Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze and explain each horizontal analysis ( balance sheet and income statement) give explanation in each data. Balance Sheet For the year ended December 31,

Analyze and explain each horizontal analysis ( balance sheet and income statement) give explanation in each data.

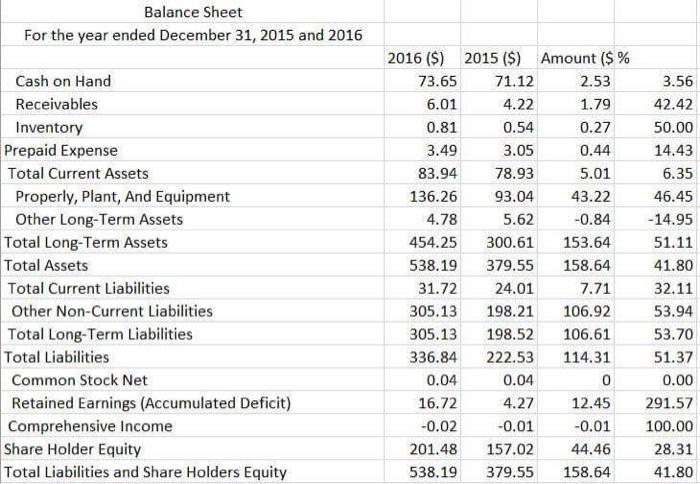

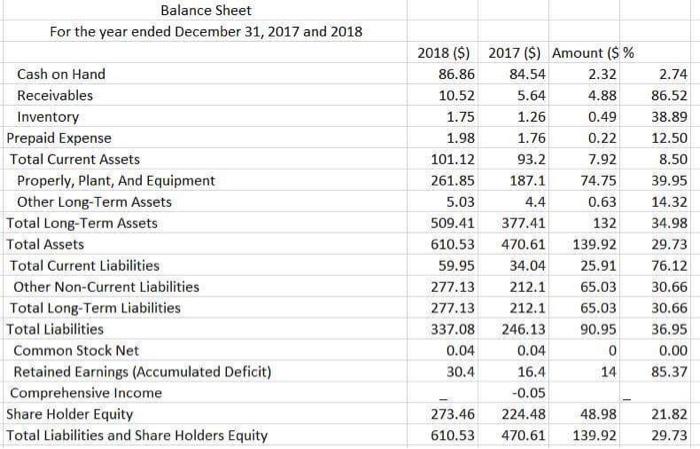

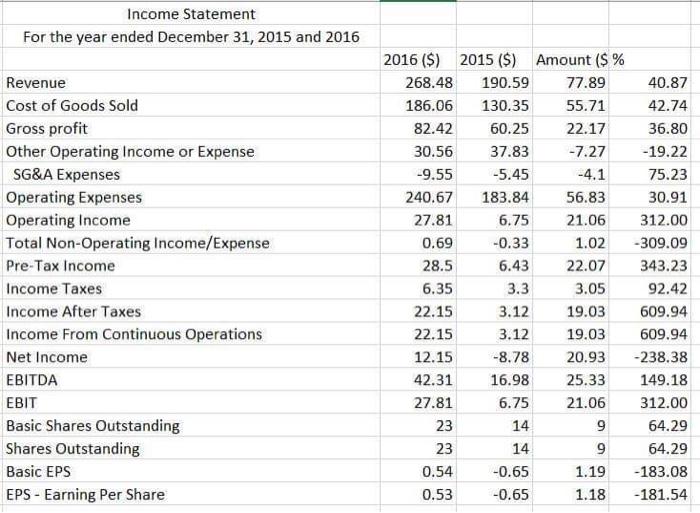

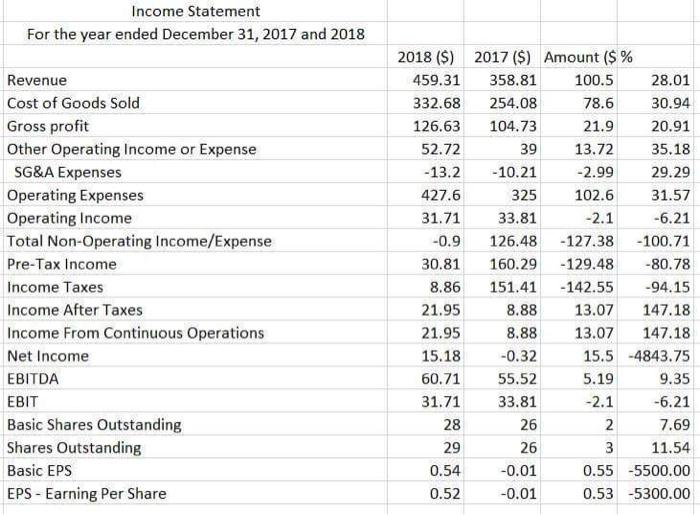

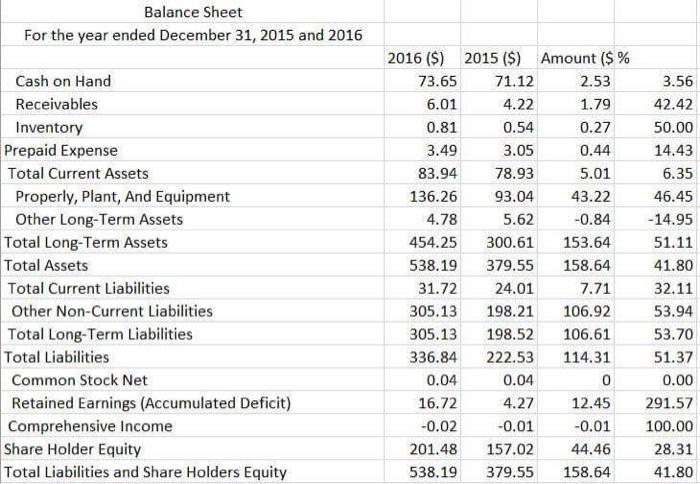

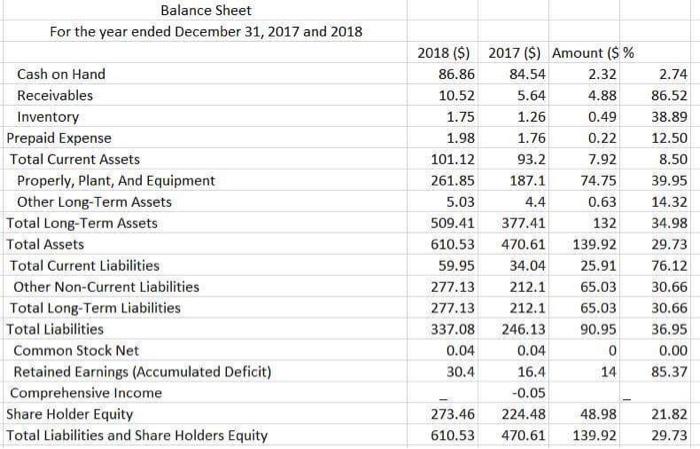

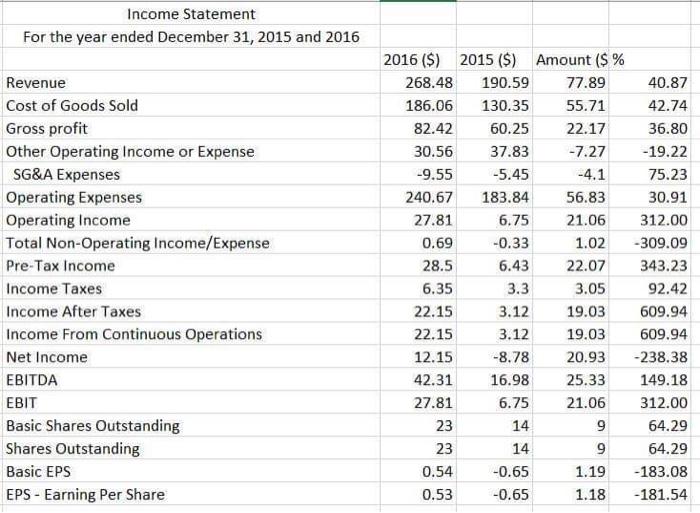

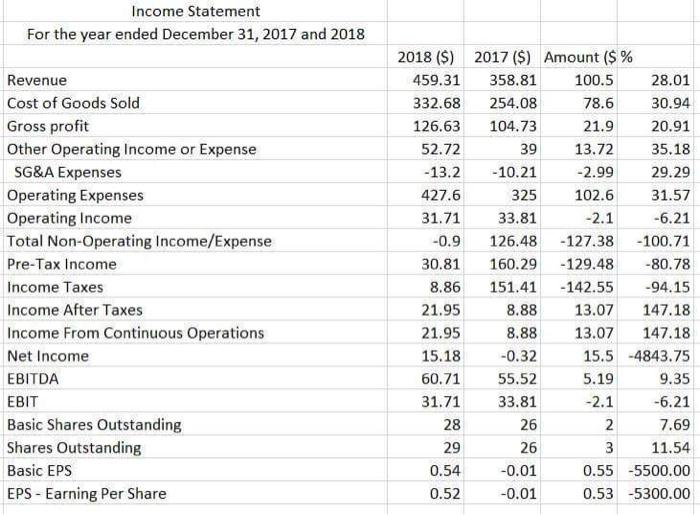

Balance Sheet For the year ended December 31, 2015 and 2016 Cash on Hand Receivables Inventory Prepaid Expense Total Current Assets Properly, Plant, And Equipment Other Long-Term Assets Total Long-Term Assets Total Assets Total Current Liabilities Other Non-Current Liabilities Total Long-Term Liabilities Total Liabilities Common Stock Net Retained Earnings (Accumulated Deficit) Comprehensive Income Share Holder Equity Total Liabilities and Share Holders Equity 2016 ($) 2015 (5) Amount ($ % 73.65 71.12 2.53 6.01 4.22 1.79 0.81 0.54 0.27 3.49 3.05 0.44 83.94 78.93 5.01 136.26 93.04 43.22 4.78 5.62 -0.84 454.25 300.61 153.64 538.19 379.55 158.64 31.72 24.01 7.71 305.13 198.21 106.92 305.13 198.52 106.61 336.84 222.53 114.31 0.04 0.04 0 16.72 4.27 12.45 -0.02 -0.01 -0.01 201.48 157.02 44.46 538.19 379.55 158.64 3.56 42.42 50.00 14.43 6.35 46.45 -14.95 51.11 41.80 32.11 53.94 53.70 51.37 0.00 291.57 100.00 28.31 41.80 Balance Sheet For the year ended December 31, 2017 and 2018 Cash on Hand Receivables Inventory Prepaid Expense Total Current Assets Properly, Plant, And Equipment Other Long-Term Assets Total Long-Term Assets Total Assets Total Current Liabilities Other Non-Current Liabilities Total Long-Term Liabilities Total Liabilities Common Stock Net Retained Earnings (Accumulated Deficit) Comprehensive Income Share Holder Equity Total Liabilities and Share Holders Equity 2018 ($) 2017 (3) Amount ($ % 86.86 84.54 2.32 10.52 5.64 4.88 1.75 1.26 0.49 1.98 1.76 0.22 101.12 93.2 7.92 261.85 187.1 74.75 5.03 4.4 0.63 509.41 377.41 132 610.53 470.61 139.92 59.95 34.04 25.91 277.13 212.1 65.03 277.13 212.1 65.03 337.08 246.13 90.95 0.04 0.04 0 30.4 16.4 14 -0.05 273.46 224.48 48.98 610.53 470.61 139.92 2.74 86.52 38.89 12.50 8.50 39.95 14.32 34.98 29.73 76.12 30.66 30.66 36.95 0.00 85.37 21.82 29.73 Income Statement For the year ended December 31, 2015 and 2016 40.87 Revenue Cost of Goods Sold Gross profit Other Operating Income or Expense SG&A Expenses Operating Expenses Operating Income Total Non-Operating Income/Expense Pre-Tax Income Income Taxes Income After Taxes Income From Continuous Operations Net Income EBITDA EBIT Basic Shares Outstanding Shares Outstanding Basic EPS EPS - Earning Per Share 2016 ($) 2015 ($) Amount ($ % 268.48 190.59 77.89 186.06 130.35 55.71 82.42 60.25 22.17 30.56 37.83 -7.27 -9.55 -5.45 -4.1 240.67 183.84 56.83 27.81 6.75 21.06 0.69 -0.33 1.02 28.5 6.43 22.07 6.35 3.3 3.05 22.15 3.12 19.03 22.15 3.12 19.03 12.15 -8.78 20.93 42.31 16.98 25.33 27.81 6.75 21.06 23 9 23 14 9 0.54 -0.65 1.19 0.53 -0.65 1.18 42.74 36.80 -19.22 75.23 30.91 312.00 - 309.09 343.23 92.42 609.94 609.94 -238.38 149.18 312.00 64.29 64.29 -183.08 -181.54 14 Income Statement For the year ended December 31, 2017 and 2018 Revenue Cost of Goods Sold Gross profit Other Operating Income or Expense SG&A Expenses Operating Expenses Operating Income Total Non-Operating Income/Expense Pre-Tax Income Income Taxes Income After Taxes Income From Continuous Operations Net Income EBITDA EBIT Basic Shares Outstanding Shares Outstanding Basic EPS EPS - Earning Per Share 2018 ($) 2017 ($) Amount ($ % 459.31 358.81 100.5 28.01 332.68 254.08 78.6 30.94 126.63 104.73 21.9 20.91 52.72 39 13.72 35.18 -13.2 - 10.21 -2.99 29.29 427.6 325 102.6 31.57 31.71 33.81 -2.1 -6.21 -0.9 126.48 -127.38 -100.71 30.81 160.29 -129.48 -80.78 8.86 151.41 -142.55 -94.15 21.95 8.88 13.07 147.18 21.95 8.88 13.07 147.18 15.18 -0.32 15.5 -4843.75 60.71 55.52 5.19 9.35 31.71 33.81 -2.1 -6.21 28 26 2 7.69 29 26 3 11.54 0.54 -0.01 0.55 -5500.00 0.52 -0.01 0.53 -5300.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started