Answered step by step

Verified Expert Solution

Question

1 Approved Answer

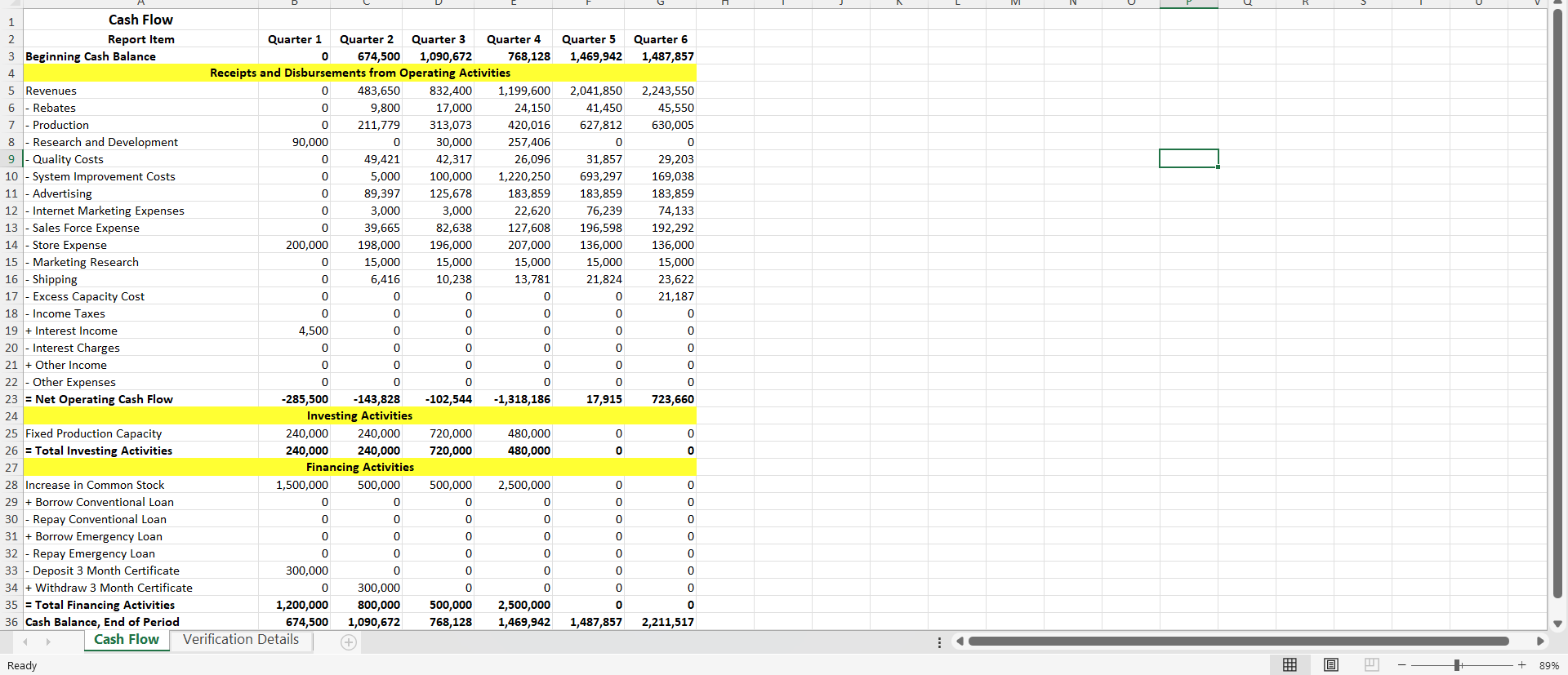

Analyze the beginning and ending cash positions from your statement of cash flows for each of the following: cash flow from operating activities

Analyze the beginning and ending cash positions from your statement of cash flows for each of the following:

• cash flow from operating activities

• cash flow from investing activities

• cash flow from financing activities

1 2 Cash Flow Report Item Quarter 1 3 Beginning Cash Balance 5 Revenues 0 Quarter 2 Quarter 3 Quarter 4 674,500 1,090,672 768,128 Quarter 5 Quarter 6 1,469,942 1,487,857 Receipts and Disbursements from Operating Activities 0 6 Rebates 0 483,650 9,800 7 Production 0 211,779 313,073 832,400 1,199,600 17,000 24,150 420,016 2,041,850 2,243,550 41,450 627,812 45,550 630,005 8 Research and Development 90,000 0 30,000 257,406 0 0 9 Quality Costs 0 49,421 42,317 26,096 31,857 29,203 10 System Improvement Costs 0 5,000 100,000 1,220,250 693,297 169,038 11 - Advertising 12 - Internet Marketing Expenses 0 89,397 125,678 183,859 183,859 183,859 0 3,000 3,000 22,620 76,239 74,133 13 Sales Force Expense 14 Store Expense 15 Marketing Research 16 Shipping 17 Excess Capacity Cost 18 Income Taxes 19 + Interest Income 20 Interest Charges 0 39,665 82,638 127,608 196,598 192,292 200,000 198,000 196,000 207,000 136,000 136,000 0 15,000 15,000 15,000 15,000 15,000 0 6,416 10,238 13,781 21,824 23,622 0 0 0 0 0 21,187 0 0 0 0 0 0 4,500 0 0 0 0 0 0 0 0 0 0 0 30 31 + Borrow Emergency Loan 32 33 21+ Other Income 22 Other Expenses 23 = Net Operating Cash Flow 24 25 Fixed Production Capacity 26 = Total Investing Activities 27 28 Increase in Common Stock 29 + Borrow Conventional Loan Repay Conventional Loan 0 0 0 0 0 0 0 0 0 0 0 0 -285,500 -143,828 -102,544 -1,318,186 17,915 723,660 Investing Activities 240,000 240,000 240,000 240,000 720,000 720,000 480,000 0 0 480,000 0 0 Financing Activities 1,500,000 500,000 500,000 2,500,000 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Repay Emergency Loan Deposit 3 Month Certificate 34 + Withdraw 3 Month Certificate 35 = Total Financing Activities 36 Cash Balance, End of Period Cash Flow 0 0 0 0 0 0 300,000 0 0 0 0 0 0 300,000 0 0 0 0 1,200,000 800,000 674,500 1,090,672 500,000 2,500,000 0 0 768,128 1,469,942 1,487,857 2,211,517 Verification Details (+ Ready 89%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started