Answered step by step

Verified Expert Solution

Question

1 Approved Answer

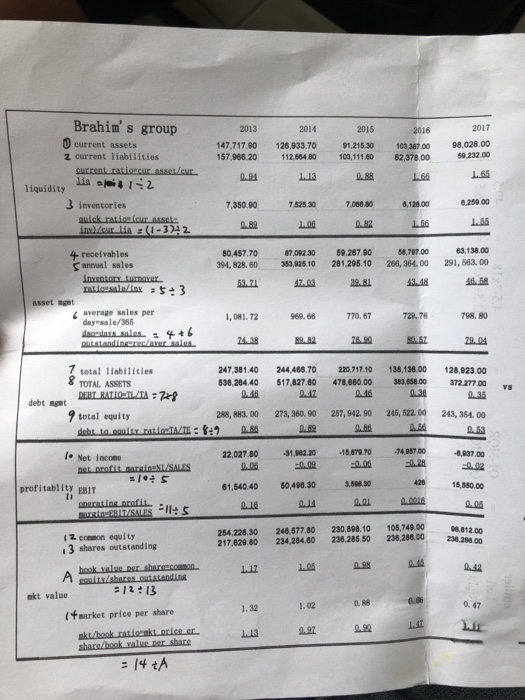

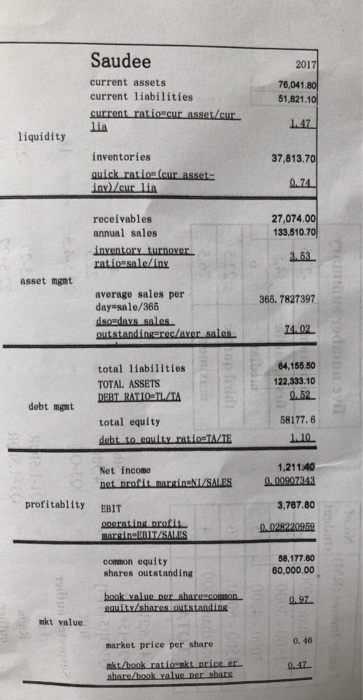

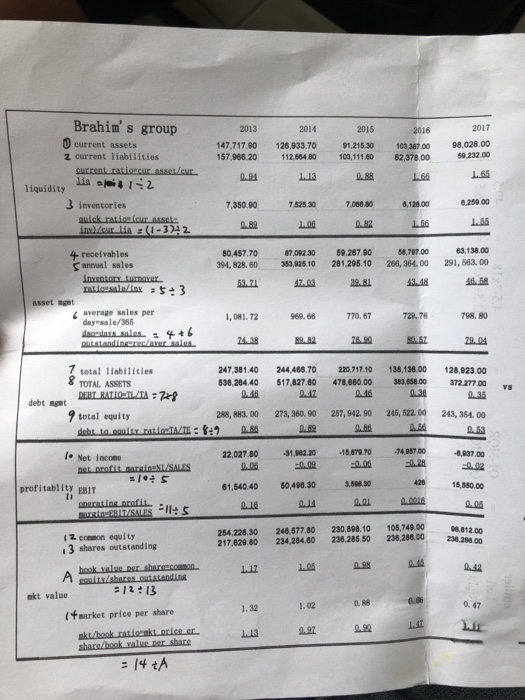

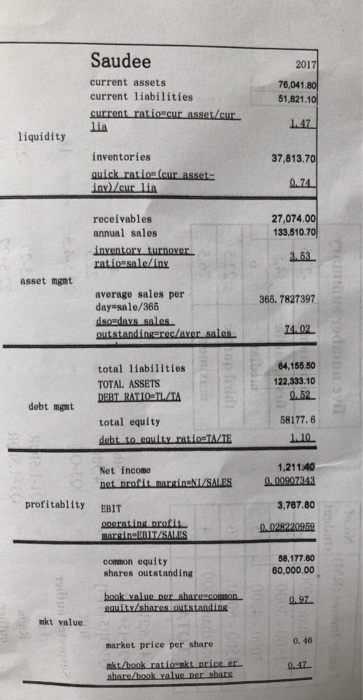

analysis A&B companys ratios 1.A company ratios cover 5 yearsFrom 2013-2017 2. campare B company 2017 ratio with A company 2017 ratio Brahim' s group

analysis A&B companys ratios

Brahim' s group 0 current assets 2 current liabilities 2017 91215.30 103.38700 98,028.00 57,966.20 112.04.80 103,111.80 62,378.00 232.00 165 2013 2014 2015 016 147,717.90 126,933.70 liquidity i 12 3 inventories 7,350.90 52530 7.00.80 7,066.80 ,128.00 6 259.00 4 receivables S annual sales 80,457.70 8702.30 59,267.90 8,70700 63,138.00 394, 828. 60363,925,10 281,295.10 266,364. 00 291, 563.00 asset mgmt average sales per day sale/38 1, 081. 72 969. 68 770.67 729.76 798. 80 outstandingerec/ayer sales 24.39 247.a0140 24.0.7020134.130.00 128.92.00 7 total Iiabllities 36,264.40 17,827.80 478.680.00 38.658.00 372 27700y 047 L693 TOTAL ASSETS 0.46 debt ngat total equity 288, 883. 00 273,360. 9 257,942. 90 245, 522. 00 243, 364. 00 22,02780 1.92.20 15.078 70 74,957 00 6,937.00 -0.02 15,580.00 l Net incom profitablity EBIT 61,540 40 50,490.30 3.598.30 iz conn equity 3 shares outstanding 254,226.30 246,577.80 230,898.10 105,749.00 217,629.80 234,284.80 238,285.50 238,286.00 236.20 .0 1213 nkt value 0.88 1. 32 1. 02 ( fmarket price per share Saudee current assets current liabilities 2017 76,041.80 1,821.10 lia liquidity inventories 37,813.70 receivables annual sales 27,074.00 133,510.70 asset mgnt average sales per day sale/365 dso days sales 365. 7827397 74.02 total liabilities TOTAL ASSETS 64,155.50 122,333.10 0.52 debt mgnt total equity deht to cauity ratiosTALTE 68177.6 Net income 1,211.40 profitablity EBIT 3,767.80 common equity shares outstanding 8,177.80 60,000.00 0.97 mkt value market price per share 0. 46 0.47 1.A company ratios cover 5 yearsFrom 2013-2017

2. campare B company 2017 ratio with A company 2017 ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started