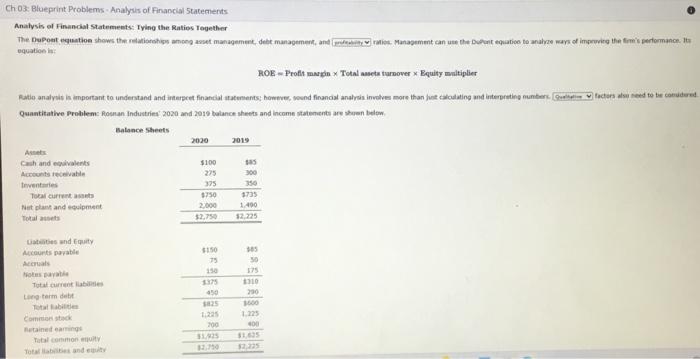

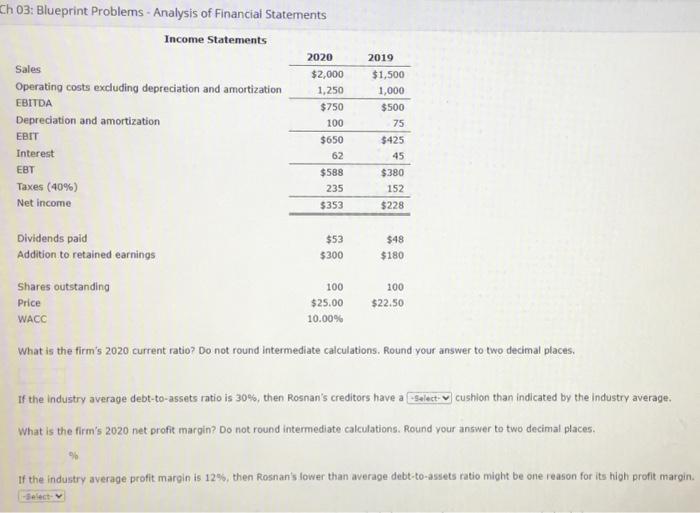

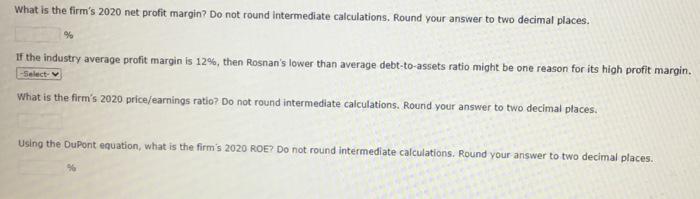

Analysis of Finandal Statements: Iying the Raties Tegether The Dupoeat eguatioe shows the relationshiss amoeg avet managemes, debt managemen, and equation in: ROE = Profit mardin Total assets tursover Equity maltiplier Rate analvis is important to understand and interpcet finatcial atatements: howeve, wosnd financal analras imvolves more than fust calcalating and interpreting mumbers. thaters alse need to te convidered Quantitathe Problem: foenan Industries' 2020 and 2010 balance sheets and income statenents are shen belew. What is the firm's 2020 net profit margin? Do not round intermediate calculations, Round your answer to two decimal places. % If the industry average profit margin is 12%, then Rosnan's lower than average debt-to-assets ratio might be one reason for its high profit margin What is the firm's 2020 price/earnings ratio? Do not round intermediate calculations. Round your answer to two decimal places. Using the DuPont equation, what is the firm 's 2020 ROE? Do not round intermediate calculations. Round your answer to two decimal places. Ch 03: Blueprint Problems - Analysis of Financiai Statements What is the firm's 2020 current ratio? Do not round intermediate calculations. Round your answer to two decimal places. If the industry average debt-to-assets ratio is 30%, then Rosnan's creditors have a cushion than indicated by the industry average. What is the firm's 2020 net profit margin? Do not round intermediate calculations. Round your answer to two decimal places. If the industry average profit margin is 12%, then Rosnan's lower than average debt-to-assets ratio might be one reason for its high profit margin. Analysis of Finandal Statements: Iying the Raties Tegether The Dupoeat eguatioe shows the relationshiss amoeg avet managemes, debt managemen, and equation in: ROE = Profit mardin Total assets tursover Equity maltiplier Rate analvis is important to understand and interpcet finatcial atatements: howeve, wosnd financal analras imvolves more than fust calcalating and interpreting mumbers. thaters alse need to te convidered Quantitathe Problem: foenan Industries' 2020 and 2010 balance sheets and income statenents are shen belew. What is the firm's 2020 net profit margin? Do not round intermediate calculations, Round your answer to two decimal places. % If the industry average profit margin is 12%, then Rosnan's lower than average debt-to-assets ratio might be one reason for its high profit margin What is the firm's 2020 price/earnings ratio? Do not round intermediate calculations. Round your answer to two decimal places. Using the DuPont equation, what is the firm 's 2020 ROE? Do not round intermediate calculations. Round your answer to two decimal places. Ch 03: Blueprint Problems - Analysis of Financiai Statements What is the firm's 2020 current ratio? Do not round intermediate calculations. Round your answer to two decimal places. If the industry average debt-to-assets ratio is 30%, then Rosnan's creditors have a cushion than indicated by the industry average. What is the firm's 2020 net profit margin? Do not round intermediate calculations. Round your answer to two decimal places. If the industry average profit margin is 12%, then Rosnan's lower than average debt-to-assets ratio might be one reason for its high profit margin