Answered step by step

Verified Expert Solution

Question

1 Approved Answer

analyze and compare Amazon.com and Wal-Mart Analyze and compare Amazon.com and Wal-Mart Amazon.com, Inc. (AMZN) is one of the largest internet retailers in the world.

analyze and compare Amazon.com and Wal-Mart

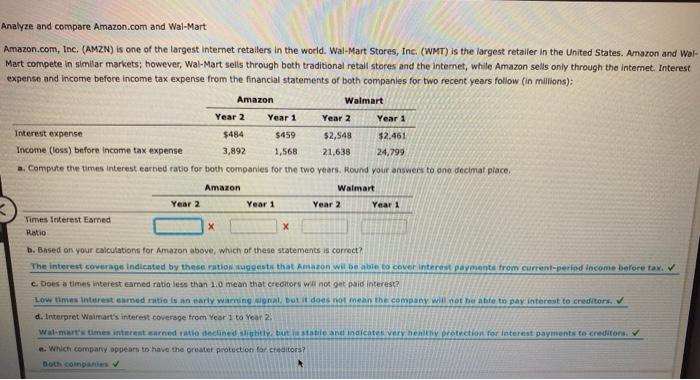

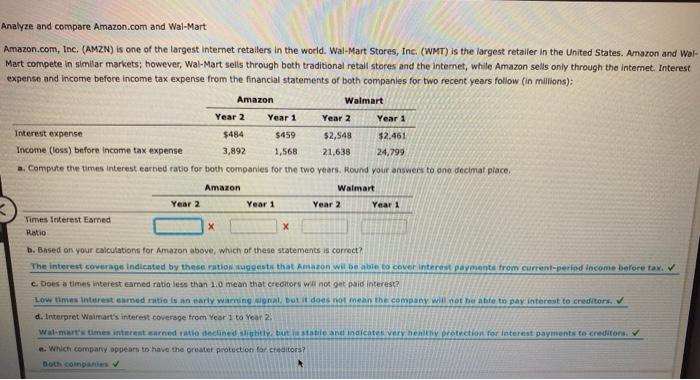

Analyze and compare Amazon.com and Wal-Mart Amazon.com, Inc. (AMZN) is one of the largest internet retailers in the world. Wal-Mart Stores, Inc. (WMT) is the largest retailer in the United States. Amazon and Wal- Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the internet, while Amazon sells only through the internet. Interest expense and income before income tax expense from the financial statements of both companies for two recent years follow (in Millions): Amazon Walmart Year 2 Year 1 Year 2 Year 1 Interest expense $484 $459 $2,548 $2.461 Income (los) before Income tax expense 3,892 1,568 21,638 24,799 a. Compute the times interest earned ratio for both companies for the two years. Round your answers to one decimal place. Amazon Walmart Year 2 Year 1 Year 2 Year 1 Times Interest Eamed X X Ratio b. Based on your calculations for Amazon above, which of these statements is correct? The interest coverage indicated by these ratio suggests that Amazon wil be able to cover interest payments from current period income before tax c. Does a times interest earned ratio less than 10 mean that creditors will not get paid interest? Low times interest Gamed ratio is an early warning soal but it does not mean the company will not be able to pay interest to creditors. d. Interpret Walmart's interest coverage from Year 1 to Year 2 Walmart's times interest earned ratio declined slightly, but la statile and indicates very hen til protection for interest payments to creditors, Which company appears to have the greater protection for creditors? Both companies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started