Analyze the companys profitability and its ability to generate sufficient operating profit by using the following ratios (Total 13 marks) (2 marks per ratio; analysis 5 marks): a. Gross Profit Margin b. Operating Profit Margin c. Operating income return on investments (ROI) d. Net Profit Margin

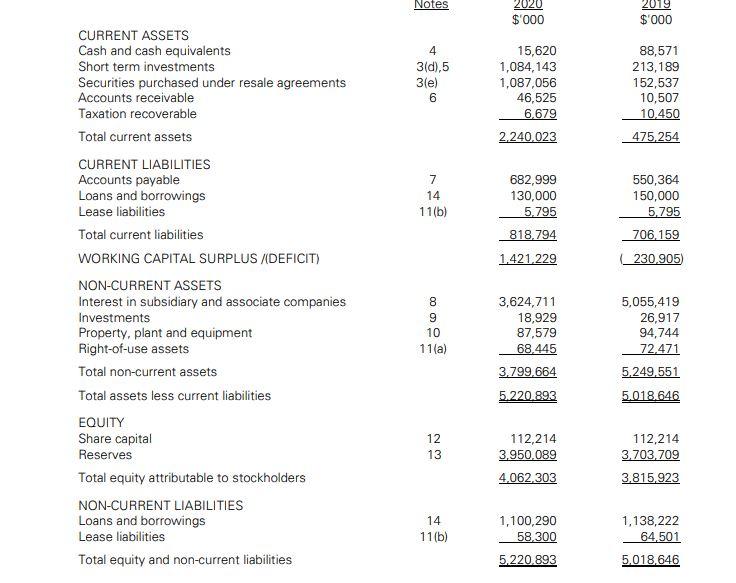

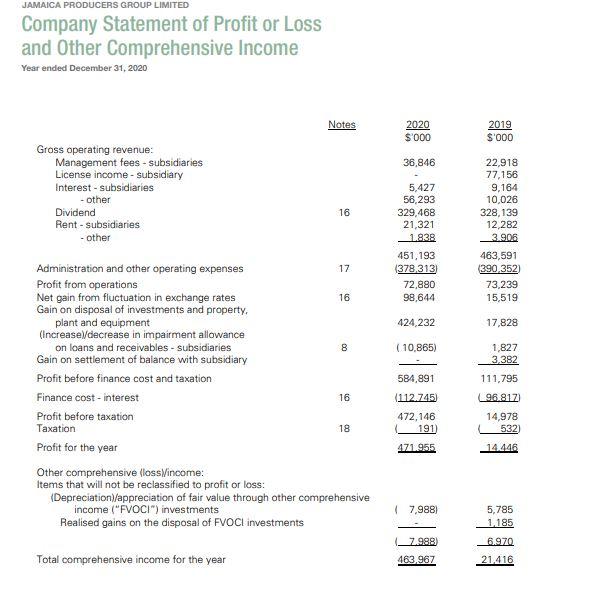

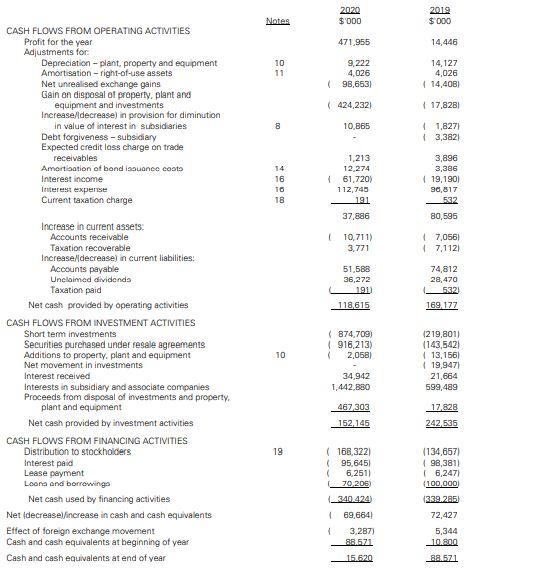

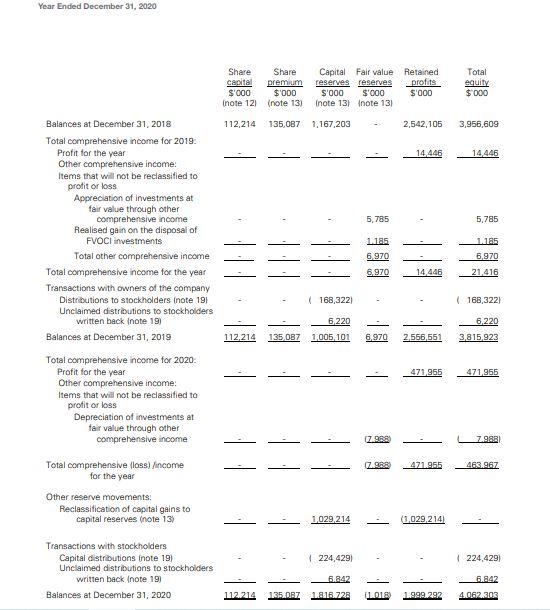

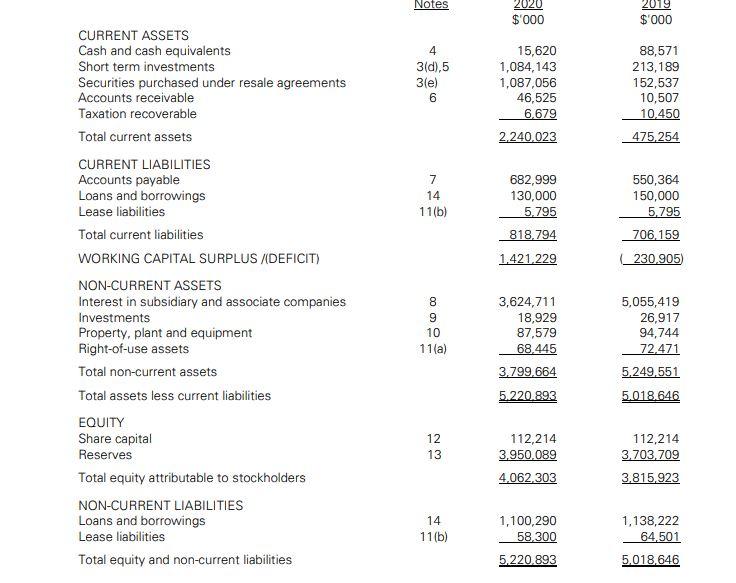

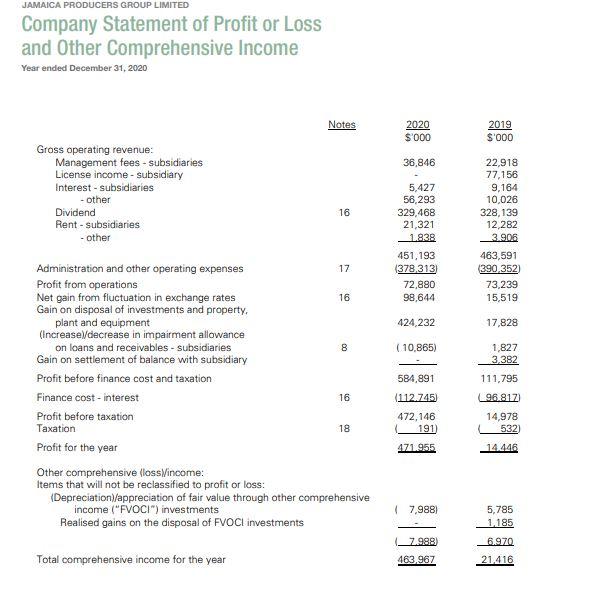

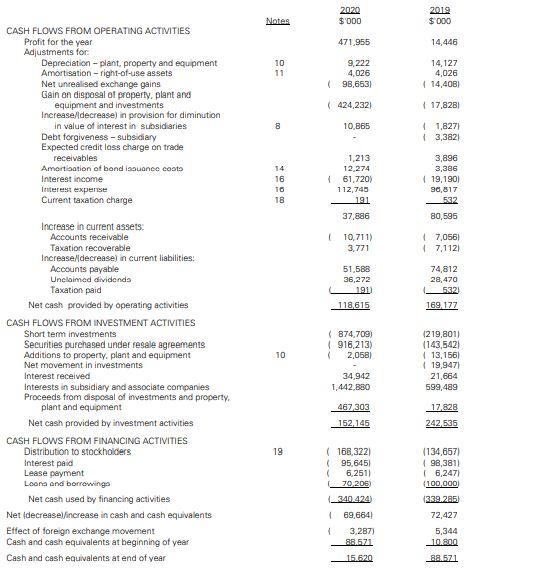

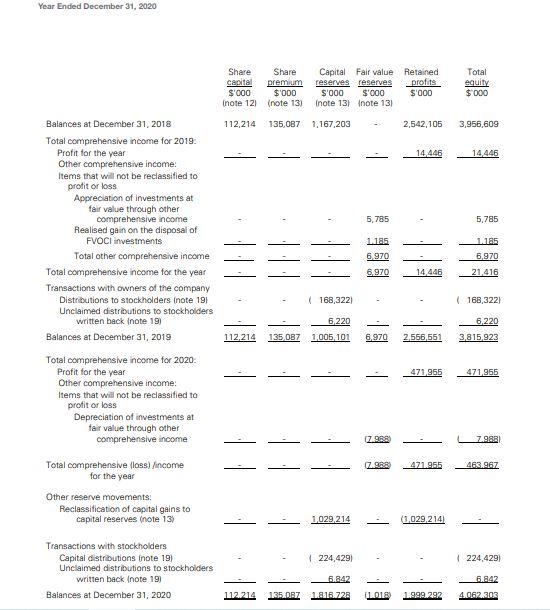

Notes 2020 $'000 2019 $ 000 4 3(d),5 3(e) 6 15,620 1,084,143 1,087,056 46,525 6.679 2.240.023 88,571 213,189 152,537 10,507 10,450 475,254 7 14 11(b) 682,999 130,000 5.795 818.794 1.421,229 550,364 150,000 5,795 706.159 230.905 CURRENT ASSETS Cash and cash equivalents Short term investments Securities purchased under resale agreements Accounts receivable Taxation recoverable Total current assets CURRENT LIABILITIES Accounts payable Loans and borrowings Lease liabilities Total current liabilities WORKING CAPITAL SURPLUS /DEFICIT) NON-CURRENT ASSETS Interest in subsidiary and associate companies Investments Property, plant and equipment Right-of-use assets Total non-current assets Total assets less current liabilities EQUITY Share capital Reserves Total equity attributable to stockholders NON-CURRENT LIABILITIES Loans and borrowings Lease liabilities Total equity and non-current liabilities 000 8 9 10 11(a) 3,624,711 18,929 87,579 68.445 3.799,664 5220,893 5,055,419 26,917 94,744 72.471 5,249,551 5.018.646 12 13 112,214 3,950.089 4,062,303 112,214 3,703,709 3.815.923 14 11(b) 1,100,290 58.300 5.220.893 1,138,222 64.501 5.018.646 JAMAICA PRODUCERS GROUP LIMITED Company Statement of Profit or Loss and Other Comprehensive Income Year ended December 31, 2020 Notes 2020 2019 S'000 $'000 36,846 Gross operating revenue: Management fees - subsidiaries License income - subsidiary Interest - subsidiaries other Dividend Rent - subsidiaries other 16 5,427 56,293 329,468 21,321 - 1838 451,193 378.313) 72,880 98,644 22,918 77,156 9,164 10,026 328,139 12,282 3.906 463,591 390.352) 73,239 15,519 424,232 17,828 00 (10.865) 1,827 3.382 111,795 584,891 Administration and other operating expenses 17 Profit from operations Net gain from fluctuation in exchange rates 16 Gain on disposal of investments and property. plant and equipment (Increase\/decrease in impairment allowance on loans and receivables - Subsidiaries Gain on settlement of balance with subsidiary Profit before finance cost and taxation Finance cost interest Profit before taxation Taxation Profit for the year Other comprehensive (loss Vincome: items that will not be reclassified to profit or loss: (Depreciation)/appreciation of fair value through other comprehensive income ("FVOCI") investments Realised gains on the disposal of FVOCl investments 16 112.745 472,146 191) 96.817 14,978 532) 18 471.955 14.446 17,988) 5,785 1,185 6.970 7.988 Total comprehensive income for the year 463.967 21,416 Notes 2020 $'000 2019 $ 000 471,955 14,446 10 11 9.222 4,026 (98,653) 14,127 4,026 (14,408) (424,2321 17,828 CASH FLOWS FROM OPERATING ACTIVITIES Profit for the year Adjustments for Depreciation - plant, property and equipment Amortisation-right-of-use assets Net unrealised exchange gains Gain on disposal of property, plant and equipment and investments Increase/ decrease) in provision for diminution in value of interest in subsidiaries Debt forgiveness-subsidiary Expected credit lass charge on trade receivables Amortisation of bond isance costs Interest income Interest expense Current taxation charge 8 10 865 1,8271 13,3821 14 16 10 18 1.213 12 274 161,720) 112,745 3,896 3,386 19,190 90,817 191 -532 37,886 80,595 10,711) 3.771 7,056) 17.1121 51,588 36,272 191 118,615 74,812 28,470 522) 169 177 (874.709) 1916,213) 2.0581 10 Increase in current assets Accounts receivable Taxation recoverable Increase/decrease) in current liabilities: Accounts payable Unclaimed dividends Taxation paid Net cash provided by operating activities CASH FLOWS FROM INVESTMENT ACTIVITIES Short term investments Securities purchased under resale agreements Additions to property, plant and equipment Net movement in investments Interest received Interests in subsidiary and associate companies Proceeds from disposal of investments and property plant and equipment Net cash provided by investment activities CASH FLOWS FROM FINANCING ACTIVITIES Distribution to stockholders Interest paid Lease payment Loora and borrowingo Net cash used by financing activities Net decrease increase in cash and cash equivalents Effect of foreign exchange movement Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year (219,8011 (143,5421 13,1561 (19,9471 21,664 599,489 34,942 1,442,880 467 303 152,145 17.828 242.535 19 ( 168,322) 95,6451 6,251) 70,206) (134,6571 98,3811 (6,2471 (100,000 329.285 72,427 340.424) 69,6641 1 3 287) 88.571 15.620 5,344 10.800 88.571 Year Ended December 31, 2020 Share Share capite premium S'000 $'000 inote 12) (note 13) Capital Fair value Retained reserves reserve profits S'000 $'000 $'000 Inote 13) Inote 13) Total equity $ 000 112,214 135,087 7,167,203 2,542,105 3,956,609 14.446 14,446 5,785 5.785 11185 11195 6970 6,970 21,416 6.970 14,446 (168,3221 - (168,322) Balances at December 31, 2018 Total comprehensive income for 2019. Profit for the year Other comprehensive income. Items that will not be reclassified to profit or loss Appreciation of investments at fair value through other comprehensive ncome Realised gain on the disposal of FVOCI investments Total other comprehensive income Total comprehensive income for the year Transactions with owners of the company Distributions to stockholders (note 19 Unclaimed distributions to stockholders written back Inote 19 Balances at December 31, 2019 Total comprehensive income for 2020. Profit for the year Other comprehensive income: Items that will not be reclassified to profit or loss Depreciation of investments at fair value through other comprehensive income Total comprehensive (loss) /income for the year Other reserve movements: Reclassification of capital gains to capital reserves note 13) 6,220 135,087 1005,101 6,220 3,815,923 112.214 6.970 2566.550 471.965 471.965 IZR 7.9881 7.989 471.955 463.967 1029214 (3,029214 224,4291 224,4291 Transactions with stockholders Capital distributions Inote 19 Unclaimed distributions to stockholders written back Inote 19 Balances at December 31, 2020 .242 5.842 125.07 1816.728 112.214 2010 .999.292 4062 303 Notes 2020 $'000 2019 $ 000 4 3(d),5 3(e) 6 15,620 1,084,143 1,087,056 46,525 6.679 2.240.023 88,571 213,189 152,537 10,507 10,450 475,254 7 14 11(b) 682,999 130,000 5.795 818.794 1.421,229 550,364 150,000 5,795 706.159 230.905 CURRENT ASSETS Cash and cash equivalents Short term investments Securities purchased under resale agreements Accounts receivable Taxation recoverable Total current assets CURRENT LIABILITIES Accounts payable Loans and borrowings Lease liabilities Total current liabilities WORKING CAPITAL SURPLUS /DEFICIT) NON-CURRENT ASSETS Interest in subsidiary and associate companies Investments Property, plant and equipment Right-of-use assets Total non-current assets Total assets less current liabilities EQUITY Share capital Reserves Total equity attributable to stockholders NON-CURRENT LIABILITIES Loans and borrowings Lease liabilities Total equity and non-current liabilities 000 8 9 10 11(a) 3,624,711 18,929 87,579 68.445 3.799,664 5220,893 5,055,419 26,917 94,744 72.471 5,249,551 5.018.646 12 13 112,214 3,950.089 4,062,303 112,214 3,703,709 3.815.923 14 11(b) 1,100,290 58.300 5.220.893 1,138,222 64.501 5.018.646 JAMAICA PRODUCERS GROUP LIMITED Company Statement of Profit or Loss and Other Comprehensive Income Year ended December 31, 2020 Notes 2020 2019 S'000 $'000 36,846 Gross operating revenue: Management fees - subsidiaries License income - subsidiary Interest - subsidiaries other Dividend Rent - subsidiaries other 16 5,427 56,293 329,468 21,321 - 1838 451,193 378.313) 72,880 98,644 22,918 77,156 9,164 10,026 328,139 12,282 3.906 463,591 390.352) 73,239 15,519 424,232 17,828 00 (10.865) 1,827 3.382 111,795 584,891 Administration and other operating expenses 17 Profit from operations Net gain from fluctuation in exchange rates 16 Gain on disposal of investments and property. plant and equipment (Increase\/decrease in impairment allowance on loans and receivables - Subsidiaries Gain on settlement of balance with subsidiary Profit before finance cost and taxation Finance cost interest Profit before taxation Taxation Profit for the year Other comprehensive (loss Vincome: items that will not be reclassified to profit or loss: (Depreciation)/appreciation of fair value through other comprehensive income ("FVOCI") investments Realised gains on the disposal of FVOCl investments 16 112.745 472,146 191) 96.817 14,978 532) 18 471.955 14.446 17,988) 5,785 1,185 6.970 7.988 Total comprehensive income for the year 463.967 21,416 Notes 2020 $'000 2019 $ 000 471,955 14,446 10 11 9.222 4,026 (98,653) 14,127 4,026 (14,408) (424,2321 17,828 CASH FLOWS FROM OPERATING ACTIVITIES Profit for the year Adjustments for Depreciation - plant, property and equipment Amortisation-right-of-use assets Net unrealised exchange gains Gain on disposal of property, plant and equipment and investments Increase/ decrease) in provision for diminution in value of interest in subsidiaries Debt forgiveness-subsidiary Expected credit lass charge on trade receivables Amortisation of bond isance costs Interest income Interest expense Current taxation charge 8 10 865 1,8271 13,3821 14 16 10 18 1.213 12 274 161,720) 112,745 3,896 3,386 19,190 90,817 191 -532 37,886 80,595 10,711) 3.771 7,056) 17.1121 51,588 36,272 191 118,615 74,812 28,470 522) 169 177 (874.709) 1916,213) 2.0581 10 Increase in current assets Accounts receivable Taxation recoverable Increase/decrease) in current liabilities: Accounts payable Unclaimed dividends Taxation paid Net cash provided by operating activities CASH FLOWS FROM INVESTMENT ACTIVITIES Short term investments Securities purchased under resale agreements Additions to property, plant and equipment Net movement in investments Interest received Interests in subsidiary and associate companies Proceeds from disposal of investments and property plant and equipment Net cash provided by investment activities CASH FLOWS FROM FINANCING ACTIVITIES Distribution to stockholders Interest paid Lease payment Loora and borrowingo Net cash used by financing activities Net decrease increase in cash and cash equivalents Effect of foreign exchange movement Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year (219,8011 (143,5421 13,1561 (19,9471 21,664 599,489 34,942 1,442,880 467 303 152,145 17.828 242.535 19 ( 168,322) 95,6451 6,251) 70,206) (134,6571 98,3811 (6,2471 (100,000 329.285 72,427 340.424) 69,6641 1 3 287) 88.571 15.620 5,344 10.800 88.571 Year Ended December 31, 2020 Share Share capite premium S'000 $'000 inote 12) (note 13) Capital Fair value Retained reserves reserve profits S'000 $'000 $'000 Inote 13) Inote 13) Total equity $ 000 112,214 135,087 7,167,203 2,542,105 3,956,609 14.446 14,446 5,785 5.785 11185 11195 6970 6,970 21,416 6.970 14,446 (168,3221 - (168,322) Balances at December 31, 2018 Total comprehensive income for 2019. Profit for the year Other comprehensive income. Items that will not be reclassified to profit or loss Appreciation of investments at fair value through other comprehensive ncome Realised gain on the disposal of FVOCI investments Total other comprehensive income Total comprehensive income for the year Transactions with owners of the company Distributions to stockholders (note 19 Unclaimed distributions to stockholders written back Inote 19 Balances at December 31, 2019 Total comprehensive income for 2020. Profit for the year Other comprehensive income: Items that will not be reclassified to profit or loss Depreciation of investments at fair value through other comprehensive income Total comprehensive (loss) /income for the year Other reserve movements: Reclassification of capital gains to capital reserves note 13) 6,220 135,087 1005,101 6,220 3,815,923 112.214 6.970 2566.550 471.965 471.965 IZR 7.9881 7.989 471.955 463.967 1029214 (3,029214 224,4291 224,4291 Transactions with stockholders Capital distributions Inote 19 Unclaimed distributions to stockholders written back Inote 19 Balances at December 31, 2020 .242 5.842 125.07 1816.728 112.214 2010 .999.292 4062 303