Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ana erl issues in Accounung urmester , Case Study 1 (Total: 25 Marks) Institutional Arrangements for Setting Accounting Standards in Australia: Citizens Insurance Ltd (CIL)

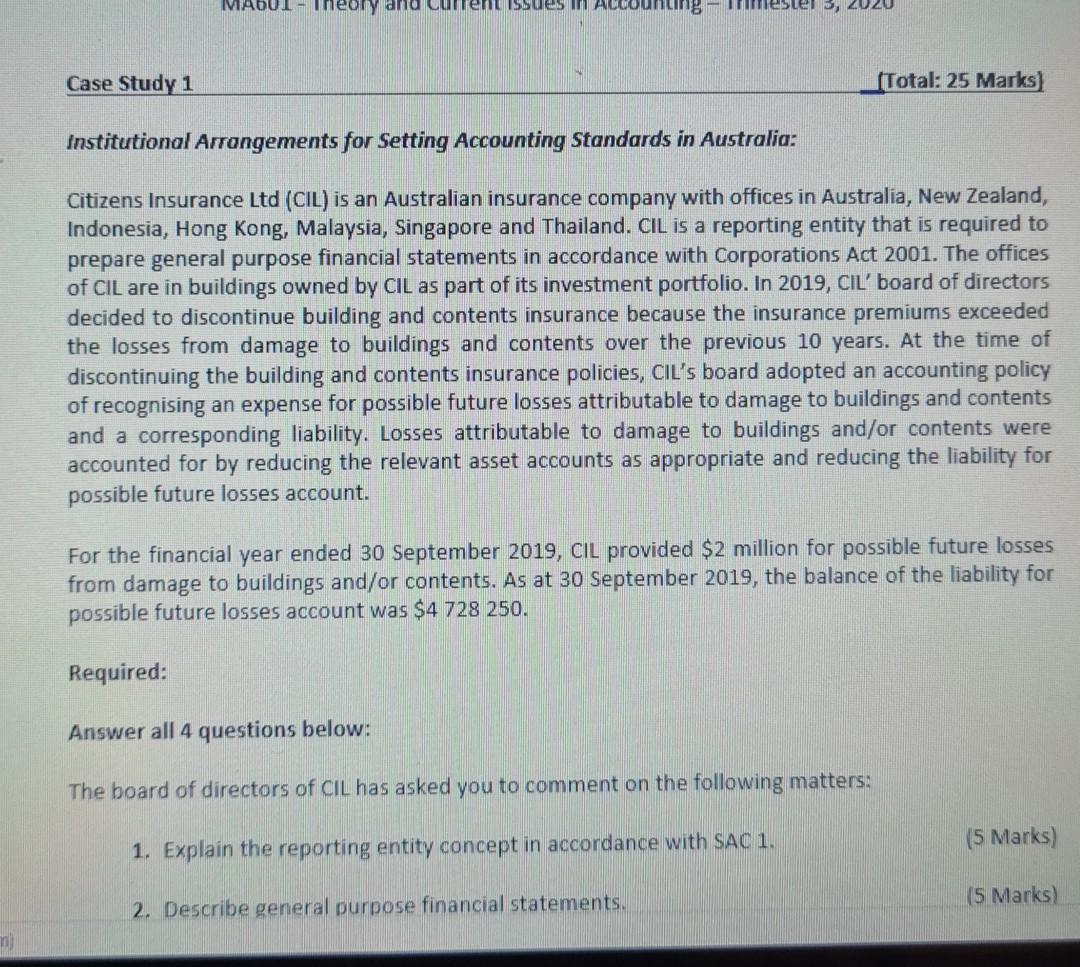

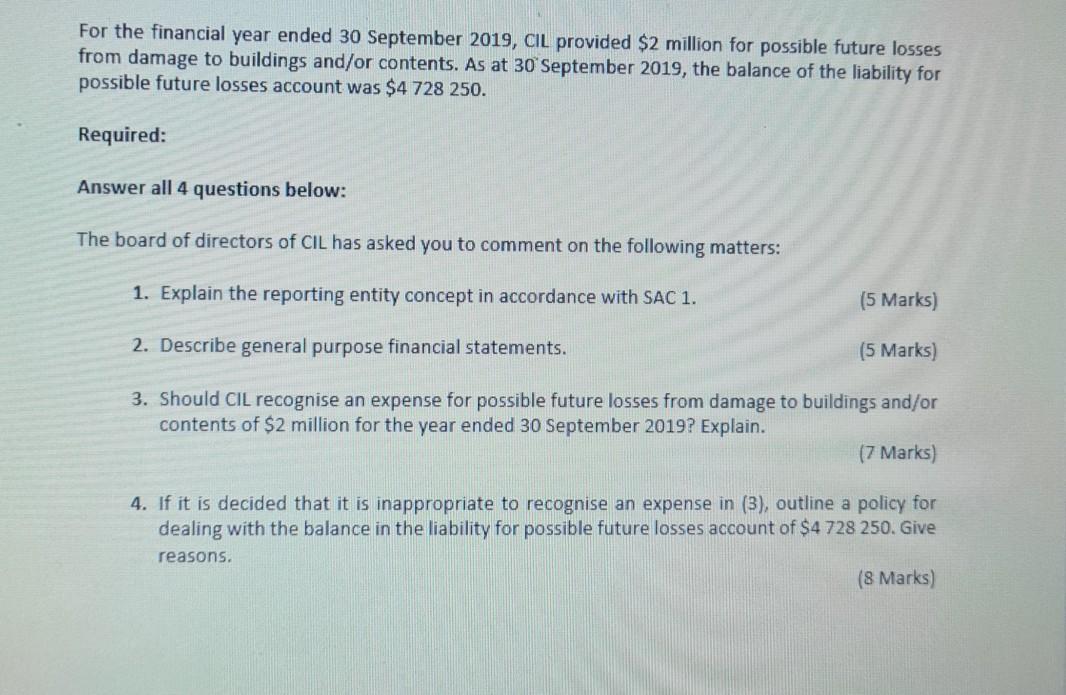

ana erl issues in Accounung urmester , Case Study 1 (Total: 25 Marks) Institutional Arrangements for Setting Accounting Standards in Australia: Citizens Insurance Ltd (CIL) is an Australian insurance company with offices in Australia, New Zealand, Indonesia, Hong Kong, Malaysia, Singapore and Thailand. CIL is a reporting entity that is required to prepare general purpose financial statements in accordance with Corporations Act 2001. The offices of CIL are in buildings owned by CIL as part of its investment portfolio. In 2019, CIL' board of directors decided to discontinue building and contents insurance because the insurance premiums exceeded the losses from damage to buildings and contents over the previous 10 years. At the time of discontinuing the building and contents insurance policies, CIL's board adopted an accounting policy of recognising an expense for possible future losses attributable to damage to buildings and contents and a corresponding liability. Losses attributable to damage to buildings and/or contents were accounted for by reducing the relevant asset accounts as appropriate and reducing the liability for possible future losses account. For the financial year ended 30 September 2019, CIL provided $2 million for possible future losses from damage to buildings and/or contents. As at 30 September 2019, the balance of the liability for possible future losses account was $4 728 250. Required: Answer all 4 questions below: The board of directors of CIL has asked you to comment on the following matters: (5 Marks) 1. Explain the reporting entity concept in accordance with SAC 1. (5 Marks) 2. Describe general purpose financial statements, For the financial year ended 30 September 2019, CIL provided $2 million for possible future losses from damage to buildings and/or contents. As at 30 September 2019, the balance of the liability for possible future losses account was $4 728 250. Required: Answer all 4 questions below: The board of directors of CIL has asked you to comment on the following matters: 1. Explain the reporting entity concept in accordance with SAC 1. (5 Marks) 2. Describe general purpose financial statements. (5 Marks) 3. Should CIL recognise an expense for possible future losses from damage to buildings and/or contents of $2 million for the year ended 30 September 2019? Explain. (7 Marks) 4. If it is decided that it is inappropriate to recognise an expense in (3), outline a policy for dealing with the balance in the liability for possible future losses account of $4 728 250. Give reasons. (8 Marks) ana erl issues in Accounung urmester , Case Study 1 (Total: 25 Marks) Institutional Arrangements for Setting Accounting Standards in Australia: Citizens Insurance Ltd (CIL) is an Australian insurance company with offices in Australia, New Zealand, Indonesia, Hong Kong, Malaysia, Singapore and Thailand. CIL is a reporting entity that is required to prepare general purpose financial statements in accordance with Corporations Act 2001. The offices of CIL are in buildings owned by CIL as part of its investment portfolio. In 2019, CIL' board of directors decided to discontinue building and contents insurance because the insurance premiums exceeded the losses from damage to buildings and contents over the previous 10 years. At the time of discontinuing the building and contents insurance policies, CIL's board adopted an accounting policy of recognising an expense for possible future losses attributable to damage to buildings and contents and a corresponding liability. Losses attributable to damage to buildings and/or contents were accounted for by reducing the relevant asset accounts as appropriate and reducing the liability for possible future losses account. For the financial year ended 30 September 2019, CIL provided $2 million for possible future losses from damage to buildings and/or contents. As at 30 September 2019, the balance of the liability for possible future losses account was $4 728 250. Required: Answer all 4 questions below: The board of directors of CIL has asked you to comment on the following matters: (5 Marks) 1. Explain the reporting entity concept in accordance with SAC 1. (5 Marks) 2. Describe general purpose financial statements, For the financial year ended 30 September 2019, CIL provided $2 million for possible future losses from damage to buildings and/or contents. As at 30 September 2019, the balance of the liability for possible future losses account was $4 728 250. Required: Answer all 4 questions below: The board of directors of CIL has asked you to comment on the following matters: 1. Explain the reporting entity concept in accordance with SAC 1. (5 Marks) 2. Describe general purpose financial statements. (5 Marks) 3. Should CIL recognise an expense for possible future losses from damage to buildings and/or contents of $2 million for the year ended 30 September 2019? Explain. (7 Marks) 4. If it is decided that it is inappropriate to recognise an expense in (3), outline a policy for dealing with the balance in the liability for possible future losses account of $4 728 250. Give reasons. (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started