Answered step by step

Verified Expert Solution

Question

1 Approved Answer

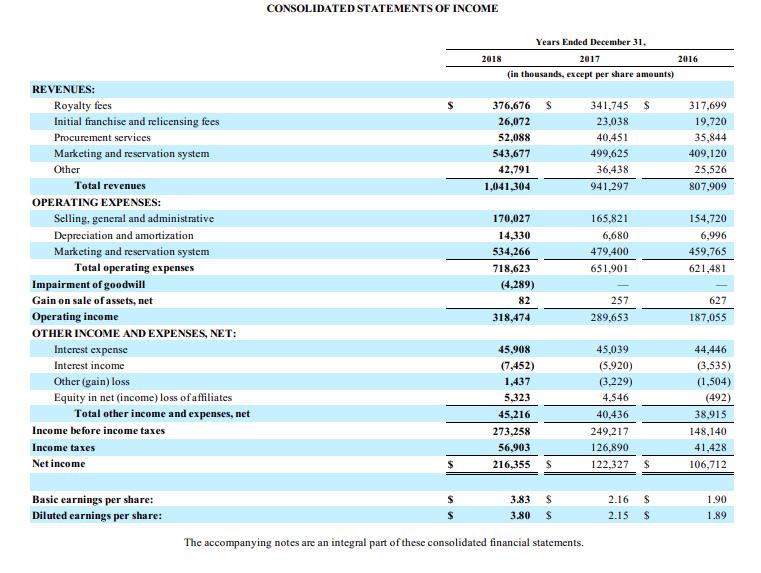

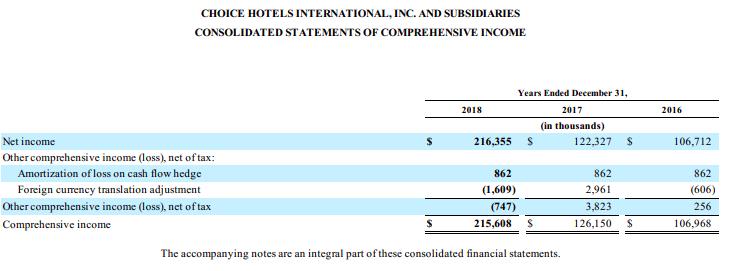

Analyze at least 3 (three) items on the income statement for your base company that would be important to an investor, and discuss whether your

Analyze at least 3 (three) items on the income statement for your base company that would be important to an investor, and discuss whether your company’s performance related to these items appeared to be improving, deteriorating, or remaining stable. Justify your answer

CONSOLIDATED STATEMENTS OF INCOME Years Ended December 31, 2018 2017 2016 (in thousands, except per share amounts) REVENUES: Royalty fees Initial franchise and relicensing fees 376,676 S 341,745 317,699 26,072 23,038 19,720 Procurement services 52,088 40,451 35,844 Marketing and rescrvation system 543,677 499,625 409,120 Other 42,791 36,438 25,526 Total revenues 1,041,304 941,297 807,909 OPERATING EXPENSES: Selling, general and administrative 170,027 165,821 154,720 Depreciation and amortization 14,330 6,680 6,996 Marketing and reservation system 534,266 479,400 459,765 Total operating expenses 718,623 651,901 621,481 Impairment of goodwill (4,289) Gain on sale of assets, net 257 627 82 Operating income 318,474 289,653 187,055 OTHER INCOME AND EXPENSES, NET: Interest expense 45,908 45,039 44,446 Interest income (7,452) (5,920) (3,535) Other (gain) loss Equity in net (income) loss of affiliates Total other income and expenses, net 1,437 (3,229) (1,504) 5,323 4,546 (492) 45,216 40,436 38,915 Income before income taxes 273,258 249,217 148,140 Income taxes 56,903 126,890 41,428 Net income 216,355 122,327 2$ 106,712 Basic earnings per share: 3.83 2.16 1.90 Diluted earnings per share: 3.80 2.15 1.89 The accompanying notes are an integral part of these consolidated financial statements.

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

When you first look at the revenue statement youll notice ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started