Answered step by step

Verified Expert Solution

Question

1 Approved Answer

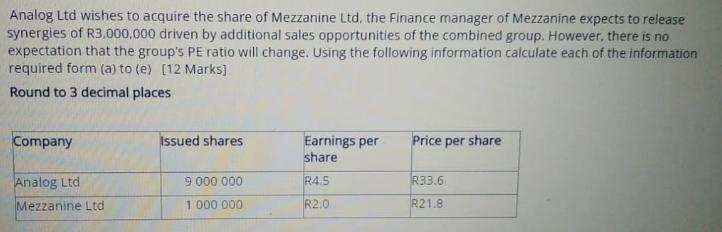

Analog Ltd wishes to acquire the share of Mezzanine Ltd, the Finance manager of Mezzanine expects to release synergies of R3,000,000 driven by additional

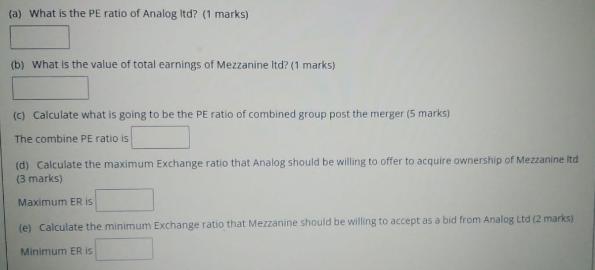

Analog Ltd wishes to acquire the share of Mezzanine Ltd, the Finance manager of Mezzanine expects to release synergies of R3,000,000 driven by additional sales opportunities of the combined group. However, there is no expectation that the group's PE ratio will change. Using the following information calculate each of the information required form (a) to (e) [12 Marks] Round to 3 decimal places Company Analog Ltd Mezzanine Ltd Issued shares 9 000 000 1 000 000 Earnings per share R4.5 R2.0 Price per share R33.6 R21.8. (a) What is the PE ratio of Analog Itd? (1 marks) (b) What is the value of total earnings of Mezzanine Itd? (1 marks) (c) Calculate what is going to be the PE ratio of combined group post the merger (5 marks) The combine PE ratio is (d) Calculate the maximum Exchange ratio that Analog should be willing to offer to acquire ownership of Mezzanine itd (3 marks) Maximum ER is (e) Calculate the minimum Exchange ratio that Mezzanine should be willing to accept as a bid from Analog Ltd (2 marks) Minimum ER is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The pricetoearnings PE ratio is calculated by dividing the market value per share by the earnings per share EPS Given the data for Analog Ltd we have Price per share R336 Earnings per share EPS R45 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started