Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As part of your role as a plant manager, you must study the profitability of 5 investment projects resulting from the head office continuous

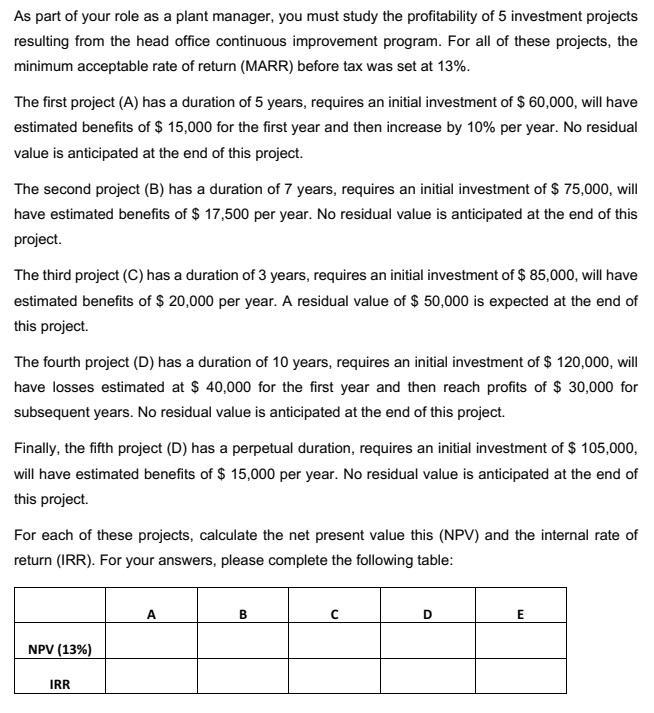

As part of your role as a plant manager, you must study the profitability of 5 investment projects resulting from the head office continuous improvement program. For all of these projects, the minimum acceptable rate of return (MARR) before tax was set at 13%. The first project (A) has a duration of 5 years, requires an initial investment of $ 60,000, will have estimated benefits of $ 15,000 for the first year and then increase by 10% per year. No residual value is anticipated at the end of this project. The second project (B) has a duration of 7 years, requires an initial investment of $ 75,000, will have estimated benefits of $ 17,500 per year. No residual value is anticipated at the end of this project. The third project (C) has a duration of 3 years, requires an initial investment of $ 85,000, will have estimated benefits of $ 20,000 per year. A residual value of $ 50,000 is expected at the end of this project. The fourth project (D) has a duration of 10 years, requires an initial investment of $ 120,000, will have losses estimated at $ 40,000 for the first year and then reach profits of $ 30,000 for subsequent years. No residual value is anticipated at the end of this project. Finally, the fifth project (D) has a perpetual duration, requires an initial investment of $ 105,000, will have estimated benefits of $ 15,000 per year. No residual value is anticipated at the end of this project. For each of these projects, calculate the net present value this (NPV) and the internal rate of return (IRR). For your answers, please complete the following table: NPV (13%) IRR A B C D E

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV and internal rate of return IRR for each project we can use t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started