Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analysts make the following forecasts for Smiggle, a retail store chain that sells stationery and related accessories, for the forecast horizon of 2018 and

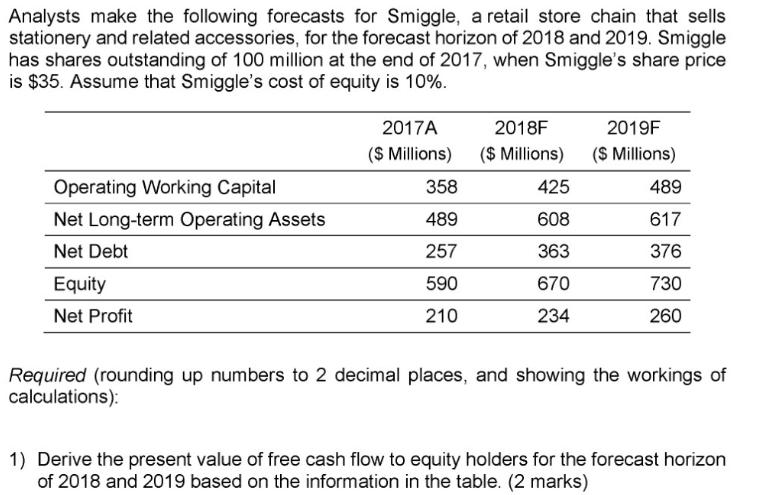

Analysts make the following forecasts for Smiggle, a retail store chain that sells stationery and related accessories, for the forecast horizon of 2018 and 2019. Smiggle has shares outstanding of 100 million at the end of 2017, when Smiggle's share price is $35. Assume that Smiggle's cost of equity is 10%. Operating Working Capital Net Long-term Operating Assets Net Debt Equity Net Profit 2017A ($ Millions) 358 489 257 590 210 2018F ($ Millions) 425 608 363 670 234 2019F ($ Millions) 489 617 376 730 260 Required (rounding up numbers to 2 decimal places, and showing the workings of calculations): 1) Derive the present value of free cash flow to equity holders for the forecast horizon of 2018 and 2019 based on the information in the table. (2 marks)

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

We will use the given data for each year to calculate the FCFE for 2018 and 2019 and then discount t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started