Answered step by step

Verified Expert Solution

Question

1 Approved Answer

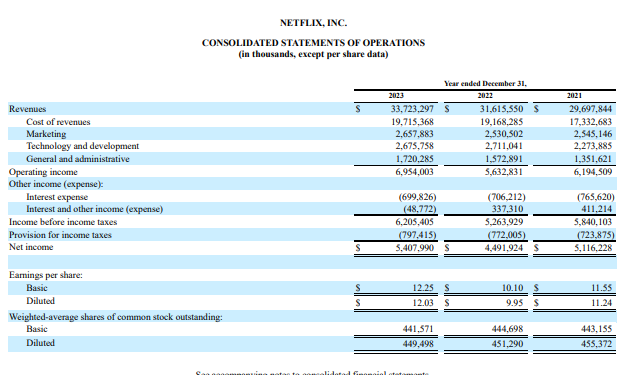

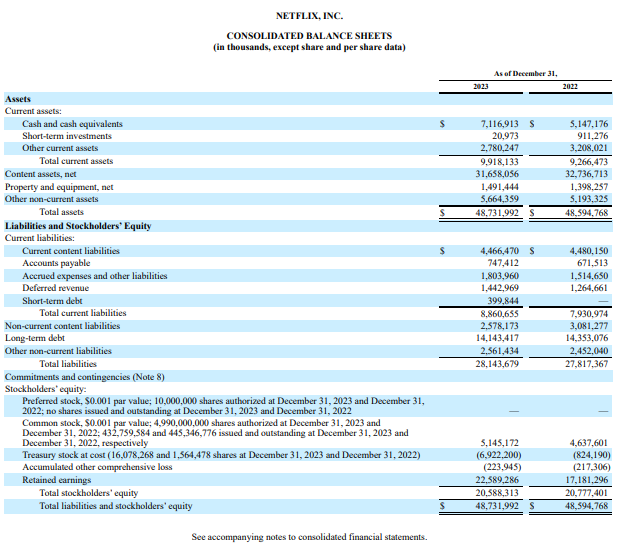

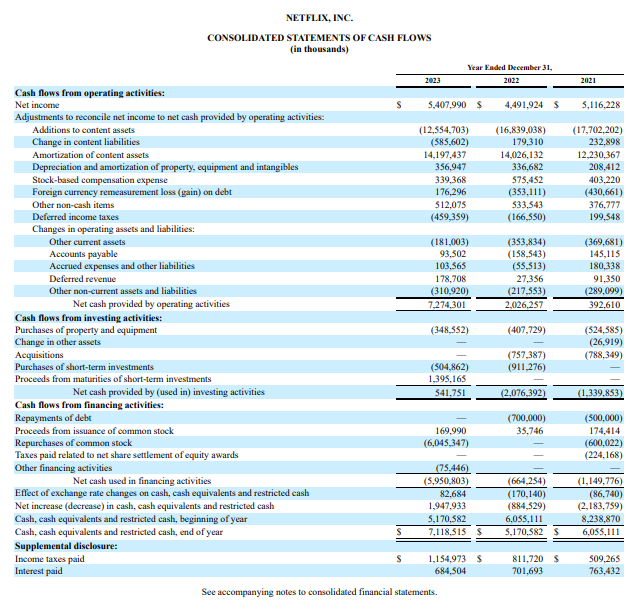

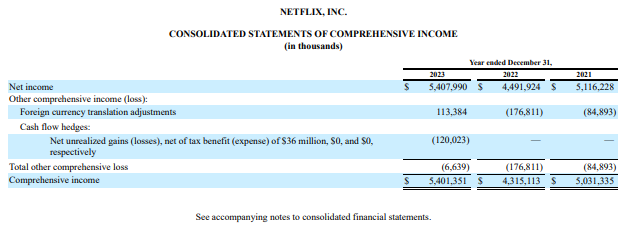

Analyze financial data of Netflix using ratio analysis. Additional sources for company's financial information can come from annual reports, Yahoo Finance, etc.) NETFLIX, INC. CONSOLIDATED

Analyze financial data of Netflix using ratio analysis. Additional sources for company's financial information can come from annual reports, Yahoo Finance, etc.)

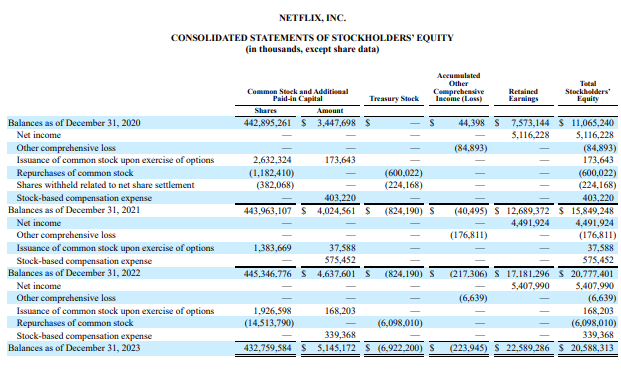

NETFLIX, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in thousands, except share data) Common Stock and Additional Paid-in Capital Shares Amount 442,895,261 $ 3,447,698 S Treasury Stock Accumulated Other Comprehensive Income (Loss) Retained Earnings Total Stockholders' Equity 44,398 $ 7,573,144 $ 11,065,240 Balances as of December 31, 2020 Net income 5,116,228 5,116,228 Other comprehensive loss (84,893) (84,893) Issuance of common stock upon exercise of options 2,632,324 173,643 173,643 Repurchases of common stock (1,182,410) Shares withheld related to net share settlement (382,068) (600,022) (224,168) (600,022) (224,168) Stock-based compensation expense 403,220 403,220 Balances as of December 31, 2021 443,963,107 $ 4,024,561 $ (824,190) S (40,495) S 12,689,372 $ 15,849,248 Other comprehensive loss Net income Issuance of common stock upon exercise of options Stock-based compensation expense 4,491,924 4,491,924 (176,811) (176,811) 1,383,669 37,588 575,452 37,588 575,452 Balances as of December 31, 2022 445,346,776 S 4.637,601 S (824,190) S (217,306) S 17,181,296 $ 20,777,401 Net income Other comprehensive loss Issuance of common stock upon exercise of options Repurchases of common stock Stock-based compensation expense Balances as of December 31, 2023 1,926,598 (14,513,790) 168,203 (6,098,010) 339,368 168,203 (6,098,010) 339,368 432,759,584 $ 5,145,172 $ (6,922,200) S (223,945) S 22,589,286 $ 20,588,313 5,407,990 5,407,990 (6,639) (6,639)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information here are the consolidated statements of stockholders equity for Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started