom is unfolding on a global scale. three biggest carmakers combined. Most will fail at one or more of these steps. Chinese startups like Aiways, Li Auto, Tesla's $60obn valuation serves as a Ironically, those with the best odds of emu- Nio, WM Motor and Xpeng are already mak- "torch at the front", says Engelbert Wim- lating Tesla's success may be the ones that ing electric vehicles (EVS) in their thou- mer of e&Co, a consultancy. Now investors look least like it. sands. In Europe, Croatia's Rimac and are looking for the next beacon. Nio listed Start with picking your battlefield. That Spain's Hispano Suiza are building hyper- in New York in 2018. Xpeng and Li followed could be geographic. Philippe Houchois of cars, while Britain's Arrival is manufacture suit last year. All are worth as much or Jefferies, another investment bank, reck- ing electric vans. American companies ons that the next Tesla will come from Chi- such as Canoo, Fisker, Lordstown, Lucid na. Consumers hungry for new tech and a and Rivian hope to start full-scale produc- -> Also in this section government keen to support electrifica tion soon. Foxconn, a Taiwanese contract tion have given China's insurgents a head- manufacturer better known for making 63 LEGO's diversity set start. Nio, the largest of the lot, made Apple's iPhones, may soon also be assem- 63 Anime blockbusters 44,000 cars in 2020. It is valued at $69bn. bling electric cars for others. As for Apple, its next gadget could be an iCar. 64 Bartleby: Not-so-bullshit jobs The market capitalisations of Xpeng and Li, respectively $28bn and $22bn, are also Most of the insurgents are loss-making. 65 China's military-industrial complex juicy. Rich access to capital helps fund ex- Some have yet to earn any revenue. But all pansion at home and abroad. Xpeng has al- see a chance to grab a slice of an industry 66 Schumpeter: Roche sees the future ready started selling cars in Norway, home62 Business The Economist June 5th 2021 to Europe's most enthusiastic EV buyers. ers of the sort used by big carmakers to Nio is about to join it. Elons in waiting 2 make small runs of cars or those with fin- Even more important than geography is Electric-vehicle makers icky features such as folding roofs. choosing the right market segment. Tesla Market capitalisation, 2021, $trn Arrival's approach may be the most in- was not the first to make Evs but it was the 1.0 novative. Where Tesla and others are going first to make big and pricey premium ones Next five biggest "giga", the British firm says "micro". Com- where the high cost of the battery could be 0.8 mercial vehicles do not require the styling absorbed. Many new firms are also aiming or customisation of passenger cars, so it is at premium suvs and saloons where profit D.6 eschewing production lines for "cell" as- margins are fattest. But competition is hot- ting up from established carmakers such 0.4 sembly of composite panels. This can be done in small industrial units that cost just as Volkswagen's Audi and Porsche brands, Tesla 0.2 $40m-5om to buy and retool. These can as well as Mercedes. In April Geely, a Chi- produce 10,000 vehicles a year close to nese firm with global ambitions, launched 0 markets, adding scale with less risk. a premium electric marque called Zeekr. Mar Apr May Jun The final hurdle is flogging the vehicles The mass market, meanwhile, is likewise Jan Feb Source: Refinitiv Datastream to consumers. The new EV-makers are busy, with GM and Ford the latest to an- mostly dispensing with traditional dealer nounce a big electric push. networks in favour of Tesla's model of on- Other segments may therefore be a bet- visiting card" for investors, says Pedro Pa- line sales backed up with shops to show off ter bet. One is light commercial vehicles, checo of Gartner, a consultancy. But it is their wares. That still leaves the challenge demand for which has been boosted by the not enough to stick big touchscreens onto of creating a servicing network if anything pandemic e-commerce boom. Alastair a standard electric power train, as many of goes wrong. Such networks, which car buy- Hayfield of Interact Analysis, a consultan- the Chinese Tesla copycats are doing. The ers have come to expect, can be as expen- cy, sees "no Tesla yet" for delivery vans. over-the-air software updates, proprietary sive and tricky to scale up as manufacture Carmakers are merely popping EV power charging networks and online direct sales ing is. Mr Pacheco of Gartner notes that trains into existing products-an unhappy pioneered by the American firm are now even Tesla's is still a work in progress. In compromise that affects performance. seen as table stakes. America the big three Detroit carmakers That leaves opportunities for firms like Ar- So the newcomers are trying to stamp have nearly 10,000 dealerships that will rival and Rivian. Another potentially lucra- their own technological mark on the in- service cars; Tesla has around 135. tive niche is the hypercar. Wealthy petrol- dustry. Lucid's techies have extracted range Many new firms won't get that far. Sev- heads seem willing to fork out $2m or so to of up to 517 miles (832km) from its batter- eral have already suffered setbacks. Dyson, add to their stables. Rimac and Pininfarina ies. Nio offers a three-minute battery-swap a British firm better known for vacuum- of Italy also see these cars as test-beds for service, to reassure Chinese buyers with- cleaners, sank $5oom ($640m) into an EV EV technology to sell to other car firms. out access to home charging. Xpeng claims effort only to conclude in 2019 that it would China's Silk EV considers its Hongqi so hy- that its voice-activation system is the best never make money. The same year Nio tee- brid as a gateway to the mass market. in the business. Fisker and Canoo offer tered on the brink of bankruptcy until the Identifying the right segment may not subscriptions that give motorists access to local government in its home city of Hefei be enough, however. Brian Gu, president of car use rather than ownership. bailed it out. A bloodbath awaits China's Xpeng, admits that the new firms must of- Ultimately, buyers will decide which of myriad smaller EV firms as they run out of fer something truly different. For years the these are desirable features and which are ideas and money. Fisker is a reborn version industry's technologically stodgier incum- gimmicks. But not before the new models of a firm that went bankrupt in 2013. bents "didn't realise it was a tech race", says are produced and sold. Making a few thou- Peter Rawlinson, who runs Lucid. As cars sand cars a year is hard enough (though Attention, vehicles reversing become more like personal electronic de- losing money doing so is easy). Actually As the complicated reality of carmaking vices, being tech firms first and carmakers selling hundreds of thousands at a profit is sets in, the hype is wearing off among in- second may confer an advantage. Fox- another matter entirely. "Production hell" vestors (see chart 2). Lordstown's value has conn's boss, Young Liu, has argued that the nearly sent Tesla under. A lead on flashy fallen by 65% since peaking in February, driving experience of the future will be software must be backed up with giant after it lowered forecast production for its 'software-driven and software-defined". presses, paint shops and assembly lines. pickup truck and said it needed fresh Novel intellectual property is a "good As such, manufacturing an EV is in many funds. Canoo's shares are worth less than ways not much different to making a petrol half what they were when it went public in car, according to Bernstein, a broker-and December, owing to growing doubts about The Musk effect 1 no less expensive. A new purpose-built car its business plan. Light-vehicle sales, by power train factory that can churn out 100,000 or so ve- In short, notes Aakash Arora of BCG, a Worldwide, m hicles a year costs at least $ibn. consultancy, the new firms need to estab 120 To get around this problem some of the lish brands. So far, he says, only Tesla has FORECAST challengers are instead repurposivexist- done so. It can take years to gain a reputa- Hybrid * 100 ing factories, as Tesla did by acquiring a tion for reliable products, while capital 30 disused one in Fremont, California, for a burns like petrol put to a spark. A new en- song. Rivian has moved into an old Mit- trant needs a trusted name, deep pockets Electric 60 batteryT subishi factory in Illinois. Other newcom- and a proven ability to come up with clever 40 ers are teaming up with the old guard, with tech. One company that has all those in experience of maintaining long and com- spades is Apple. The iPhone-maker has Conventional 20 fuels plex supply chains. Baidu has entered into been working on an EV for several years. 0 a partnership with Geely and Huawei with The latest chatter is that it will have one in 2018 21 25 30 35 its domestic rivals, BAIC, Changan and production by the middle of the decade. Source: BCG *Including plug-in including fuel cell GAC. Fisker and Nio are taking an asset- Some of its potential competitors will by light route by using contract manufacture then be well on the way to oblivion.Ihr' _ In. ommmr. Bunged up A great green investment boom is under way. Bottlenecks are an underappreciated problem 5 THE WORLD economy wakes back up, shortages and price spikes are affecting everything from the supply of Taiwan- ese chips to the cost of a French breakfast. As we explain this week, one kind of bottleneck deserves special attention: the supply-side problems, such as scarce metals and land con- straints. that threaten to slow the green-energy boom (see Brief- ing). Far from being transitory, these bottlenecks risk becoming a recurring feature of the world economy for years to come be- cause the shift to a cleaner energy system is still only in its in- fancy. Governments must respond to these market signals, fa- cilitating a huge private-sector investment boom over the next decade that increases capacity. If they don't, they stand little chance of keeping theirpromises to reach "net-zero" emissions. Scientists and activists have worried about climate change for decades. ReCently politicians have shown signs of mo re com- mitment: countries aCCounting for over 70% of world GDP and greenhouse gases now have targets for net-zero emissions, typi- cally by 2050. And there has been a dramatic shift in the attitude of business. Investors are demanding that rms change tack, spurred by the new reality that clean technologies are more cost- competitive. The giants of the fossil-fuel age, such as Volks- wagen and ExxonMobil, are having to shift their investment plans, while clean-energy pioneers are cranking up capital spending fast. Orsted, a wind-farm champion, plans a rise of 30% this year; Tesla, an electric- car maker, a jump of 62%. Meanwhile a cool $178bn owed into green-tinged investment funds in the rst quarter of 2021. This sudden shift in how resources are allo- cated is causing stresses and strains as demand surges for raw materials and a scramble occurs for the few projects with regulatory approval. We calculate that the price of a basket of ve minerals used in electric cars and power grids has soared by 139% in the past year. Timber maas are roaming Ecuadorean forests to nd balsa wood used in wind-turbine blades. In February a British auction of sea-bed rights for offshore wind farms brought in up to $12bn because energy rms rushed to get exposure whatever the cost. The shortages extend to nance: as a mass of money chases a few renewable-energy rms, valuations have been stretched in- to bubbly territory. Although the weight of the renewable-ener- gy industry in consumer-price indices is still small, some nan- ciers fear that supply shortages over years could eventually fuel higher ination. What makes these signs of overstretch so striking is that they are materialising even as the energy transition is less than 10% complete (measured by the share of cumulative energy-invest- ment needed by 2050 that has already taken place). It is true that some of the technologies which will be required barely exist yet and so are not available for investment. That is why so much re- search and development is needed. But in other areas the brain work has largely been doneso the 20205 must be the decade of brawn, ramping up established technologies with massive cap- ital spending. The gures for the coming decade are mind-concentrating. To stay on track for net zero, by 2030 annual production of elec- tric vehicles needs to be ten times higher than it was last year and the number of roadside charging stations 31 times bigger. The installed base of renewable-power generation needs to rise three-fold. Global mining rms may have to raise the annual production of critical minerals by 500%. Perhaps 2% of Amer- ica's land will have to be blanketed in turbines and solar panels. All this will require vast investment: some $35trn over the next decade. equivalent to a third of the global fund-manage ment industry's as sets today. The system best equipped to deliv- er this is the network of cross-border supply chains and capital markets that has revolutionised the world since the 19905. Yet even this system is underdelivering, with energy investment running at about half the level required, and skewed towards a few rich countries and China. Despite soaring metals prices, for example, mining rms are wary of boosting supply. The main reason for the investment shortfall is that it takes too long to get projects approved and their expected risk and re- turns are still too opaque. Governments are making things worse by using climate policy as a vehicle for other political ob- jectives. The European Union aspires to strategic autonomy in batteries and its green agenda directs a chunk of its budget to de- prived areas. China is considering domestic price caps on com- modities in its next ve-year plan. Similarly, President Joe Biden's nascent green plan prior- itises unionjobs and local manufacturers. This mix of blurred goals and soft protectionism hobbles the necessary investment. Governments need to be more hardheaded. There is a crucial role for an activist state in supporting the construction of key infrastruc- ture. such as transmission lines, and in re- search and development. But the overwhelming priority must be to catalyse a bigger surge in private investment, in two ways. First, by easing planning rules. The average global mining project takes 16 years to get approval; the typical wind project in America over a decade to get lease approvals and permits, which is one reason why its offshore-wind capacity is less than 1% of Europe's. Speed requires centralised decision-making, and will often mean disappointing local NIMBYs and conservationists. Perfect is the enemy of good Second, governments can help companies and investors deal with risks. They can provide certainty in some areas: for exam- ple, by guaranteeing minimum prices for power generation. Western governments also have a duty to provide cheap nanc- ing to lift investment in poorer countries. But the key is the in- troduction of carbon prices which embed market signals into millions of everyday commercial decisions and give entrepre- neurs and investors more visibility over a long-term horizon. Today only 22% of the world's greenhouse-gas emissions are covered by pricing schemes, and those schemes are not joined up. Green bottlenecks are a sign that decarbonisation is at last shifting from being a theoretical idea to a reality. A powerful push is now needed to help make the revolution happen. I Leaders 9 The Economist March 27th 2021 Business 61 Schumpeter | Herbie goes electric Volkswagen will catch up with Tesla. Then comes the hard part solid-state batteries from 2024. But he has not put a date on those cost cuts, whereas Tesla is introducing a more powerful battery this year that could lower costs immediately. By 2030, when Volks- wagen vows to have built six "gigafactories" capable of churning out 240 gigawatt-hours' worth of batteries a year, Mr Musk says, with signature ballyhoo, that Tesla's factories will be producing an order of magnitude more, or around 3,000 gigawatt-hours. In software, the distance between the two looks yet more daunting. Tesla has set the pace by designing a car as a software product that can be regularly upgraded, like the iPhone. Volks- wagen has recently started to do the same with its new ID. 3 EV, and has set out to become the biggest computing company in Germany after SAP, a maker of business software. But whereas Tesla has tech in its DNA, Volkswagen's most notable software achievement was to facilitate the ignominious emissions-cheating. Autonomous driving will add a whole new realm of complexity. Volkswagen is pursuing two types of software development, one for self-driving passenger cars, the other for fleets of autonomous vehicles offer- ing "mobility as a service" (which includes ride-sharing and other alternatives to traditional car ownership). In both cases, tech gi- ants from America and China, as well as Tesla, will be formidable foes. Mr Diess himself acknowledges that as software increasingly THERE IS SOMETHING of the "Herbie" about Herbert Diess, boss turns the car into a computer on wheels, it will transform the in- of Volkswagen Group. Like his four-wheeled namesake, the dustry even more than electrification does. star of several Disney films, he has a mind of his own and a flair for Yet for a legacy manufacturer, Volkswagen has already made grabbing attention. He is in a high-stakes race in which he is seen bold moves. The company counts on its vast combustion-engine as the underdog. And his main rival, Tesla's Elon Musk, is a "frene- business to fund a planned E15on a year in electric and digital in- my" with whom occasionally he banters. Investors are salivating: vestments until 2025. It is already creating a modular platform on during the past month the German giant's share price has surged which its EVs can be built, rather than jerry-rigging its existing by 60% while Tesla's has slipped. That is mainly because of a production lines, which adds flexibility. Sensibly, it is designing change of heart about which of the two will win the electric-vehi- the car around the battery, rather than the other way around. In or- cle (EV) contest. Investors have, it seems, caught "The LoEV Bug". der to secure access to batteries as demand for EVs grows, it is, like It is a spectacular turnaround. For most of last year the EV am- Tesla, vertically integrating its supply chain. Most EV production, bitions of one of the world's biggest carmakers looked like a from batteries and chassis to software, will be done in-house. smokescreen to hide the lingering fallout of the five-year-old Die- Other firms under assault from cleaner technologies, like selgate-emissions scandal, bloated costs and fractious relations those in the oil business, will study Volkswagen's efforts closely. between Mr Diess and organised labour. But then Volkswagen's As Mark Newman of Nyobolt, a car-battery startup, notes, in in- boss pulled off two coups. First, he won the full backing of the su- dustries such as computers and mobile phones that have faced pervisory board, ending the showdown with unions. This may en- disruption in the past, the usual pattern is for an innovator to able him to improve lacklustre profit margins. Second, he sought build a new product from scratch, as Tesla has done (and as Apple to out-meme Mr Musk. He used shareable videos, Twitter and a once did). Once the products are on the market, they can be co- virtual "Power Day" to wow the underdog-loving retail investors pied, and outsourced by incumbents. Volkswagen's vertical inte- that helped drive Tesla's market value to $80obn last year. gration shows that it is not following the same playbook. Mr Diess It isn't all fumes. Based on the company's updates, some car- argues that the long life cycle of a car gives his company more time industry analysts say that within two years or so its marques, in- to catch up than makers of PCS and feature phones had. Whether cluding vw, Audi and Porsche, could produce 1.5m EVs, up from he is right or not, that makes Volkswagen a fascinating case study. 230,000 in 2020. The group may catch up with Tesla, which made 500,000 cars last year-or even overtake it. Only then would the Going the Diesstance fun really start, however. For alongside electrification, revolu- Legacy firms should observe not just Volkswagen but Mr Diess tions in automation and e-mobility are fast approaching. Besides himself. The changes he has set in motion demonstrate that he is Tesla, new competitors such as Apple, keen to affix wheels to an ready to overhaul the old petrol-headed mindset. And just as the iGadget, and Baidu, a Chinese tech giant, are entering the race. For firm is copying Tesla, so he is copying Mr Musk-albeit with Ger- laggards, it could quickly turn into a demolition derby. man characteristics. The buzz he has created around his firm bol- Start with electrification. Volkswagen has little experience of sters his position within the group, even among previously restive making batteries, whereas Tesla has already been through Mr workers. The more clout he has, the more freedom he may enjoy to Musk's "production hell". Catching up with the American firm will reform an unwieldy corporate structure, including spinning off not be easy. Tesla's stockmarket value, currently nearly four times Porsche, a sports-car brand that is fast-becoming an EV gem and Volkswagen's E135bn ($160bn), gives it huge capacity to raise could be valued above 675bn. And if one day he builds an afforda- funds. Mr Diess has excited investors by promising to halve bat- ble, electric, self-driving, Beetle-like icon-a real-life e-Herbie, in tery costs, partly by producing long-range and fast-charging other words-then Tesla better call it quits. "