Answered step by step

Verified Expert Solution

Question

1 Approved Answer

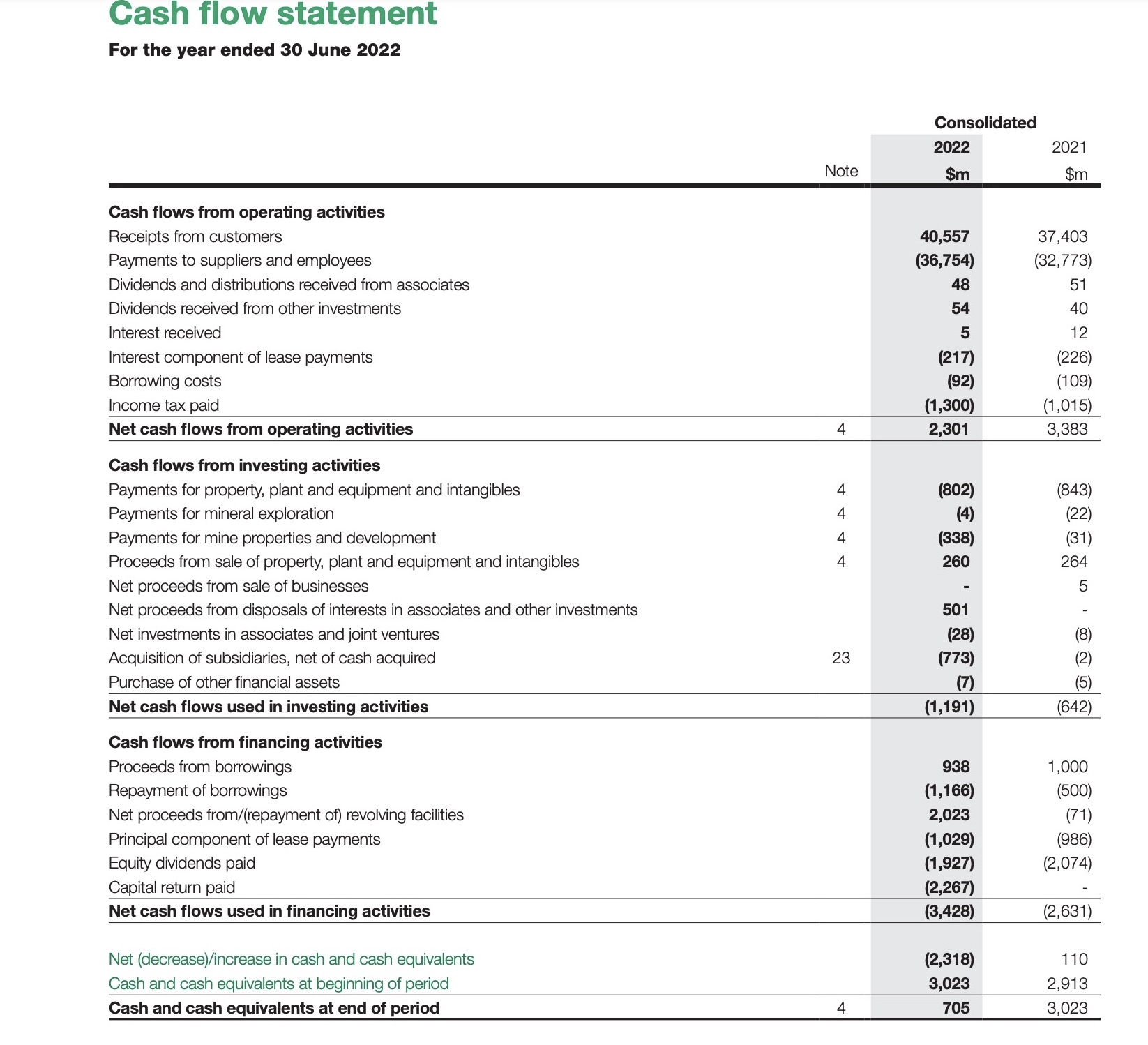

Analyse your allocated company's investing and financing activities for the year 2022as identified in the statement of cash flows, specifically identifying the two largest investing

Analyse your allocated company's investing and financing activities for the year 2022as identified in the statement of cash flows, specifically identifying the two largest investing activities and the two largest financing activities.

Cash flow statement For the year ended 30 June 2022 Cash flows from operating activities Receipts from customers Payments to suppliers and employees Dividends and distributions received from associates Dividends received from other investments Interest received Interest component of lease payments Borrowing costs Income tax paid Net cash flows from operating activities Cash flows from investing activities Payments for property, plant and equipment and intangibles Payments for mineral exploration Payments for mine properties and development Proceeds from sale of property, plant and equipment and intangibles Net proceeds from sale of businesses Net proceeds from disposals of interests in associates and other investments Net investments in associates and joint ventures Acquisition of subsidiaries, net of cash acquired Purchase of other financial assets Net cash flows used in investing activities Cash flows from financing activities Proceeds from borrowings Repayment of borrowings Net proceeds from/(repayment of) revolving facilities Principal component of lease payments Equity dividends paid Capital return paid Net cash flows used in financing activities Net (decrease)/increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Note Consolidated 2022 2021 $m $m 40,557 (36,754) 37,403 (32,773) 48 51 54 15 40 12 (217) (226) (92) (109) (1,300) (1,015) 4 2,301 3,383 4444 (802) (843) (4) (338) 260 (22) (31) 264 5 501 (28) 23 (773) (7) (1,191) (5) (642) 938 1,000 (1,166) (500) 2,023 (71) (1,029) (986) (1,927) (2,074) (2,267) (3,428) (2,631) (2,318) 110 3,023 2,913 4 705 3,023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started