Analyze Horizontal CS Income Statement

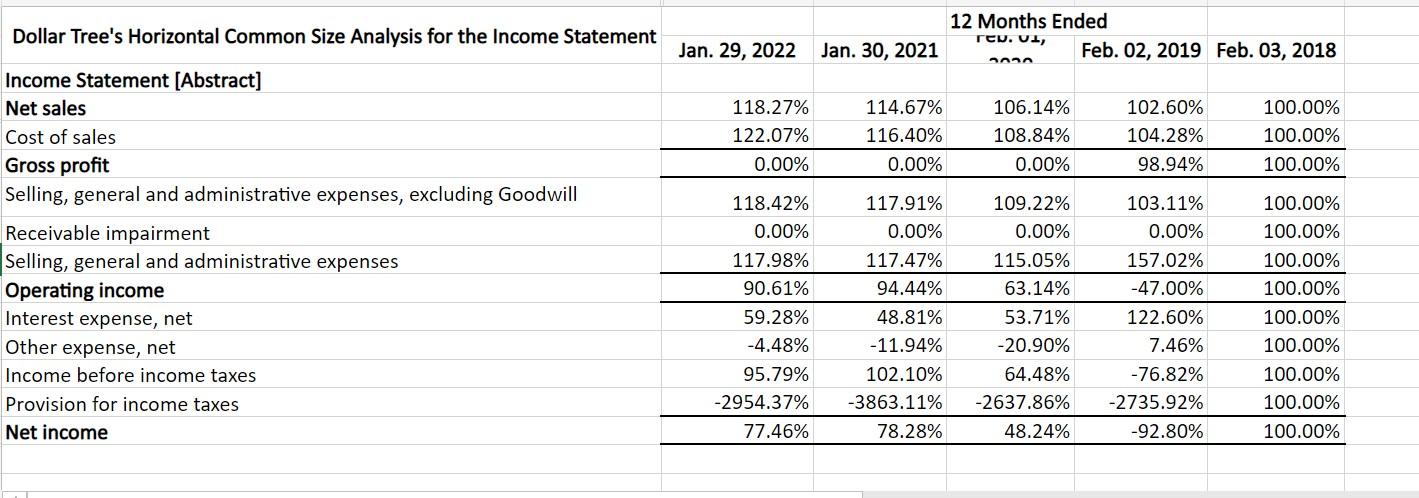

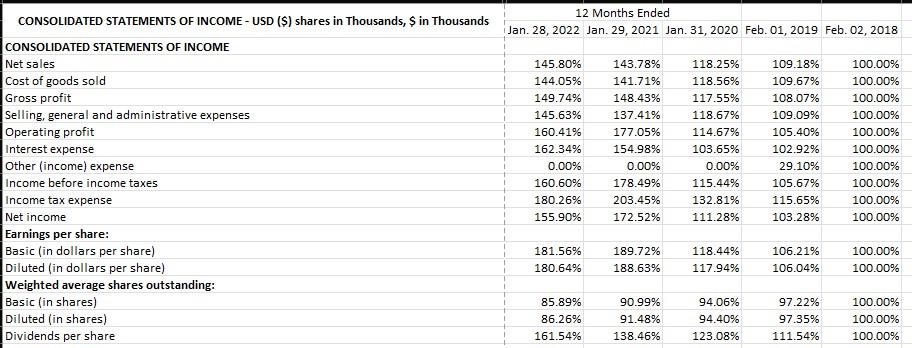

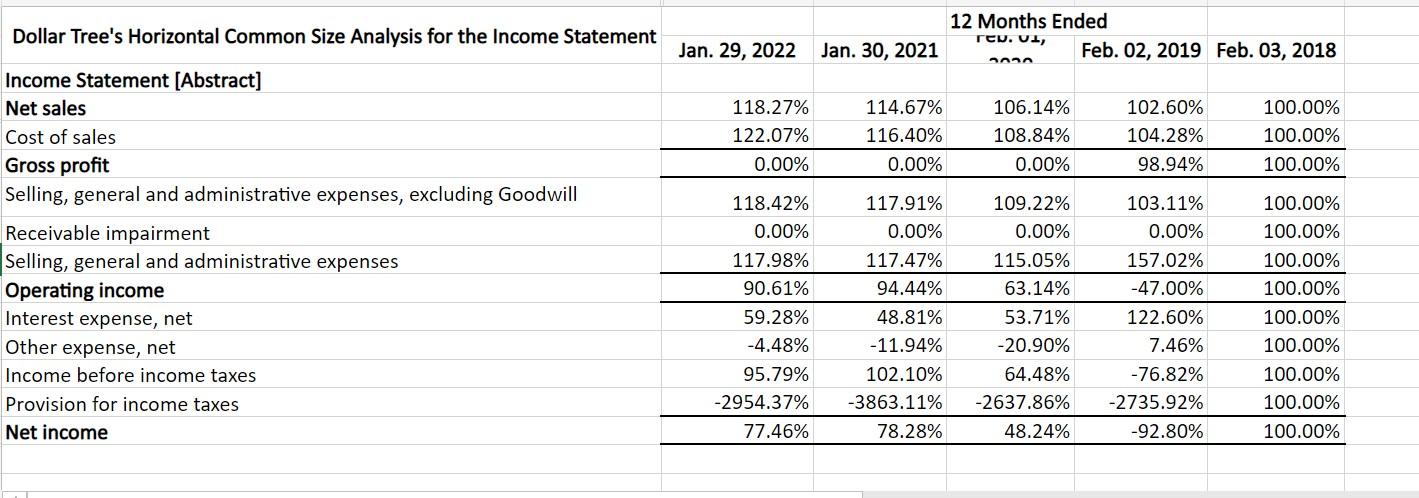

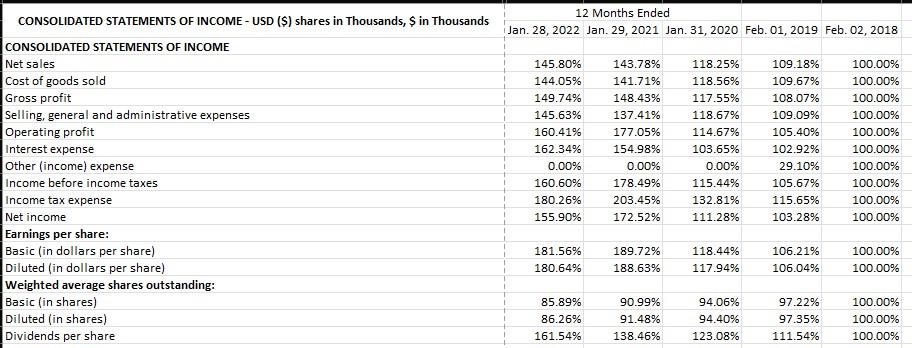

Dollar General

B) HORIZONTAL COMMON-SIZE ANALYSIS a) Dollar Tree b) Dollar General DGHorizontalCommonSizeIncomeStatement2022IncomeStatement2021DGHorizontalCommonSizeDGHorizontalCommonSizeIncomeStatement2020 Dollar Tree's Horizontal Common Size Analysis for the Income Statement Income Statement [Abstract] Net sales Cost of sales Gross profit Selling, general and administrative expenses, excluding Goodwill Receivable impairment \begin{tabular}{|l|l|c|c|c|} \hline Jan. 29, 2022 & Jan. 30, 2021 & rew. UL, & Feb. 02, 2019 & Feb. 03, 2018 \\ \hline \end{tabular} Selling, general and administrative expenses Operating income Interest expense, net Other expense, net Income before income taxes Provision for income taxes Net income \begin{tabular}{|r|r|r|r|r|} \hline 118.27% & 114.67% & 106.14% & 102.60% & 100.00% \\ \hline 122.07% & 116.40% & 108.84% & 104.28% & 100.00% \\ \hline 0.00% & 0.00% & 0.00% & 98.94% & 100.00% \\ \hline 118.42% & 117.91% & 109.22% & 103.11% & 100.00% \\ \hline 0.00% & 0.00% & 0.00% & 0.00% & 100.00% \\ \hline 117.98% & 117.47% & 115.05% & 157.02% & 100.00% \\ \hline 90.61% & 94.44% & 63.14% & 47.00% & 100.00% \\ \hline 59.28% & 48.81% & 53.71% & 122.60% & 100.00% \\ \hline4.48% & 11.94% & 20.90% & 7.46% & 100.00% \\ \hline 95.79% & 102.10% & 64.48% & 76.82% & 100.00% \\ \hline2954.37% & 3863.11% & 2637.86% & 2735.92% & 100.00% \\ \hline 77.46% & 78.28% & 48.24% & 92.80% & 100.00% \\ \hline \end{tabular} CONSOLIDATED STATEMENTS OF INCOME - USD (\$) shares in Thousands, \$ in Thousands 12 Months Ended CONSOLIDATED STATEMENTS OF INCOME Net sales Cost of goods sold Gross profit Selling, general and administrative expenses Operating profit Interest expense Other (income) expense income before income taxes Income tax expense Net income Jan. 28, 2022 Jan. 29,2021 Jan. 31, 2020 Feb. 01, 2019 Feb. 02, 2018 Earnings per share: Basic (in dollars per share) Diluted (in dollars per share) Weighted average shares outstanding: Basic (in shares) Diluted (in shares) Dividends per share \begin{tabular}{:r|r|r|r|r|} \hline 145.80% & 143.78% & 118.25% & 109.18% & 100.00% \\ \hline 144.05% & 141.71% & 118.56% & 109.67% & 100.00% \\ \hline 149.74% & 148.43% & 117.55% & 108.07% & 100.00% \\ \hline 145.63% & 137.41% & 118.67% & 109.09% & 100.00% \\ \hline 160.41% & 177.05% & 114.67% & 105.40% & 100.00% \\ \hline 162.34% & 154.98% & 103.65% & 102.92% & 100.00% \\ \hline 0.00% & 0.00% & 0.00% & 29.10% & 100.00% \\ \hline 160.60% & 178.49% & 115.44% & 105.67% & 100.00% \\ \hline 180.26% & 203.45% & 132.81% & 115.65% & 100.00% \\ \hline 155.90% & 172.52% & 111.28% & 103.28% & 100.00% \\ \hline & & & & \\ \hline 181.56% & 189.72% & 118.44% & 106.21% & 100.00% \\ \hline 180.64% & 188.63% & 117.94% & 106.04% & 100.00% \\ \hline & & & & \\ \hline 85.89% & 90.99% & 94.06% & 97.22% & 100.00% \\ \hline 161.54% & 138.46% & 123.08% & 111.54% & 100.00% \\ \hline \end{tabular} B) HORIZONTAL COMMON-SIZE ANALYSIS a) Dollar Tree b) Dollar General DGHorizontalCommonSizeIncomeStatement2022IncomeStatement2021DGHorizontalCommonSizeDGHorizontalCommonSizeIncomeStatement2020 Dollar Tree's Horizontal Common Size Analysis for the Income Statement Income Statement [Abstract] Net sales Cost of sales Gross profit Selling, general and administrative expenses, excluding Goodwill Receivable impairment \begin{tabular}{|l|l|c|c|c|} \hline Jan. 29, 2022 & Jan. 30, 2021 & rew. UL, & Feb. 02, 2019 & Feb. 03, 2018 \\ \hline \end{tabular} Selling, general and administrative expenses Operating income Interest expense, net Other expense, net Income before income taxes Provision for income taxes Net income \begin{tabular}{|r|r|r|r|r|} \hline 118.27% & 114.67% & 106.14% & 102.60% & 100.00% \\ \hline 122.07% & 116.40% & 108.84% & 104.28% & 100.00% \\ \hline 0.00% & 0.00% & 0.00% & 98.94% & 100.00% \\ \hline 118.42% & 117.91% & 109.22% & 103.11% & 100.00% \\ \hline 0.00% & 0.00% & 0.00% & 0.00% & 100.00% \\ \hline 117.98% & 117.47% & 115.05% & 157.02% & 100.00% \\ \hline 90.61% & 94.44% & 63.14% & 47.00% & 100.00% \\ \hline 59.28% & 48.81% & 53.71% & 122.60% & 100.00% \\ \hline4.48% & 11.94% & 20.90% & 7.46% & 100.00% \\ \hline 95.79% & 102.10% & 64.48% & 76.82% & 100.00% \\ \hline2954.37% & 3863.11% & 2637.86% & 2735.92% & 100.00% \\ \hline 77.46% & 78.28% & 48.24% & 92.80% & 100.00% \\ \hline \end{tabular} CONSOLIDATED STATEMENTS OF INCOME - USD (\$) shares in Thousands, \$ in Thousands 12 Months Ended CONSOLIDATED STATEMENTS OF INCOME Net sales Cost of goods sold Gross profit Selling, general and administrative expenses Operating profit Interest expense Other (income) expense income before income taxes Income tax expense Net income Jan. 28, 2022 Jan. 29,2021 Jan. 31, 2020 Feb. 01, 2019 Feb. 02, 2018 Earnings per share: Basic (in dollars per share) Diluted (in dollars per share) Weighted average shares outstanding: Basic (in shares) Diluted (in shares) Dividends per share \begin{tabular}{:r|r|r|r|r|} \hline 145.80% & 143.78% & 118.25% & 109.18% & 100.00% \\ \hline 144.05% & 141.71% & 118.56% & 109.67% & 100.00% \\ \hline 149.74% & 148.43% & 117.55% & 108.07% & 100.00% \\ \hline 145.63% & 137.41% & 118.67% & 109.09% & 100.00% \\ \hline 160.41% & 177.05% & 114.67% & 105.40% & 100.00% \\ \hline 162.34% & 154.98% & 103.65% & 102.92% & 100.00% \\ \hline 0.00% & 0.00% & 0.00% & 29.10% & 100.00% \\ \hline 160.60% & 178.49% & 115.44% & 105.67% & 100.00% \\ \hline 180.26% & 203.45% & 132.81% & 115.65% & 100.00% \\ \hline 155.90% & 172.52% & 111.28% & 103.28% & 100.00% \\ \hline & & & & \\ \hline 181.56% & 189.72% & 118.44% & 106.21% & 100.00% \\ \hline 180.64% & 188.63% & 117.94% & 106.04% & 100.00% \\ \hline & & & & \\ \hline 85.89% & 90.99% & 94.06% & 97.22% & 100.00% \\ \hline 161.54% & 138.46% & 123.08% & 111.54% & 100.00% \\ \hline \end{tabular}