Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analysis of all the other areas of financial planning that have tax ramifications Analysis of any decisions related to any sort of taxes (e.g., income,

Analysis of all the other areas of financial planning that have tax ramifications Analysis of any decisions related to any sort of taxes (e.g., income, gift, estate, property, payroll, etc.) Strategies to reduce current or future tax liabilities (e.g., deduction bunching, traditional vs Roth contributions, back-door Roth IRAs, Roth conversions, charitable giving, etc.) Question: Give reasonable analysis and suggestions.

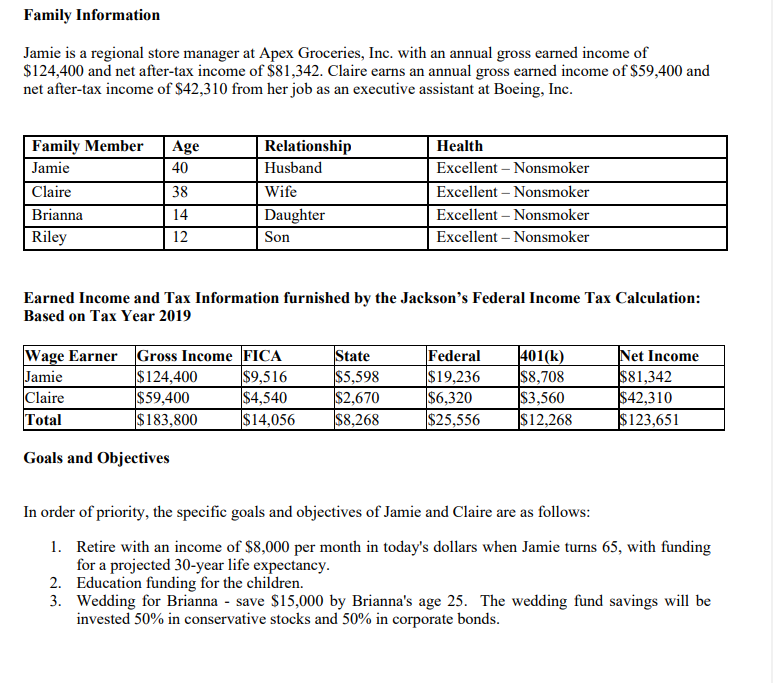

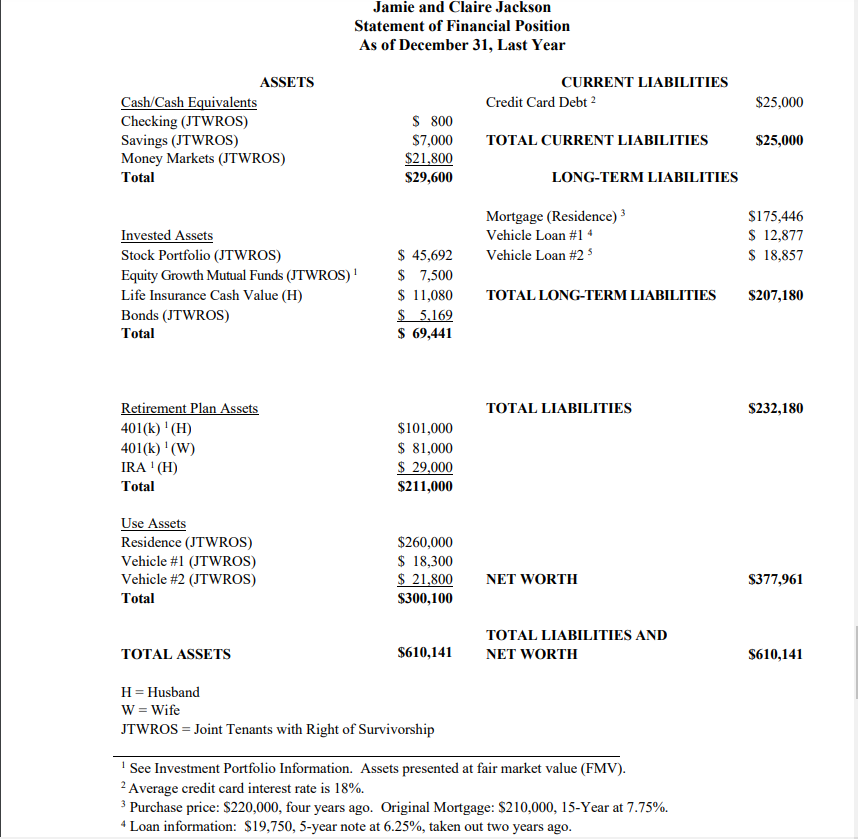

Family Information Jamie is a regional store manager at Apex Groceries, Inc. with an annual gross earned income of $124,400 and net after-tax income of $81,342. Claire earns an annual gross earned income of $59,400 and net after-tax income of $42,310 from her job as an executive assistant at Boeing, Inc. Family Member Age Health Relationship Husband Jamie 40 Claire 38 Wife Excellent - Nonsmoker Excellent - Nonsmoker Excellent - Nonsmoker Excellent - Nonsmoker Brianna 14 Daughter Riley 12 Son Earned Income and Tax Information furnished by the Jackson's Federal Income Tax Calculation: Based on Tax Year 2019 Wage Earner Gross Income FICA State Federal 401(k) Net Income Jamie $124,400 $9,516 $5,598 $19,236 $8,708 $81,342 Claire $59,400 $4,540 $2,670 $6,320 $3,560 $42,310 Total $183,800 $14,056 $8,268 $25,556 $12,268 $123,651 Goals and Objectives In order of priority, the specific goals and objectives of Jamie and Claire are as follows: 1. Retire with an income of $8,000 per month in today's dollars when Jamie turns 65, with funding for a projected 30-year life expectancy. 2. Education funding for the children. 3. Wedding for Brianna - save $15,000 by Brianna's age 25. The wedding fund savings will be invested 50% in conservative stocks and 50% in corporate bonds. Jamie and Claire Jackson Statement of Financial Position As of December 31, Last Year CURRENT LIABILITIES Cash/Cash Equivalents Credit Card Debt $ 800 Checking (JTWROS) Savings (JTWROS) $7,000 TOTAL CURRENT LIABILITIES $21,800 Money Markets (JTWROS) Total $29,600 LONG-TERM LIABILITIES Mortgage (Residence) Invested Assets Vehicle Loan #14 Stock Portfolio (JTWROS) $ 45,692 Vehicle Loan #2 5 1 Equity Growth Mutual Funds (JTWROS) $ 7,500 Life Insurance Cash Value (H) $ 11,080 TOTAL LONG-TERM LIABILITIES Bonds (JTWROS) $ 5,169 Total $ 69,441 Retirement Plan Assets TOTAL LIABILITIES 401(k) ' (H) $101,000 401(k) (W) IRA (H) $ 81,000 $ 29,000 $211,000 Total Use Assets Residence (JTWROS) $260,000 Vehicle #1 (JTWROS) $ 18,300 $ 21,800 NET WORTH Vehicle #2 (JTWROS) Total $300,100 TOTAL LIABILITIES AND NET WORTH TOTAL ASSETS $610,141 H = Husband W = Wife JTWROS = Joint Tenants with Right of Survivorship 1 See Investment Portfolio Information. Assets presented at fair market value (FMV). Average credit card interest rate is 18%. 3 Purchase price: $220,000, four years ago. Original Mortgage: $210,000, 15-Year at 7.75%. 4 Loan information: $19,750, 5-year note at 6.25%, taken out two years ago. ASSETS $25,000 $25,000 $175,446 $ 12,877 $ 18,857 $207,180 $232,180 $377,961 $610,141 Family Information Jamie is a regional store manager at Apex Groceries, Inc. with an annual gross earned income of $124,400 and net after-tax income of $81,342. Claire earns an annual gross earned income of $59,400 and net after-tax income of $42,310 from her job as an executive assistant at Boeing, Inc. Family Member Age Health Relationship Husband Jamie 40 Claire 38 Wife Excellent - Nonsmoker Excellent - Nonsmoker Excellent - Nonsmoker Excellent - Nonsmoker Brianna 14 Daughter Riley 12 Son Earned Income and Tax Information furnished by the Jackson's Federal Income Tax Calculation: Based on Tax Year 2019 Wage Earner Gross Income FICA State Federal 401(k) Net Income Jamie $124,400 $9,516 $5,598 $19,236 $8,708 $81,342 Claire $59,400 $4,540 $2,670 $6,320 $3,560 $42,310 Total $183,800 $14,056 $8,268 $25,556 $12,268 $123,651 Goals and Objectives In order of priority, the specific goals and objectives of Jamie and Claire are as follows: 1. Retire with an income of $8,000 per month in today's dollars when Jamie turns 65, with funding for a projected 30-year life expectancy. 2. Education funding for the children. 3. Wedding for Brianna - save $15,000 by Brianna's age 25. The wedding fund savings will be invested 50% in conservative stocks and 50% in corporate bonds. Jamie and Claire Jackson Statement of Financial Position As of December 31, Last Year CURRENT LIABILITIES Cash/Cash Equivalents Credit Card Debt $ 800 Checking (JTWROS) Savings (JTWROS) $7,000 TOTAL CURRENT LIABILITIES $21,800 Money Markets (JTWROS) Total $29,600 LONG-TERM LIABILITIES Mortgage (Residence) Invested Assets Vehicle Loan #14 Stock Portfolio (JTWROS) $ 45,692 Vehicle Loan #2 5 1 Equity Growth Mutual Funds (JTWROS) $ 7,500 Life Insurance Cash Value (H) $ 11,080 TOTAL LONG-TERM LIABILITIES Bonds (JTWROS) $ 5,169 Total $ 69,441 Retirement Plan Assets TOTAL LIABILITIES 401(k) ' (H) $101,000 401(k) (W) IRA (H) $ 81,000 $ 29,000 $211,000 Total Use Assets Residence (JTWROS) $260,000 Vehicle #1 (JTWROS) $ 18,300 $ 21,800 NET WORTH Vehicle #2 (JTWROS) Total $300,100 TOTAL LIABILITIES AND NET WORTH TOTAL ASSETS $610,141 H = Husband W = Wife JTWROS = Joint Tenants with Right of Survivorship 1 See Investment Portfolio Information. Assets presented at fair market value (FMV). Average credit card interest rate is 18%. 3 Purchase price: $220,000, four years ago. Original Mortgage: $210,000, 15-Year at 7.75%. 4 Loan information: $19,750, 5-year note at 6.25%, taken out two years ago. ASSETS $25,000 $25,000 $175,446 $ 12,877 $ 18,857 $207,180 $232,180 $377,961 $610,141

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started