Question

An owner of XYZ Uniform has called you in as consultants. XYZ Uniform sells uniforms and provides embroidery services for high school, college, and recreational

An owner of XYZ Uniform has called you in as consultants. XYZ Uniform sells uniforms and provides embroidery services for high school, college, and recreational sports teams in the Los Angeles metropolitan area. The owner has managers in the following departments: High School Sales, Collegiate Sales, Recreational Sales, and Accounting. The High School and Collegiate Sales have one full-time sales associate and two part-time associates as well as a delivery person. The Recreational Sales department has one full-time and one part-time associate. The Accounting department has two full-time employees that report to the manager.

The problem this company is experiencing is that XYZ Uniform business grows too fast than the owner's expectation. XYZ Uniform's demand has been historically high from all sale departments, and the owner personally believes that this high demand will last at least 5 years. However, the demand is too high to meet without hiring new employees, so the owner wants to hire 100 employees to meet the demand. The owner wants you to suggest the new organizational structure with new blood (100 new employees) to meet the high demand and to ensure XYZ Uniform's long-term success.

Question 1. Please list and explain three recommendations in which you can improve the way the current structure operates to meet the high demand and to ensure XYZ Uniform's long-term success.

Question 2. Which type of organizational structures is the most appropriate to adapt your three recommendations from Question 1? Please draw an organizational chart, which reflects your recommendations, and explain your rationale.

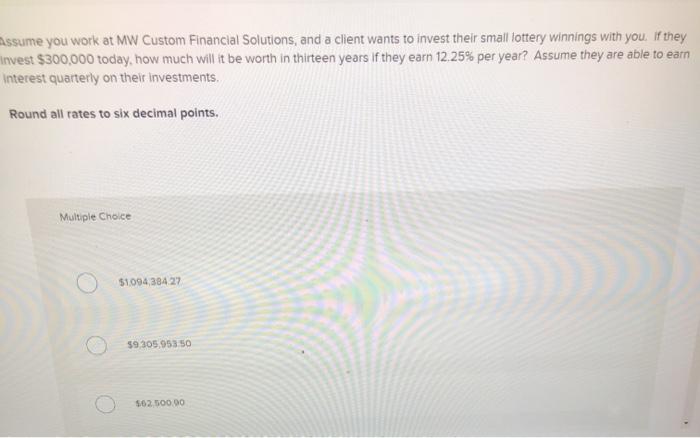

assume you work at MW Custom Financial Solutions, and a client wants to invest their small lottery winnings with you. If they Invest $300,000 today, how much will it be worth in thirteen years if they earn 12.25% per year? Assume they are able to earn Interest quarterly on their investments. Round all rates to six decimal points. Multiple Choice $1.094,384.27 $9,305,953.50 $62,500.00

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Here are my recommendations for improving the current structure of XYZ Uniform to meet the high demand and ensure longterm success 1 Hire add...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started