Question

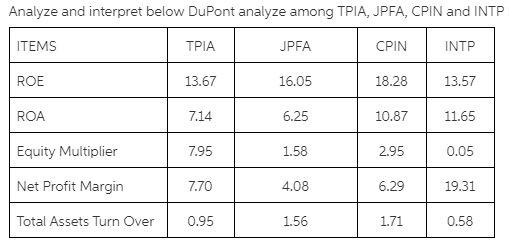

Analyze and interpret below DuPont analyze among TPIA, JPFA, CPIN and INTP ITEMS ROE ROA Equity Multiplier Net Profit Margin Total Assets Turn Over

Analyze and interpret below DuPont analyze among TPIA, JPFA, CPIN and INTP ITEMS ROE ROA Equity Multiplier Net Profit Margin Total Assets Turn Over TPIA 13.67 7.14 7.95 7.70 0.95 JPFA 16.05 6.25 1.58 4.08 1.56 CPIN 18.28 10.87 2.95 6.29 1.71 INTP 13.57 11.65 0.05 19.31 0.58

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings for DuPont analysis of the companies For TPIA ROE Net Income Shareholders Equity Net Income Total Assets Total Liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Managerial Finance

Authors: Lawrence J. Gitman, Chad J. Zutter, Wajeeh Elali, Amer Al Roubaix

Arab World Edition

1408271583, 978-1408271582

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App