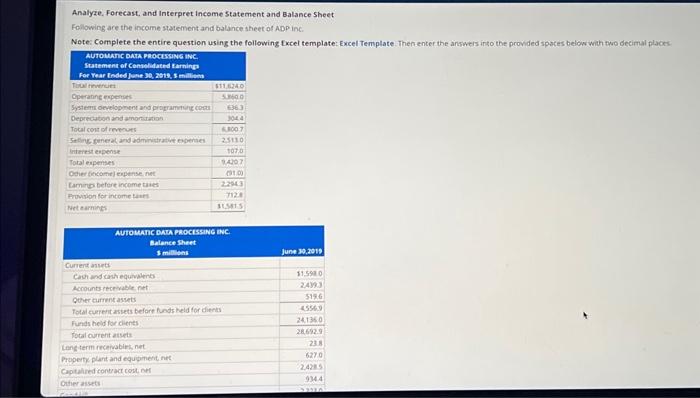

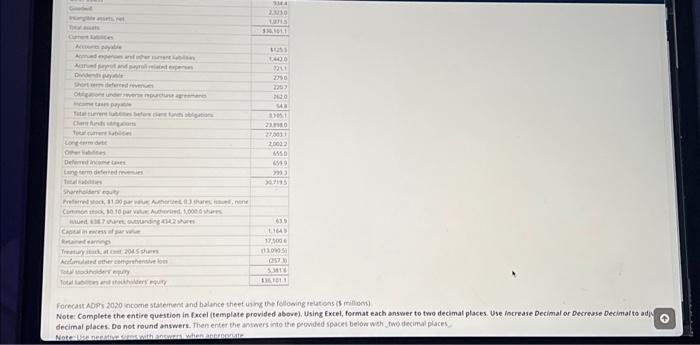

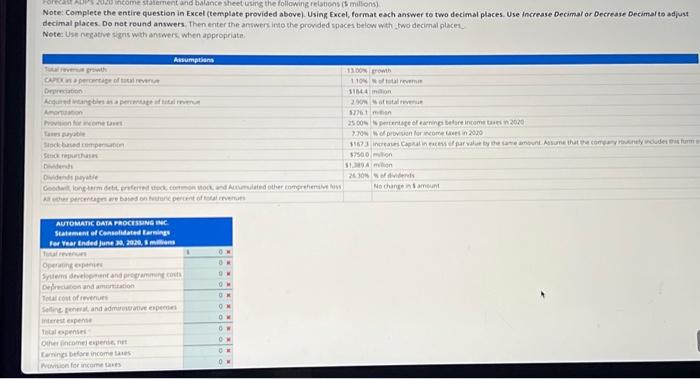

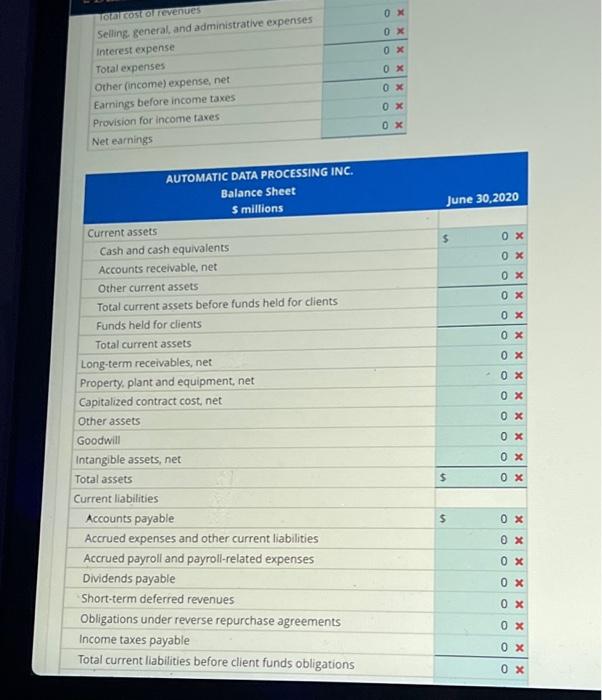

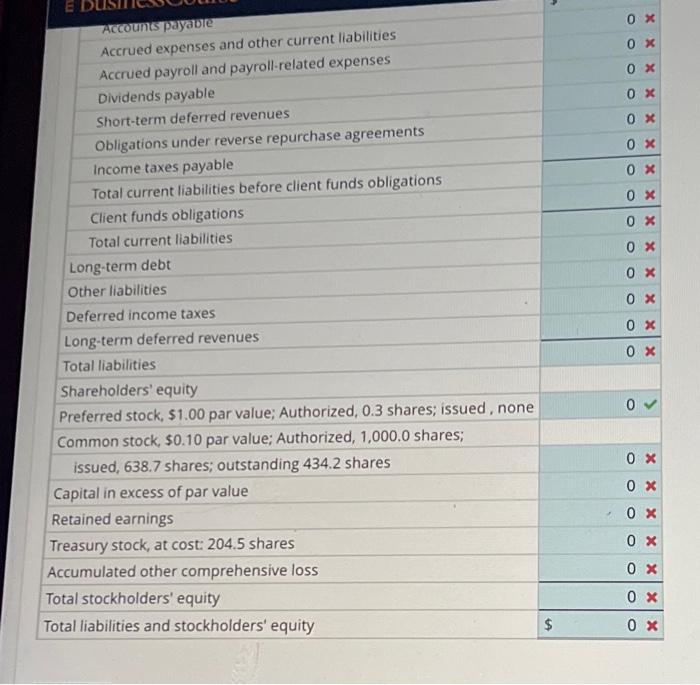

Analyze. Forecast, and Interpret income Statement and Balance Sheet Following ace the income starement and balance sheet of ADP inc. Note: Complete the entire question using the following fxcel template: Excel Template. Thenenter the anrwitis into the provided spotes below with bwo decimal places. forecaur ADers 2020 income statervent and balance theet ings the folowing relatons is mill omb) Note Complete the entire question in. fxtel (template provided abeve). Using Excel, format each answer to two decimal places. Use hncrease Decimal or Decresse Decimal to adj decimal places. Do net round answers. Then enter the answers into thie peovided spacet below weh, two decimal places Note: Complece the entire question in Excel (template provided above). Using Excel, format esch answer to two decimal places. Use increase Decimar or Decrease Decimal to adjust decimal places. Do not round anwwers. Then enter the arswers into the provided rpaces below wth fwo decimal places Note: Uie negative Agrs whth antwers wten appropriate. Totrcostof revenues Accounts payave Accrued expenses and other current liabilities Accrued payroll and payroll-related expenses Dividends payable Short-term deferred revenues Obligations under reverse repurchase agreements Income taxes payable Total current liabilities before client funds obligations Client funds obligations Total current liabilities Long-term debt Other liabilities Deferred income taxes Long-term deferred revenues Total liabilities Shareholders' equity Preferred stock, $1.00 par value; Authorized, 0.3 shares; issued, none Common stock, $0.10 par value; Authorized, 1,000.0 shares; issued, 638.7 shares; outstanding 434.2 shares Capital in excess of par value Retained earnings Treasury stock, at cost: 204.5 shares Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity Analyze. Forecast, and Interpret income Statement and Balance Sheet Following ace the income starement and balance sheet of ADP inc. Note: Complete the entire question using the following fxcel template: Excel Template. Thenenter the anrwitis into the provided spotes below with bwo decimal places. forecaur ADers 2020 income statervent and balance theet ings the folowing relatons is mill omb) Note Complete the entire question in. fxtel (template provided abeve). Using Excel, format each answer to two decimal places. Use hncrease Decimal or Decresse Decimal to adj decimal places. Do net round answers. Then enter the answers into thie peovided spacet below weh, two decimal places Note: Complece the entire question in Excel (template provided above). Using Excel, format esch answer to two decimal places. Use increase Decimar or Decrease Decimal to adjust decimal places. Do not round anwwers. Then enter the arswers into the provided rpaces below wth fwo decimal places Note: Uie negative Agrs whth antwers wten appropriate. Totrcostof revenues Accounts payave Accrued expenses and other current liabilities Accrued payroll and payroll-related expenses Dividends payable Short-term deferred revenues Obligations under reverse repurchase agreements Income taxes payable Total current liabilities before client funds obligations Client funds obligations Total current liabilities Long-term debt Other liabilities Deferred income taxes Long-term deferred revenues Total liabilities Shareholders' equity Preferred stock, $1.00 par value; Authorized, 0.3 shares; issued, none Common stock, $0.10 par value; Authorized, 1,000.0 shares; issued, 638.7 shares; outstanding 434.2 shares Capital in excess of par value Retained earnings Treasury stock, at cost: 204.5 shares Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity