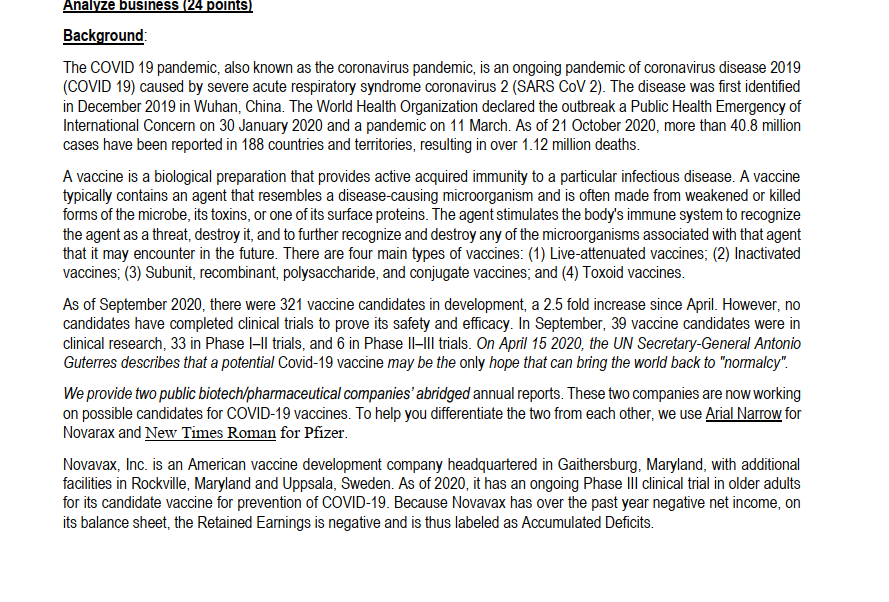

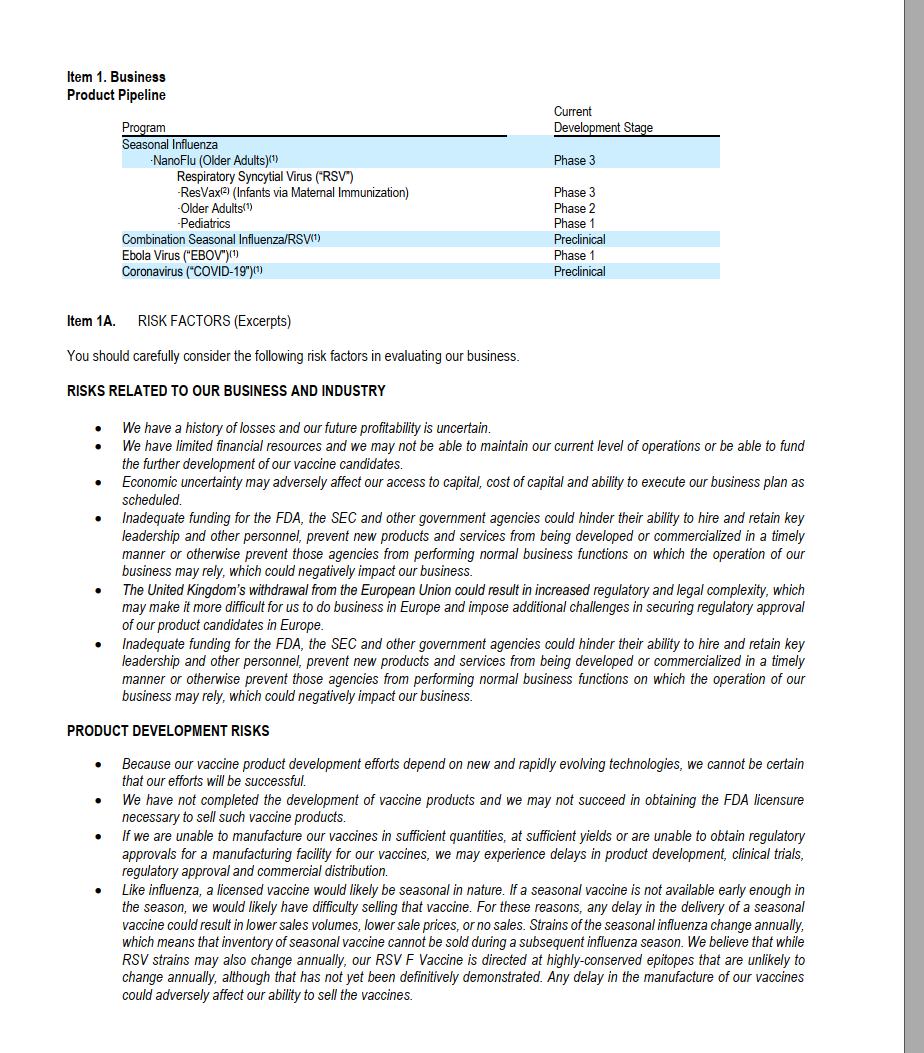

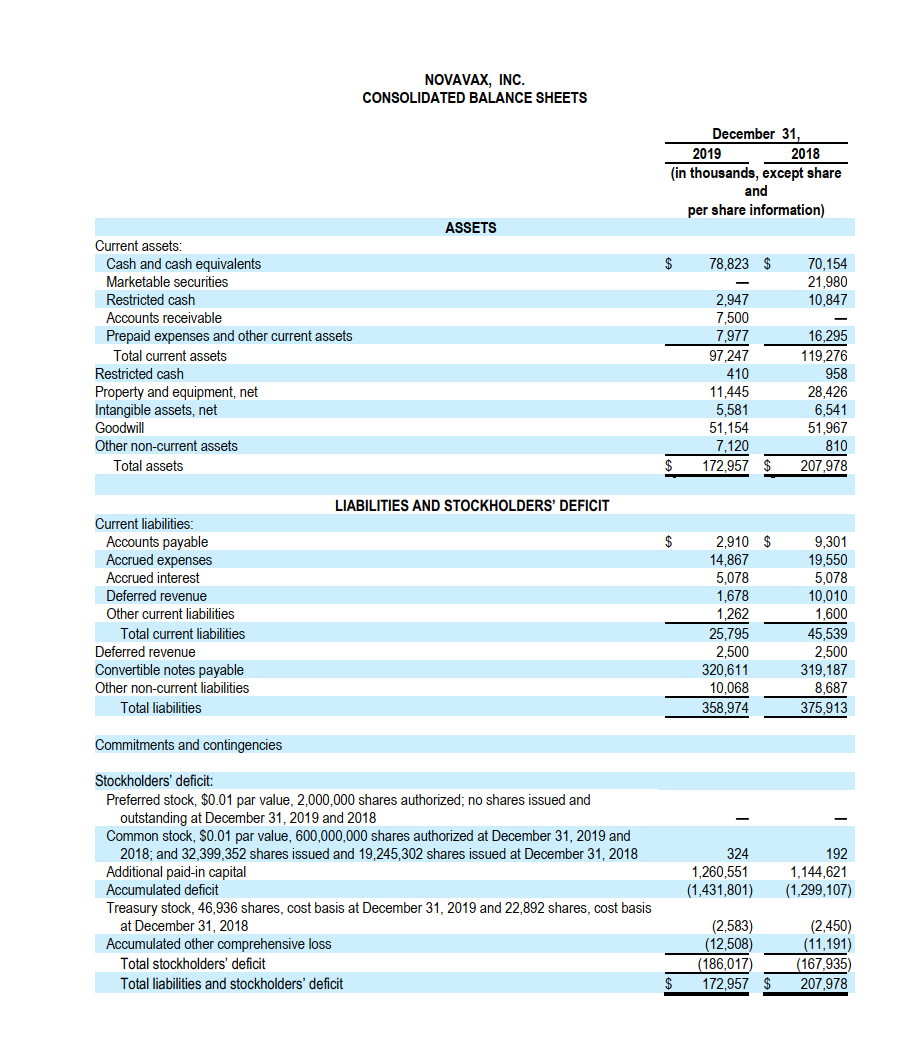

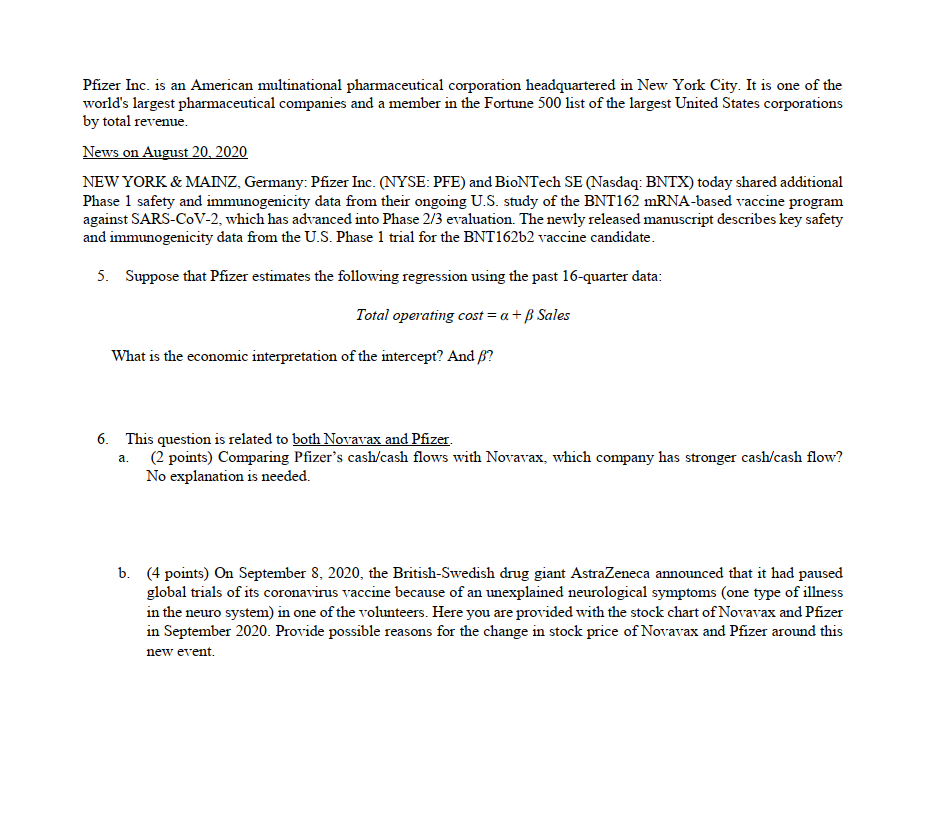

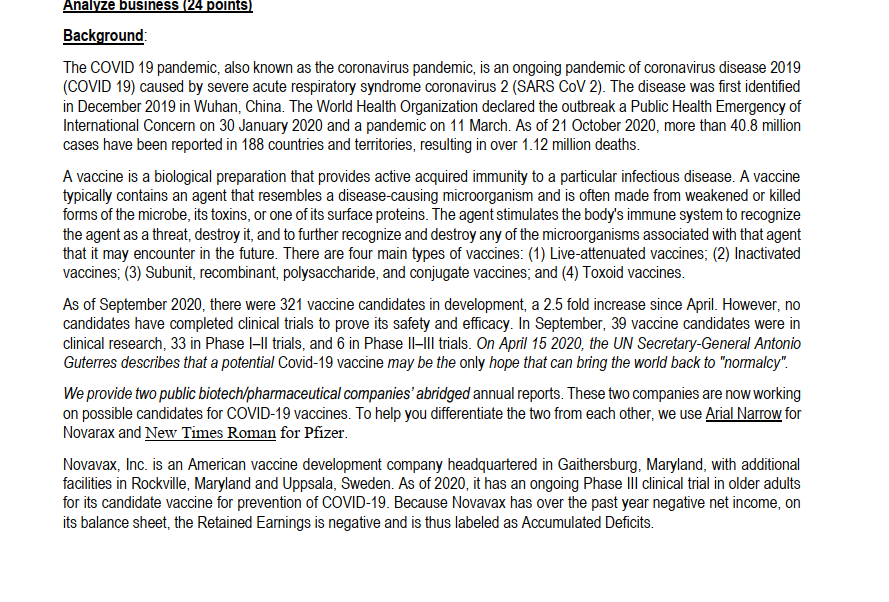

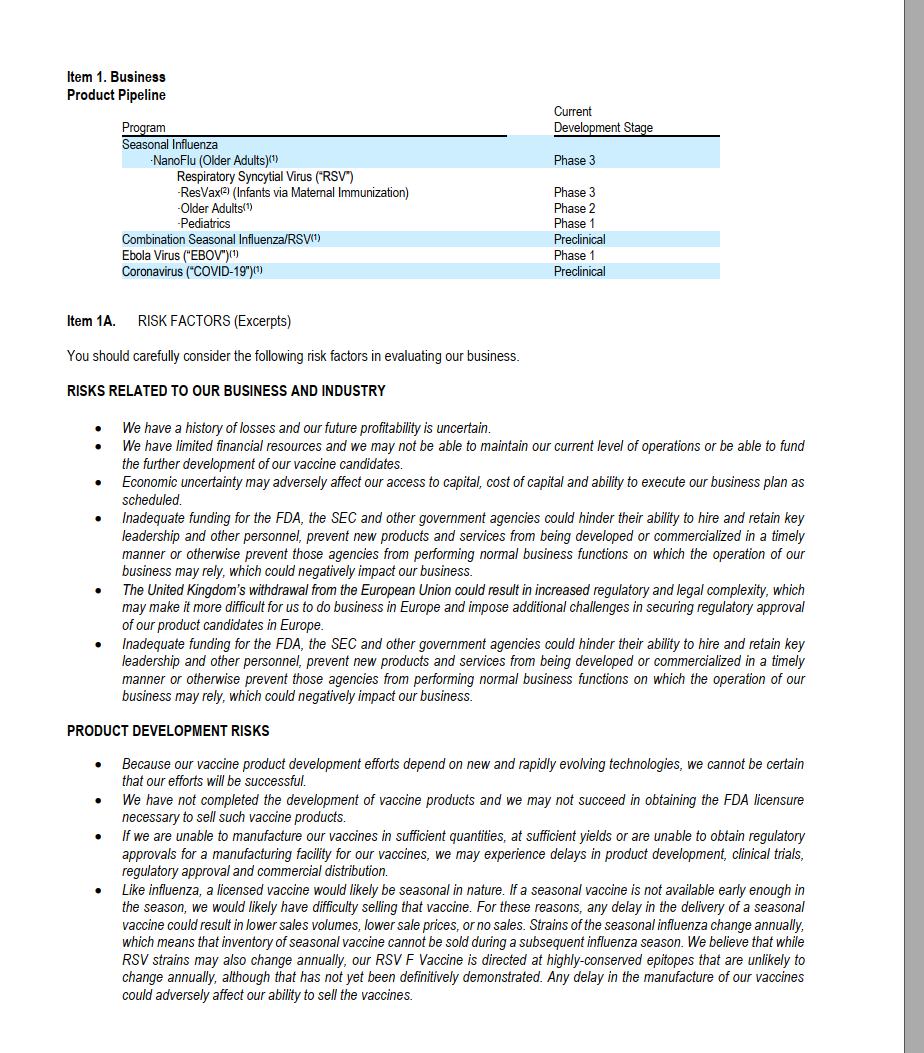

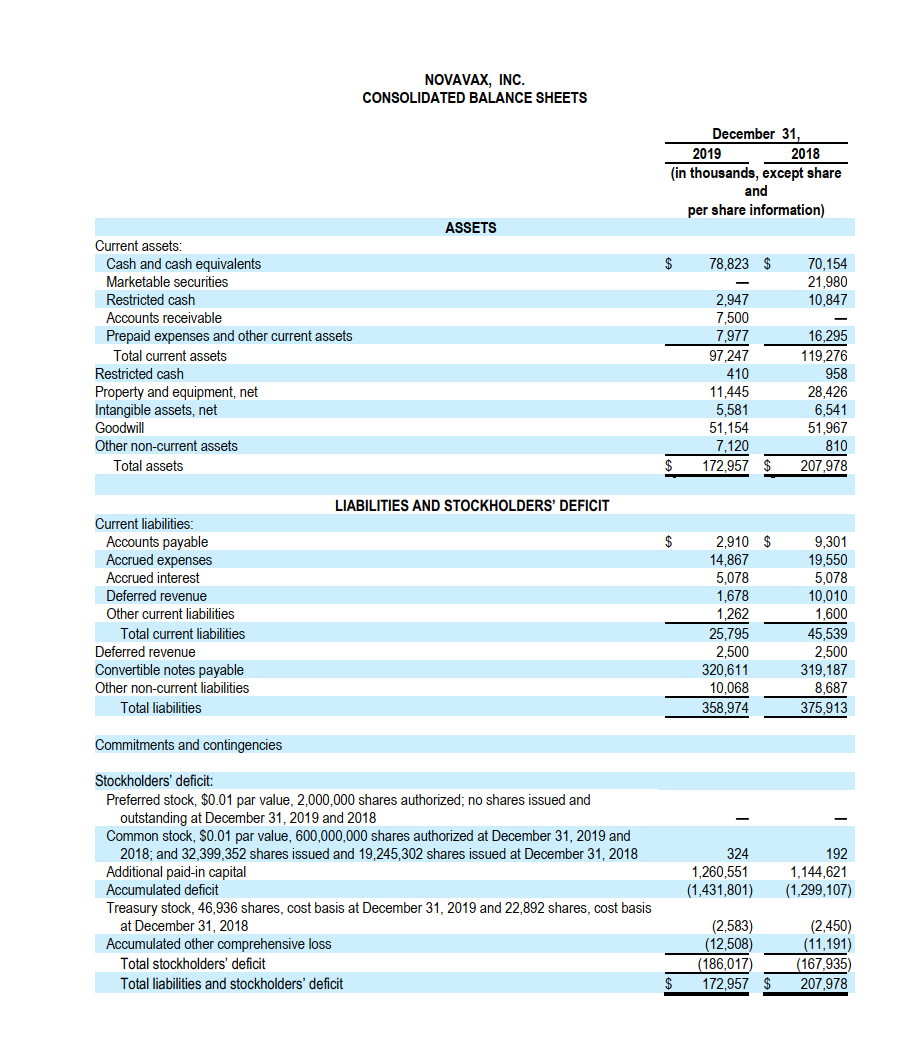

Analyze business (24 points) Background: The COVID 19 pandemic, also known as the coronavirus pandemic, is an ongoing pandemic of coronavirus disease 2019 (COVID 19) caused by severe acute respiratory syndrome coronavirus 2 (SARS COV 2). The disease was first identified in December 2019 in Wuhan, China. The World Health Organization declared the outbreak a Public Health Emergency of International Concern on 30 January 2020 and a pandemic on 11 March. As of 21 October 2020, more than 40.8 million cases have been reported in 188 countries and territories, resulting in over 1.12 million deaths. A vaccine is a biological preparation that provides active acquired immunity to a particular infectious disease. A vaccine typically contains an agent that resembles a disease-causing microorganism and is often made from weakened or killed forms of the microbe, its toxins, or one of its surface proteins. The agent stimulates the body's immune system to recognize the agent as a threat, destroy it, and to further recognize and destroy any of the microorganisms associated with that agent that it may encounter in the future. There are four main types of vaccines: (1) Live-attenuated vaccines; (2) Inactivated vaccines; (3) Subunit, recombinant, polysaccharide, and conjugate vaccines; and (4) Toxoid vaccines. As of September 2020, there were 321 vaccine candidates in development, a 2.5 fold increase since April. However, no candidates have completed clinical trials to prove its safety and efficacy. In September, 39 vaccine candidates were in clinical research, 33 in Phase I-II trials, and 6 in Phase II-III trials. On April 15 2020, the UN Secretary-General Antonio Guterres describes that a potential Covid-19 vaccine may be the only hope that can bring the world back to "normalcy". We provide two public biotech/pharmaceutical companies'abridged annual reports. These two companies are now working on possible candidates for COVID-19 vaccines. To help you differentiate the two from each other, we use Arial Narrow for Novarax and New Times Roman for Pfizer. Novavax, Inc. is an American vaccine development company headquartered in Gaithersburg, Maryland, with additional facilities in Rockville, Maryland and Uppsala, Sweden. As of 2020, it has an ongoing Phase III clinical trial in older adults for its candidate vaccine for prevention of COVID-19. Because Novavax has over the past year negative net income, on its balance sheet, the Retained Earnings is negative and is thus labeled as Accumulated Deficits. Item 1. Business Product Pipeline Current Development Stage Phase 3 Program Seasonal Influenza NanoFlu (Older Adults)) Respiratory Syncytial Virus ("RSV") ResVax(2) Infants via Maternal Immunization) -Older Adults(1) -Pediatrics Combination Seasonal Influenza/RSV) Ebola Virus ("EBOV")" Coronavirus ("COVID-19")(!) Phase 3 Phase 2 Phase 1 Preclinical Phase 1 Preclinical Item 1A. RISK FACTORS (Excerpts) You should carefully consider the following risk factors in evaluating our business. RISKS RELATED TO OUR BUSINESS AND INDUSTRY We have a history of losses and our future profitability is uncertain. We have limited financial resources and we may not be able to maintain our current level of operations or be able to fund the further development of our vaccine candidates. Economic uncertainty may adversely affect our access to capital, cost of capital and ability to execute our business plan as scheduled. Inadequate funding for the FDA, the SEC and other government agencies could hinder their ability to hire and retain key leadership and other personnel, prevent new products and services from being developed or commercialized in a timely manner or otherwise prevent those agencies from performing normal business functions on which the operation of our business may rely, which could negatively impact our business. The United Kingdom's withdrawal from the European Union could result in increased regulatory and legal complexity, which may make it more difficult for us to do business in Europe and impose additional challenges in securing regulatory approval of our product candidates in Europe. Inadequate funding for the FDA, the SEC and other government agencies could hinder their ability to hire and retain key leadership and other personnel, prevent new products and services from being developed or commercialized in a timely manner or otherwise prevent those agencies from performing normal business functions on which the operation of our business may rely, which could negatively impact our business. PRODUCT DEVELOPMENT RISKS Because our vaccine product development efforts depend on new and rapidly evolving technologies, we cannot be certain that our efforts will be successful. We have not completed the development of vaccine products and we may not succeed in obtaining the FDA licensure necessary to sell such vaccine products. If we are unable to manufacture our vaccines in sufficient quantities, at sufficient yields or are unable to obtain regulatory approvals for a manufacturing facility for our vaccines, we may experience delays in product development, clinical trials, regulatory approval and commercial distribution. Like influenza, a licensed vaccine would likely be seasonal in nature. If a seasonal vaccine is not available early enough in the season, we would likely have difficulty selling that vaccine. For these reasons, any delay in the delivery of a seasonal vaccine could result in lower sales volumes, lower sale prices, or no sales. Strains of the seasonal influenza change annually, which means that inventory of seasonal vaccine cannot be sold during a subsequent influenza season. We believe that while RSV strains may also change annually, our RSV F Vaccine is directed at highly-conserved epitopes that are unlikely to change annually, although that has not yet been definitively demonstrated. Any delay in the manufacture of our vaccines could adversely affect our ability to sell the vaccines. NOVAVAX, INC. CONSOLIDATED BALANCE SHEETS December 31, 2019 2018 (in thousands, except share and per share information) ASSETS $ 78,823 $ 70,154 21,980 10,847 2.947 7,500 7,977 Current assets: Cash and cash equivalents Marketable securities Restricted cash Accounts receivable Prepaid expenses and other current assets Total current assets Restricted cash Property and equipment, net Intangible assets, net Goodwill Other non-current assets Total assets 97,247 410 11,445 5,581 51,154 7,120 172,957 16,295 119,276 958 28.426 6,541 51,967 810 207,978 LIABILITIES AND STOCKHOLDERS' DEFICIT 9,301 Current liabilities: Accounts payable Accrued expenses Accrued interest Deferred revenue Other current liabilities Total current liabilities Deferred revenue Convertible notes payable Other non-current liabilities Total liabilities 2,910 $ 14,867 5,078 1,678 1,262 25,795 2,500 320.611 10,068 358.974 19,550 5,078 10,010 1,600 45,539 2,500 319,187 8,687 375,913 Commitments and contingencies - Stockholders' deficit: Preferred stock. $0.01 par value, 2,000,000 shares authorized; no shares issued and outstanding at December 31, 2019 and 2018 Common stock, $0.01 par value, 600,000,000 shares authorized at December 31, 2019 and 2018; and 32,399,352 shares issued and 19,245,302 shares issued at December 31, 2018 Additional paid-in capital Accumulated deficit Treasury stock, 46,936 shares, cost basis at December 31, 2019 and 22,892 shares, cost basis at December 31, 2018 Accumulated other comprehensive loss Total stockholders' deficit Total liabilities and stockholders' deficit 324 1,260,551 (1,431,801) 192 1,144,621 (1,299,107) (2,583) (12,508) (186,017) 172,957 $ (2,450) (11,191) (167,935) 207,978 NOVAVAX, INC. CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31, 2019 2018 2017 (in thousands, except per share information) $ $ Revenue: Government contract Grant and other Total revenue 7,500 $ 11,162 18,662 34,288 34,288 31,176 31,176 173,797 168,435 Expenses: Research and development Gain on Catalent transaction General and administrative Total expenses Loss from operations Other income (expense) Investment income Interest expense Other income (expense) Net loss 113,842 (9,016) 34,417 139,243 (120,581) 34,409 208,206 (173,918) 34,451 202,886 (171,710) 1,512 (13,612) (13) (132,694) $ 2,674 (13,612) 108 (184,748) $ 1,946 (14,072) 67 (183,769) $ Pfizer Inc. is an American multinational pharmaceutical corporation headquartered in New York City. It is one of the world's largest pharmaceutical companies and a member in the Fortune 500 list of the largest United States corporations by total revenue. News on August 20, 2020 NEW YORK & MAINZ, Germany: Pfizer Inc. (NYSE: PFE) and BioNTech SE (Nasdaq: BNTX) today shared additional Phase 1 safety and immunogenicity data from their ongoing U.S. study of the BNT162 mRNA-based vaccine program against SARS-CoV-2, which has advanced into Phase 2/3 evaluation. The newly released manuscript describes key safety and immunogenicity data from the U.S. Phase 1 trial for the BNT16262 vaccine candidate. 5. Suppose that Pfizer estimates the following regression using the past 16-quarter data: Total operating cost = a + Sales What is the economic interpretation of the intercept? And B? 6. This question is related to both Novavax and Pfizer. (2 points) Comparing Pfizer's cash/cash flows with Novavax, which company has stronger cash/cash flow? No explanation is needed. a. b. (4 points) On September 8, 2020, the British-Swedish drug giant AstraZeneca announced that it had paused global trials of its coronavirus vaccine because of an unexplained neurological symptoms (one type of illness in the neuro system) in one of the volunteers. Here you are provided with the stock chart of Novavax and Pfizer in September 2020. Provide possible reasons for the change in stock price of Novavax and Pfizer around this new event. Analyze business (24 points) Background: The COVID 19 pandemic, also known as the coronavirus pandemic, is an ongoing pandemic of coronavirus disease 2019 (COVID 19) caused by severe acute respiratory syndrome coronavirus 2 (SARS COV 2). The disease was first identified in December 2019 in Wuhan, China. The World Health Organization declared the outbreak a Public Health Emergency of International Concern on 30 January 2020 and a pandemic on 11 March. As of 21 October 2020, more than 40.8 million cases have been reported in 188 countries and territories, resulting in over 1.12 million deaths. A vaccine is a biological preparation that provides active acquired immunity to a particular infectious disease. A vaccine typically contains an agent that resembles a disease-causing microorganism and is often made from weakened or killed forms of the microbe, its toxins, or one of its surface proteins. The agent stimulates the body's immune system to recognize the agent as a threat, destroy it, and to further recognize and destroy any of the microorganisms associated with that agent that it may encounter in the future. There are four main types of vaccines: (1) Live-attenuated vaccines; (2) Inactivated vaccines; (3) Subunit, recombinant, polysaccharide, and conjugate vaccines; and (4) Toxoid vaccines. As of September 2020, there were 321 vaccine candidates in development, a 2.5 fold increase since April. However, no candidates have completed clinical trials to prove its safety and efficacy. In September, 39 vaccine candidates were in clinical research, 33 in Phase I-II trials, and 6 in Phase II-III trials. On April 15 2020, the UN Secretary-General Antonio Guterres describes that a potential Covid-19 vaccine may be the only hope that can bring the world back to "normalcy". We provide two public biotech/pharmaceutical companies'abridged annual reports. These two companies are now working on possible candidates for COVID-19 vaccines. To help you differentiate the two from each other, we use Arial Narrow for Novarax and New Times Roman for Pfizer. Novavax, Inc. is an American vaccine development company headquartered in Gaithersburg, Maryland, with additional facilities in Rockville, Maryland and Uppsala, Sweden. As of 2020, it has an ongoing Phase III clinical trial in older adults for its candidate vaccine for prevention of COVID-19. Because Novavax has over the past year negative net income, on its balance sheet, the Retained Earnings is negative and is thus labeled as Accumulated Deficits. Item 1. Business Product Pipeline Current Development Stage Phase 3 Program Seasonal Influenza NanoFlu (Older Adults)) Respiratory Syncytial Virus ("RSV") ResVax(2) Infants via Maternal Immunization) -Older Adults(1) -Pediatrics Combination Seasonal Influenza/RSV) Ebola Virus ("EBOV")" Coronavirus ("COVID-19")(!) Phase 3 Phase 2 Phase 1 Preclinical Phase 1 Preclinical Item 1A. RISK FACTORS (Excerpts) You should carefully consider the following risk factors in evaluating our business. RISKS RELATED TO OUR BUSINESS AND INDUSTRY We have a history of losses and our future profitability is uncertain. We have limited financial resources and we may not be able to maintain our current level of operations or be able to fund the further development of our vaccine candidates. Economic uncertainty may adversely affect our access to capital, cost of capital and ability to execute our business plan as scheduled. Inadequate funding for the FDA, the SEC and other government agencies could hinder their ability to hire and retain key leadership and other personnel, prevent new products and services from being developed or commercialized in a timely manner or otherwise prevent those agencies from performing normal business functions on which the operation of our business may rely, which could negatively impact our business. The United Kingdom's withdrawal from the European Union could result in increased regulatory and legal complexity, which may make it more difficult for us to do business in Europe and impose additional challenges in securing regulatory approval of our product candidates in Europe. Inadequate funding for the FDA, the SEC and other government agencies could hinder their ability to hire and retain key leadership and other personnel, prevent new products and services from being developed or commercialized in a timely manner or otherwise prevent those agencies from performing normal business functions on which the operation of our business may rely, which could negatively impact our business. PRODUCT DEVELOPMENT RISKS Because our vaccine product development efforts depend on new and rapidly evolving technologies, we cannot be certain that our efforts will be successful. We have not completed the development of vaccine products and we may not succeed in obtaining the FDA licensure necessary to sell such vaccine products. If we are unable to manufacture our vaccines in sufficient quantities, at sufficient yields or are unable to obtain regulatory approvals for a manufacturing facility for our vaccines, we may experience delays in product development, clinical trials, regulatory approval and commercial distribution. Like influenza, a licensed vaccine would likely be seasonal in nature. If a seasonal vaccine is not available early enough in the season, we would likely have difficulty selling that vaccine. For these reasons, any delay in the delivery of a seasonal vaccine could result in lower sales volumes, lower sale prices, or no sales. Strains of the seasonal influenza change annually, which means that inventory of seasonal vaccine cannot be sold during a subsequent influenza season. We believe that while RSV strains may also change annually, our RSV F Vaccine is directed at highly-conserved epitopes that are unlikely to change annually, although that has not yet been definitively demonstrated. Any delay in the manufacture of our vaccines could adversely affect our ability to sell the vaccines. NOVAVAX, INC. CONSOLIDATED BALANCE SHEETS December 31, 2019 2018 (in thousands, except share and per share information) ASSETS $ 78,823 $ 70,154 21,980 10,847 2.947 7,500 7,977 Current assets: Cash and cash equivalents Marketable securities Restricted cash Accounts receivable Prepaid expenses and other current assets Total current assets Restricted cash Property and equipment, net Intangible assets, net Goodwill Other non-current assets Total assets 97,247 410 11,445 5,581 51,154 7,120 172,957 16,295 119,276 958 28.426 6,541 51,967 810 207,978 LIABILITIES AND STOCKHOLDERS' DEFICIT 9,301 Current liabilities: Accounts payable Accrued expenses Accrued interest Deferred revenue Other current liabilities Total current liabilities Deferred revenue Convertible notes payable Other non-current liabilities Total liabilities 2,910 $ 14,867 5,078 1,678 1,262 25,795 2,500 320.611 10,068 358.974 19,550 5,078 10,010 1,600 45,539 2,500 319,187 8,687 375,913 Commitments and contingencies - Stockholders' deficit: Preferred stock. $0.01 par value, 2,000,000 shares authorized; no shares issued and outstanding at December 31, 2019 and 2018 Common stock, $0.01 par value, 600,000,000 shares authorized at December 31, 2019 and 2018; and 32,399,352 shares issued and 19,245,302 shares issued at December 31, 2018 Additional paid-in capital Accumulated deficit Treasury stock, 46,936 shares, cost basis at December 31, 2019 and 22,892 shares, cost basis at December 31, 2018 Accumulated other comprehensive loss Total stockholders' deficit Total liabilities and stockholders' deficit 324 1,260,551 (1,431,801) 192 1,144,621 (1,299,107) (2,583) (12,508) (186,017) 172,957 $ (2,450) (11,191) (167,935) 207,978 NOVAVAX, INC. CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31, 2019 2018 2017 (in thousands, except per share information) $ $ Revenue: Government contract Grant and other Total revenue 7,500 $ 11,162 18,662 34,288 34,288 31,176 31,176 173,797 168,435 Expenses: Research and development Gain on Catalent transaction General and administrative Total expenses Loss from operations Other income (expense) Investment income Interest expense Other income (expense) Net loss 113,842 (9,016) 34,417 139,243 (120,581) 34,409 208,206 (173,918) 34,451 202,886 (171,710) 1,512 (13,612) (13) (132,694) $ 2,674 (13,612) 108 (184,748) $ 1,946 (14,072) 67 (183,769) $ Pfizer Inc. is an American multinational pharmaceutical corporation headquartered in New York City. It is one of the world's largest pharmaceutical companies and a member in the Fortune 500 list of the largest United States corporations by total revenue. News on August 20, 2020 NEW YORK & MAINZ, Germany: Pfizer Inc. (NYSE: PFE) and BioNTech SE (Nasdaq: BNTX) today shared additional Phase 1 safety and immunogenicity data from their ongoing U.S. study of the BNT162 mRNA-based vaccine program against SARS-CoV-2, which has advanced into Phase 2/3 evaluation. The newly released manuscript describes key safety and immunogenicity data from the U.S. Phase 1 trial for the BNT16262 vaccine candidate. 5. Suppose that Pfizer estimates the following regression using the past 16-quarter data: Total operating cost = a + Sales What is the economic interpretation of the intercept? And B? 6. This question is related to both Novavax and Pfizer. (2 points) Comparing Pfizer's cash/cash flows with Novavax, which company has stronger cash/cash flow? No explanation is needed. a. b. (4 points) On September 8, 2020, the British-Swedish drug giant AstraZeneca announced that it had paused global trials of its coronavirus vaccine because of an unexplained neurological symptoms (one type of illness in the neuro system) in one of the volunteers. Here you are provided with the stock chart of Novavax and Pfizer in September 2020. Provide possible reasons for the change in stock price of Novavax and Pfizer around this new event