Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyse a portfolio of loans consisting of 3 companies of your choice with characteristics shown in table below. For example, if you choose company

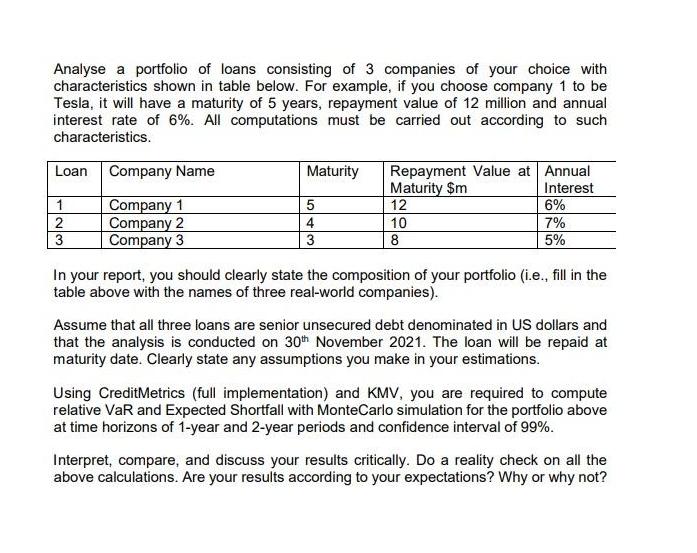

Analyse a portfolio of loans consisting of 3 companies of your choice with characteristics shown in table below. For example, if you choose company 1 to be Tesla, it will have a maturity of 5 years, repayment value of 12 million and annual interest rate of 6%. All computations must be carried out according to such characteristics. Loan Company Name Company 1 Company 2 Company 3 1 2 3 Maturity 5 4 3 Repayment Value at Annual Maturity $m Interest 12 10 8 6% 7% 5% In your report, you should clearly state the composition of your portfolio (i.e., fill in the table above with the names of three real-world companies). Assume that all three loans are senior unsecured debt denominated in US dollars and that the analysis is conducted on 30th November 2021. The loan will be repaid at maturity date. Clearly state any assumptions you make in your estimations. Using CreditMetrics (full implementation) and KMV, you are required to compute relative VaR and Expected Shortfall with MonteCarlo simulation for the portfolio above at time horizons of 1-year and 2-year periods and confidence interval of 99%. Interpret, compare, and discuss your results critically. Do a reality check on all the above calculations. Are your results according to your expectations? Why or why not?

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Composition of the portfolio Loan Company Name Maturity Repayment Value at Maturity m Annual Interest 1 Amazon 5 12 6 2 Microsoft 4 10 7 3 Apple 3 8 5 Assumptions For the purpose of this analysis we a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started