Answered step by step

Verified Expert Solution

Question

1 Approved Answer

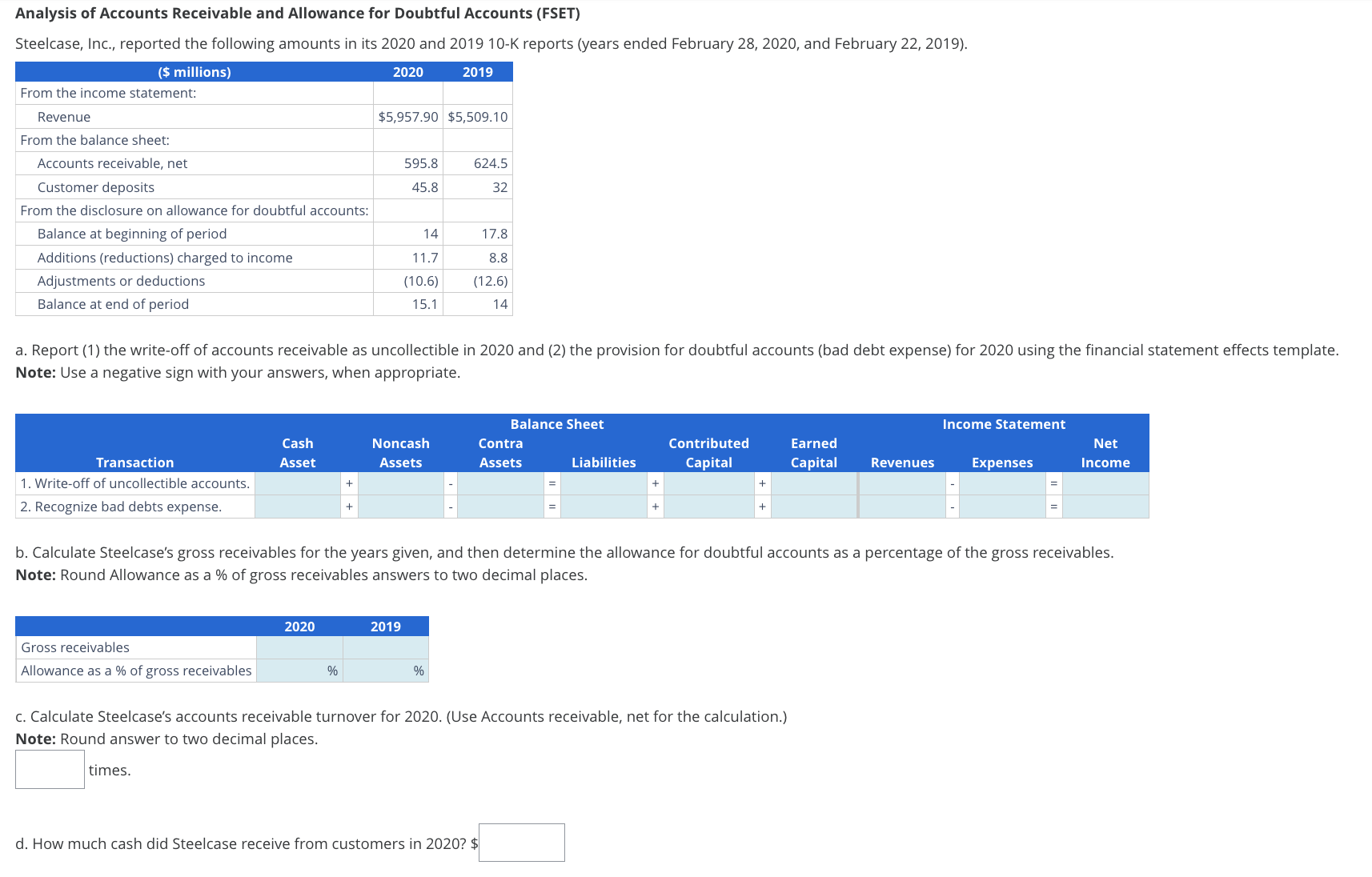

Analysis of Accounts Receivable and Allowance for Doubtful Accounts ( FSET ) Analysis of Accounts Receivable and Allowance for Doubtful Accounts ( FSET ) Steelcase,

Analysis of Accounts Receivable and Allowance for Doubtful Accounts FSET Analysis of Accounts Receivable and Allowance for Doubtful Accounts FSET

Steelcase, Inc., reported the following amounts in its and K reports years ended February and February

a Report the writeoff of accounts receivable as uncollectible in and the provision for doubtful accounts bad debt expense for using the financial statement effects template.

Note: Use a negative sign with your answers, when appropriate.

b Calculate Steelcase's gross receivables for the years given, and then determine the allowance for doubtful accounts as a percentage of the gross receivables.

Note: Round Allowance as a of gross receivables answers to two decimal places.

c Calculate Steelcase's accounts receivable turnover for Use Accounts receivable, net for the calculation.

Note: Round answer to two decimal places.

times.

d How much cash did Steelcase receive from customers in $

Steelcase, Inc., reported the following amounts in its and K reports years ended February and February

$ millions

From the income statement:

Revenue $ $

From the balance sheet:

Accounts receivable, net

Customer deposits

From the disclosure on allowance for doubtful accounts:

Balance at beginning of period

Additions reductions charged to income

Adjustments or deductions

Balance at end of period

a Report the writeoff of accounts receivable as uncollectible in and the provision for doubtful accounts bad debt expense for using the financial statement effects template.

Note: Use a negative sign with your answers, when appropriate.

Balance Sheet Income Statement

Cash Noncash Contra Contributed Earned Net

Transaction Asset Assets Assets Liabilities Capital Capital Revenues Expenses Income

Writeoff of uncollectible accounts. Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Recognize bad debts expense. Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

Answer

b Calculate Steelcases gross receivables for the years given, and then determine the allowance for doubtful accounts as a percentage of the gross receivables.

Note: Round Allowance as a of gross receivables answers to two decimal places.

Gross receivables Answer

Answer

Allowance as a of gross receivables Answer

Answer

c Calculate Steelcases accounts receivable turnover for Use Accounts receivable, net for the calculation.

Note: Round answer to two decimal places.

Answer

times.

d How much cash did Steelcase receive from customers in $Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started