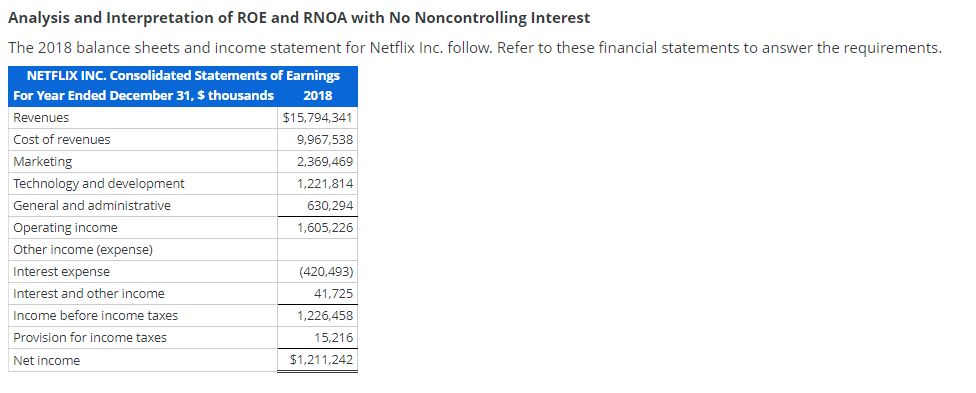

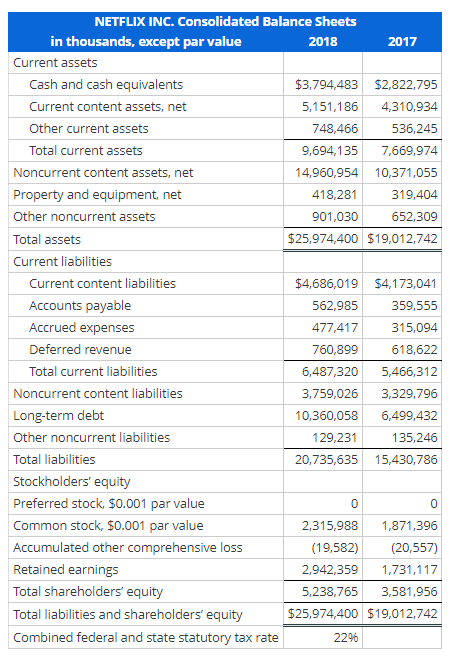

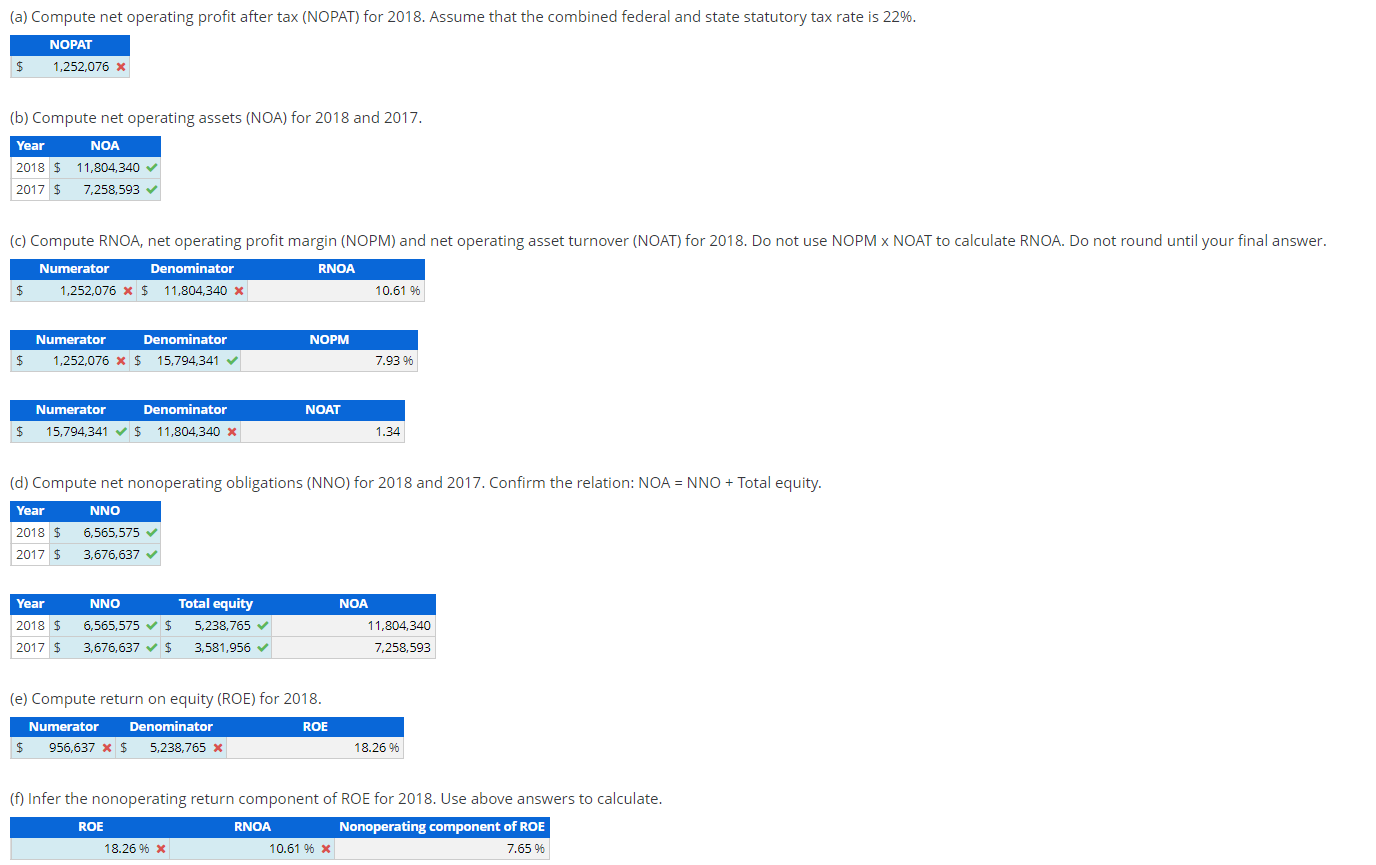

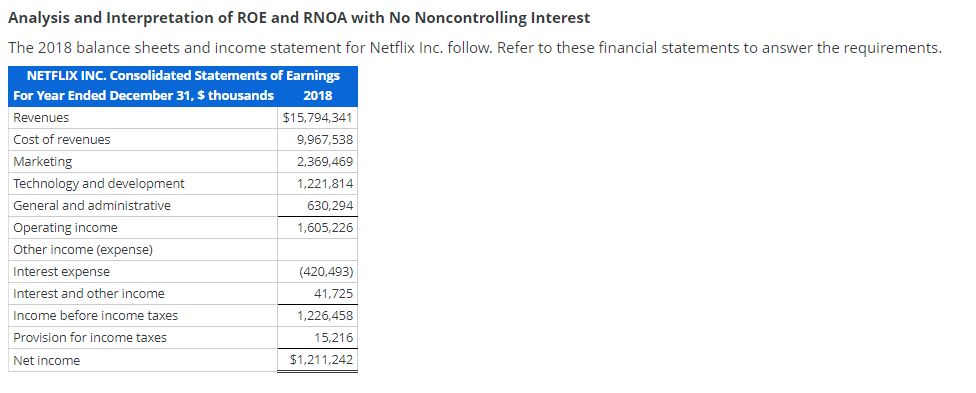

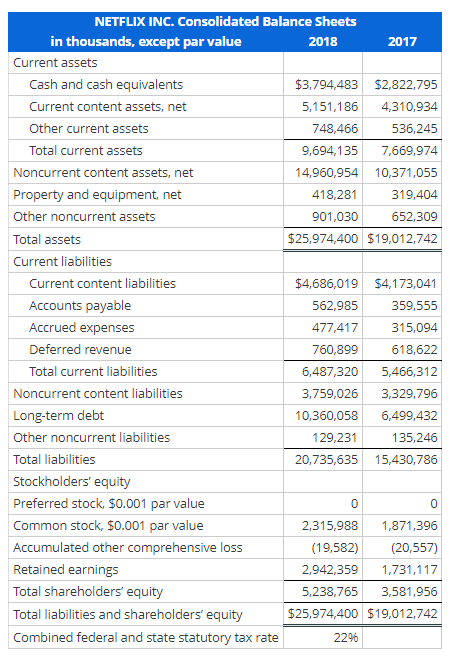

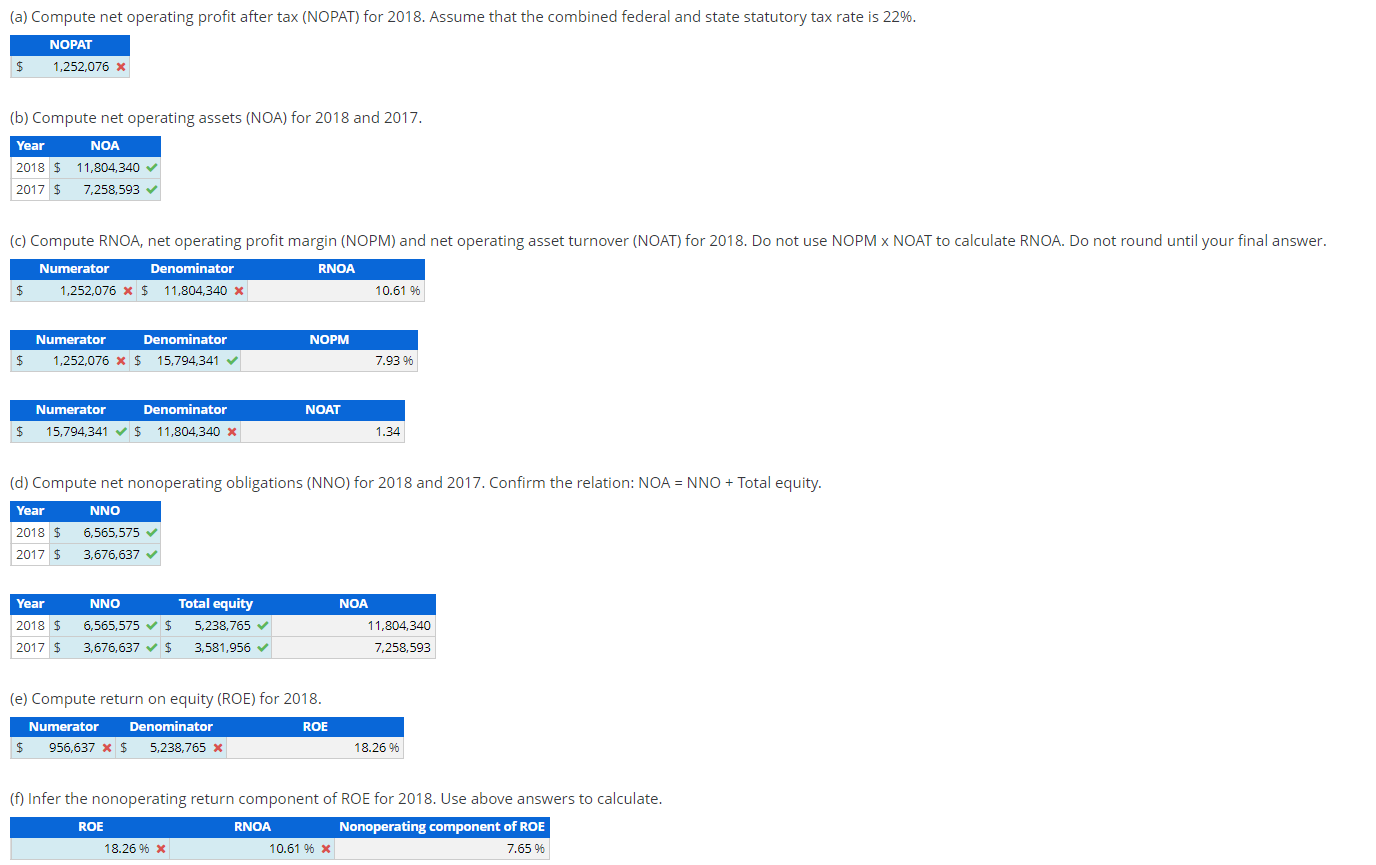

Analysis and Interpretation of ROE and RNOA with No Noncontrolling Interest The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements. NETFLIX INC. Consolidated Balance Sheets in thousands, except par value 2018 Current assets \begin{tabular}{|l|r|r|} \hline Cash and cash equivalents & $3,794,483 & $2,822,795 \\ \hline Current content assets, net & 5,151,186 & 4,310,934 \\ \hline Other current assets & 748,466 & 536,245 \\ \hline Total current assets & 9,694,135 & 7,669,974 \\ \hline Noncurrent content assets, net & 14,960,954 & 10,371,055 \\ \hline Property and equipment, net & 418,281 & 319,404 \\ \hline Other noncurrent assets & 901,030 & 652,309 \\ \hline Total assets & $25,974,400 & $19,012,742 \\ \hline \hline Current liabilities & & \\ \hline Current content liabilities & $4,686,019 & $4,173,041 \\ \hline Accounts payable & 562,985 & 359,555 \\ \hline Accrued expenses & 477,417 & 315,094 \\ \hline Deferred revenue & 760,899 & 618,622 \\ \hline Total current liabilities & 6,487,320 & 5,466,312 \\ \hline Noncurrent content liabilities & 3,759,026 & 3,329,796 \\ \hline Long-term debt & 10,360,058 & 6,499,432 \\ \hline Other noncurrent liabilities & 129,231 & 135,246 \\ \hline Total liabilities & 20,735,635 & 15,430,786 \\ \hline Stockholders' equity & & \\ \hline Preferred stock, \$0.001 par value & 0 & \\ \hline Common stock, $0.001 par value & 0,315,988 & 1,871,396 \\ \hline Accumulated other comprehensive loss & (19,582) & (20,557) \\ \hline Retained earnings & 2,942,359 & 1,731,117 \\ \hline Total shareholders' equity & 5,238,765 & 3,581,956 \\ \hline Total liabilities and shareholders' equity & $25,974,400 & $19,012,742 \\ \hline Combined federal and state statutory tax rate & 22%% & \\ \hline & & \\ \hline \end{tabular} (b) Compute net operating assets (NOA) for 2018 and 2017. (c) Compute RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2018. Do not use NOF (d) Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. (e) Compute return on equity (ROE) for 2018. (f) Infer the nonoperating return component of ROE for 2018 . Use above answers to calculate