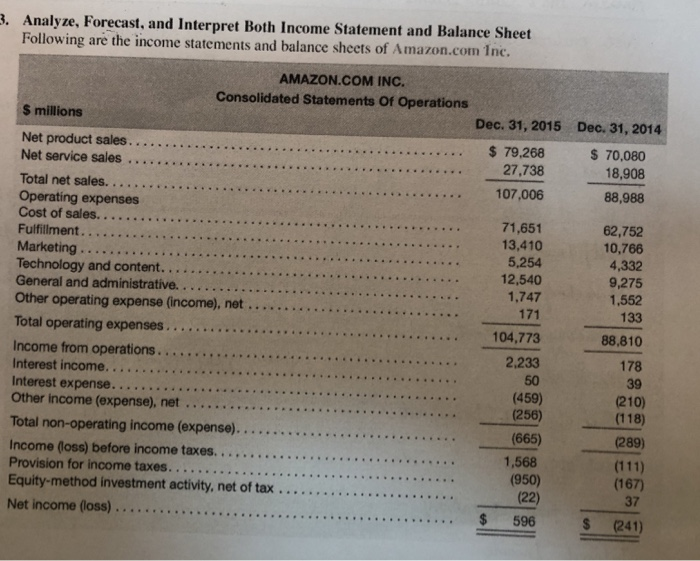

Analyze, Forecast, and Interpret Both Income Statement and Balance Sheet Following are the income statements and balance sheets of Amazon.com Inc. Dec. 31, 2014 $ 70,080 18,908 88,988 AMAZON.COM INC. Consolidated Statements Of Operations S millions Dec. 31, 2015 Net product sales ........ $ 79,268 Net service sales ...... 27,738 Total net sales. 107,006 Operating expenses Cost of sales................ ... ... .... 71,651 Fulfillment ......... **** 13,410 Marketing ................. 5,254 Technology and content...... 12,540 General and administrative..... 1,747 Other operating expense (income), net ........ 171 Total operating expenses.............. 104,773 Income from operations ....... 2,233 Interest income............... 50 Interest expense.................... (459) Other income (expense), net .................. (256) Total non-operating income (expense)... (665) Income (oss) before income taxes.......... 1,568 Provision for income taxes........... (950) Equity-method investment activity, net of tax Net income (loss) .......... 62,752 10,766 4,332 9,275 1,552 133 88,810 178 39 (210) (118) (289) (111) (167) 37 $ (241) (22) 596 Analyze, Forecast, and Interpret Both Income Statement and Balance Sheet Following are the income statements and balance sheets of Amazon.com Inc. Dec. 31, 2014 $ 70,080 18,908 88,988 AMAZON.COM INC. Consolidated Statements Of Operations S millions Dec. 31, 2015 Net product sales ........ $ 79,268 Net service sales ...... 27,738 Total net sales. 107,006 Operating expenses Cost of sales................ ... ... .... 71,651 Fulfillment ......... **** 13,410 Marketing ................. 5,254 Technology and content...... 12,540 General and administrative..... 1,747 Other operating expense (income), net ........ 171 Total operating expenses.............. 104,773 Income from operations ....... 2,233 Interest income............... 50 Interest expense.................... (459) Other income (expense), net .................. (256) Total non-operating income (expense)... (665) Income (oss) before income taxes.......... 1,568 Provision for income taxes........... (950) Equity-method investment activity, net of tax Net income (loss) .......... 62,752 10,766 4,332 9,275 1,552 133 88,810 178 39 (210) (118) (289) (111) (167) 37 $ (241) (22) 596